Blog

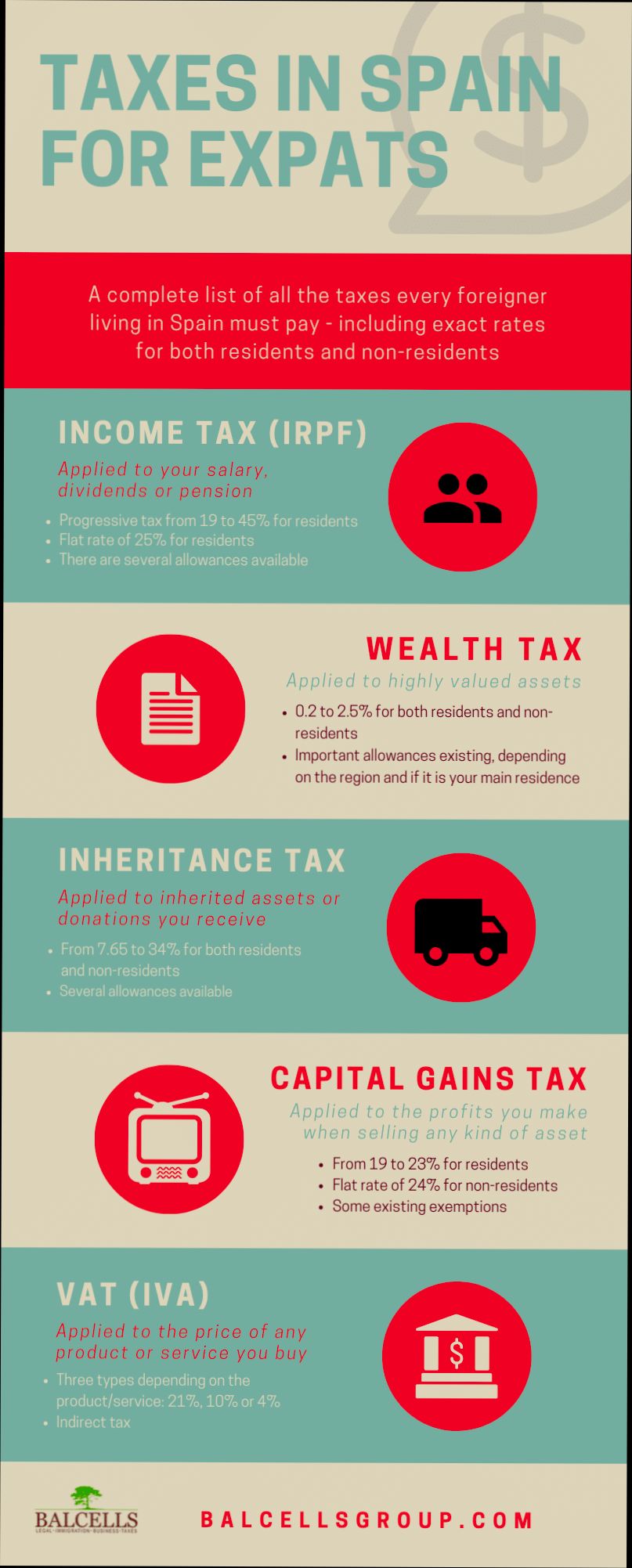

How does Spain’s wealth tax affect expats?

How does Spain’s wealth tax affect expats? If you’re living the dream in Spain, sipping sangria on the beach and enjoying tapas, you might want to pay closer attention to your finances. Spain’s wealth tax, known as “Impuesto sobre el Patrimonio,” targets anyone with net assets exceeding a certain threshold, which varies by region. For instance, in areas like Catalonia, individuals owe taxes on net wealth over €500,000, while in Madrid, there’s an exemption up to €2 million. This means if you’ve accumulated assets like property, investments, or savings during your time here, you could find yourself facing some hefty tax bills.

How does Spain’s wealth tax affect foreigners?

How does Spain’s wealth tax affect foreigners? If you’ve got your eye on moving to Spain or investing in property there, understanding this tax is crucial. Essentially, Spain's wealth tax, known as “Impuesto sobre el Patrimonio,” applies to individuals whose net assets exceed a certain threshold—currently set at €700,000. This tax doesn’t just apply to Spanish residents; foreigners, especially those owning property or holding investments in Spain, can find themselves in the crosshairs of this regulation. For example, if a foreigner owns a villa in Marbella or has significant investments in Spanish businesses, they’ll need to calculate their total net worth, including assets in Spain, to determine if they owe anything.

How easy is it to find a job in Spain as an expat?

How easy is it to find a job in Spain as an expat? Well, that depends on a bunch of factors. As someone who’s taken the plunge into the Spanish job market, I can tell you that your experience might vary based on what industry you're in, your language skills, and where in Spain you’re looking to settle. For instance, if you’re in tech, you might find plenty of opportunities in major cities like Barcelona or Madrid, where startups and big companies are always on the lookout for fresh talent. However, if you're hoping to land a job in the hospitality sector, places like Ibiza or Valencia could be a goldmine, especially during the tourist season.

How expensive is traveling in southern Spain?

How expensive is traveling in southern Spain? If you’re dreaming of sun-soaked beaches, vibrant cities like Seville and Granada, and mouthwatering tapas, you might be wondering about the costs involved. From accommodation to meals, the financial side of your Andalusian adventure can vary quite a bit. For instance, a budget-friendly hostel might set you back around €15-30 a night, while mid-range hotels usually hover between €70-150. And in a city like Marbella, where luxury is the name of the game, prices can soar even higher for a decent stay.

How much can you charge for rent in Spain?

How much can you charge for rent in Spain? Well, that’s a question on the minds of many property owners and landlords looking to make some extra cash from their investments. The truth is, rent prices vary widely depending on factors like location, property type, and even the time of year. If you've got a cozy one-bedroom apartment in the heart of Barcelona, you might be looking at anywhere between €1,000 to €1,500 a month, while a similar place in a smaller town might go for €500 to €800.

How much council tax do you pay in Spain?

How much council tax do you pay in Spain? This is a question that many expats and locals alike grapple with when settling down in this sun-kissed country. Council tax in Spain, often referred to as Impuesto sobre Bienes Inmuebles (IBI), varies based on a range of factors. The tax is typically based on the cadastral value of your property, which can fluctuate depending on location, size, and age. For instance, in bustling cities like Barcelona and Madrid, you might see higher rates compared to smaller towns or rural areas.

How much deposit can you ask from tenants in Spain?

How much deposit can you ask from tenants in Spain? This is a burning question for many landlords navigating the rental landscape in this beautiful country. The law here typically allows landlords to request a deposit equivalent to one or two months' rent, depending on the type of rental agreement. For example, if you're renting out an apartment for €800 a month, you could ask for a deposit of either €800 or €1,600, depending on the specifics of your lease.

How much deposit do you need to buy a house in Spain?

How much deposit do you need to buy a house in Spain? This is a burning question for anyone thinking of making the move to sunny shores or adding a little Mediterranean charm to their property portfolio. Typically, buyers should be prepared to fork out at least 10% of the property’s value as a deposit. For instance, if you're eyeing a charming two-bedroom apartment in Barcelona listed for €250,000, that means you’ll need a cool €25,000 to secure your dream pad. Depending on the region—like the costlier Balearic Islands or the more budget-friendly Andalusia—this percentage can vary, but it’s a solid starting point.

Tags