- Who is Affected by the Wealth Tax?

- Key Exemptions and Allowances for Expats

- Comparative Analysis: Spain vs. Other Countries on Wealth Tax

- Statistics on Wealth Tax Contributions by Expatriates

- Common Misconceptions About Spain's Wealth Tax

- Step-by-Step Guide to Reporting Wealth Tax as an Expat

- Impact of Wealth Tax on Expat Living: A Financial Overview

- Wealth Tax Revenue: Where Does the Money Go?

- Navigating Tax Residency: Implications for Expats

- Case Study: Wealth Tax Scenarios for Different Expat Profiles

- Future Trends: Potential Changes to Spain’s Wealth Tax

- Resources for Expats: Tools and Calculators for Wealth Tax Planning

How does Spain’s wealth tax affect expats? If you’re living the dream in Spain, sipping sangria on the beach and enjoying tapas, you might want to pay closer attention to your finances. Spain’s wealth tax, known as “Impuesto sobre el Patrimonio,” targets anyone with net assets exceeding a certain threshold, which varies by region. For instance, in areas like Catalonia, individuals owe taxes on net wealth over €500,000, while in Madrid, there’s an exemption up to €2 million. This means if you’ve accumulated assets like property, investments, or savings during your time here, you could find yourself facing some hefty tax bills.

Now, let’s break it down a bit. Imagine you’ve got a charming home in Valencia and a few art pieces you adore; that could quickly push you over the limit. Expats who may think they’re in the clear because of their income alone should take note that Spain’s tax calculations consider your global assets. So, if you own a vacation home across the sea or have investment accounts in your home country, they could all count towards your wealth tax assessment. It’s a good idea to stay informed and understand how this tax structure could impact your wallet—because when it comes to taxes, knowledge is definitely power in the beautiful land of paella and fiestas.

Understanding Spain’s Wealth Tax Framework

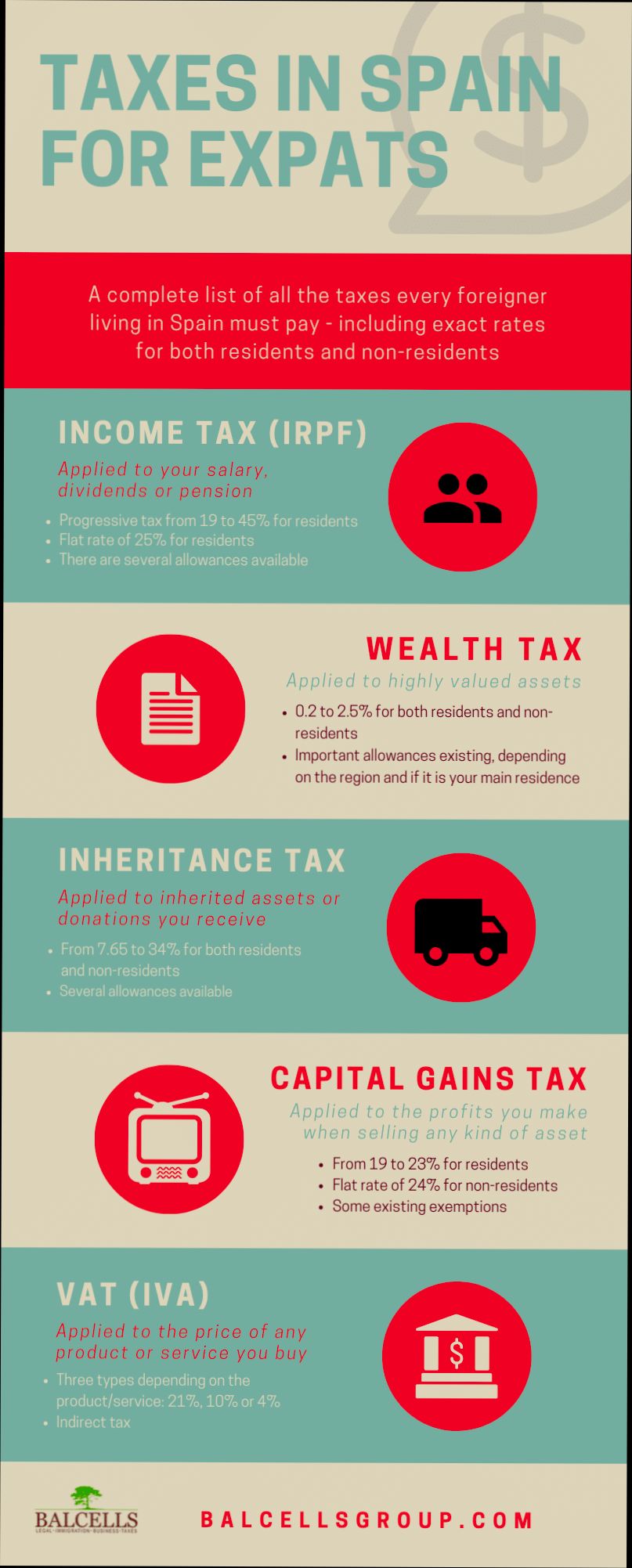

Alright, let’s cut to the chase. If you’re an expat in Spain, you’ve probably heard about the wealth tax or “Impuesto sobre el Patrimonio.” This tax is applied to individuals’ net wealth and can have a pretty big impact on your finances.

What is Wealth Tax?

Wealth tax in Spain is charged on the value of your assets. Think properties, bank accounts, shares—basically anything that holds financial value. If your total assets exceed a certain threshold, you’re looking at paying this tax once a year. This means that it’s crucial to keep an eye on how your wealth stacks up!

Who Needs to Pay?

Typically, residents in Spain, including expats, are liable for the wealth tax on their worldwide assets. If you have assets worth more than €700,000, it’s time to take notice! But here’s the kicker: if you’re a non-resident, you only pay tax on assets located in Spain.

| Residency Status | Taxable Assets | Exemptions |

|---|---|---|

Resident | Worldwide assets over €700,000 | Up to €300,000 for the main residence |

Non-Resident | Spanish assets only | No exemptions |

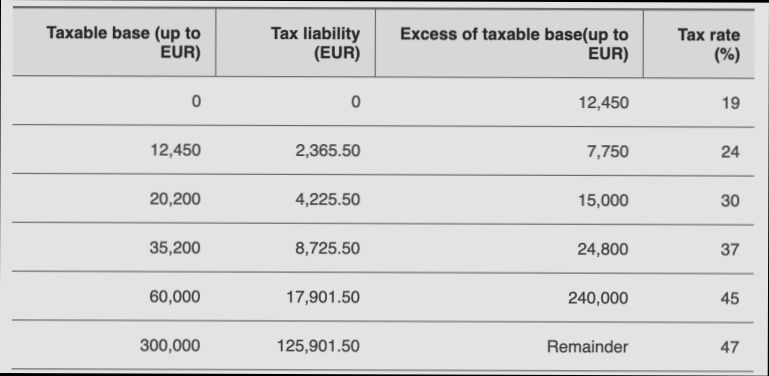

How Much Will You Pay?

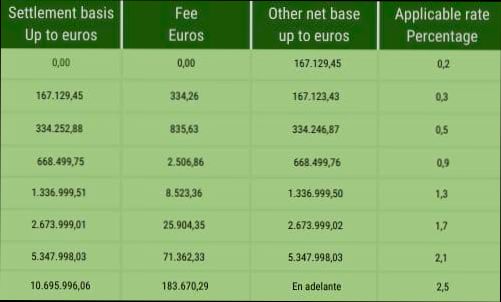

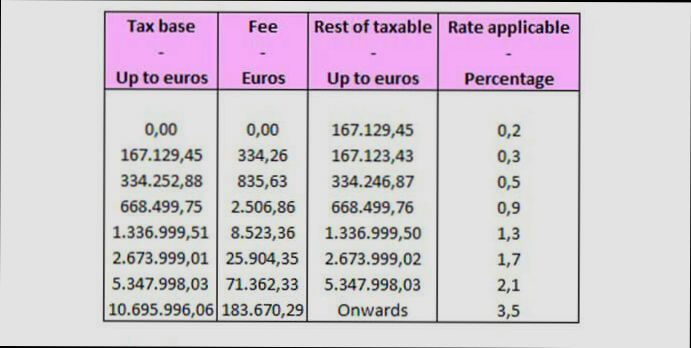

The wealth tax rates can vary across different regions in Spain, ranging from 0.2% to 3.5% depending on the total value of your assets. If you’re in the wealthier bracket, that could mean coughing up quite a bit! For instance:

If your net assets are valued at €1 million, you might pay around €2,000 in wealth tax.

Hit the €5 million mark? You’re looking at approximately €40,000!

Investment Properties

Got investment properties? Well, they contribute to your net wealth and could push you over that €700,000 threshold. Platforms like Residoora can help you assess your real estate investments and their potential impact on your wealth tax obligations. By making informed decisions, you can manage your assets smartly and possibly mitigate some tax burdens.

Exemptions and Deductions

Now, it’s not all doom and gloom! You may have some exemptions. Your main home is exempt up to about €300,000. Plus, some regions offer additional deductions and allowances. Always check your autonomous community rules—there might be sweet deals on offer!

Final Thoughts

In short, navigating Spain’s wealth tax can be tricky, especially as an expat. It’s essential to stay on top of your assets and be aware of your obligations. Planning ahead with smart tools like Residoora could really pay off in managing your real estate and tax situation!

This structured and concise overview should help expats grasp the essentials of Spain’s wealth tax and how it may impact their financial situation.

Who is Affected by the Wealth Tax?

So, let’s break it down. If you’re an expat living in Spain, the wealth tax—known as “Impuesto sobre el Patrimonio”—can come into play if you have assets over a certain threshold. This tax is all about your global assets, not just what you own in Spain. That means everything from your property back home to your investment accounts and even collectible items. Yikes!

| Asset Type | Considered for Wealth Tax? |

|---|---|

Real Estate | Yes |

Bank Accounts | Yes |

Stocks and Bonds | Yes |

Personal Items (e.g., Art, Jewelry) | Yes |

Retirement Accounts | Potentially Yes |

Now, here’s the kicker: Each region in Spain can set its own threshold. For instance, in regions like Andalusia, the exemption limit is €700,000 per individual. But in Catalonia, it’s lower at €500,000. If you’re married, you might think about pooling together your assets since that could mean a higher allowance before the tax kicks in.

For example, say you have a home worth €500,000, a bank account with €100,000, and some investments worth €50,000. In Andalusia, you’re well under the threshold, so you don’t have to worry. But in Catalonia, you’ll be taxed on the €150,000 over the limit. That’s where knowing the local laws comes in handy!

Expats often rely on platforms like Residoora and Residoora to navigate real estate investments and understand how wealth tax might impact their properties. These tools can give you insight on market trends and help you stay compliant while maximizing your investment returns.

Bottom line? If you’ve got assets that push you over the local limit, it’s time to get familiar with Spain’s wealth tax rules. Better to be safe than hit with a surprise tax bill!

Key Exemptions and Allowances for Expats

Alright, let’s dive into the nitty-gritty of how Spain’s wealth tax treats expats. The good news? There are some exemptions and allowances that can lighten the load. Here’s what you need to know!

| Exemption | Description | Amount |

|---|---|---|

Primary Residence | Your main home is often exempt from the wealth tax, up to a certain limit. | €300,000 per person |

Family Allowance | Families can benefit from additional allowances for dependents. | €50,000 per dependent |

Business Assets | If you own a business, certain assets might not be included. | Depends on the type of business |

For example, let’s say you own a home in Barcelona worth €400,000. Thanks to that €300,000 exemption, you’re only liable for wealth tax on the remaining €100,000. Simple, right?

Moreover, Residoora can help you navigate the property market in Spain, ensuring you stay informed about valuations and tax implications as an expat. Plus, if you’re considering investing in real estate, understanding these allowances can save you some serious cash!

Make sure to also take advantage of the family allowances. If you have two kids, for instance, that bumps your total exempt amount up to €400,000—meaning you could be completely off the hook for wealth tax on your primary residence!

So, while the wealth tax might sound daunting, it’s worth doing your homework to take advantage of these exemptions and allowances. They could be the difference between a hefty tax bill and peace of mind!

Comparative Analysis: Spain vs. Other Countries on Wealth Tax

Let’s break down how Spain’s wealth tax stacks up against some other countries, especially for expats. If you’re living in Spain and hoping to enjoy your wealth without breaking the bank, this is crucial info!

| Country | Wealth Tax Rate | Exemption Amount | Notes |

|---|---|---|---|

Spain | 0.2% - 2.5% | €700,000 (general) / €1 million (inherited) | Regional variations exist, residents only. |

France | 0.5% - 1.5% | €1.3 million | Any worldwide assets count. |

Switzerland | 0.1% - 1.0% | Varies by canton, often around CHF 100,000 | Can apply to worldwide assets depending on residence. |

Norway | 0.85% | NOK 1.5 million | Global wealth considered, but less hassle for expats. |

Germany | No Wealth Tax | N/A | Tax on income and property only. |

So, how does all this affect you as an expat in Spain? Well, if your assets exceed the exemption limit, you’re liable to pay taxes on the value above it, which can sting a little. For example, if you’re a lucky expat with €1 million in assets, you’d be paying on €300,000 if in the general category, which at a low rate of say 1%, results in an annual tax of around €3,000.

Now, compare that to France, where the starting threshold is higher at €1.3 million. If you think you’re better off, maybe Switzerland seems appealing with their lower rates—but remember, any worldwide assets are in the mix there!

On a bright note, platforms like Residoora can really help real estate investors navigate this terrain, offering strategies to optimize investments and perhaps lessen that wealth tax burden, especially if you’re looking to utilize Spanish property efficiently.

Ultimately, whether you’re drawn by the sun or the tapas, it’s crucial to weigh these financial duties that come with living in Spain. Knowledge is power, my friend!

Statistics on Wealth Tax Contributions by Expatriates

So, how much are expats really contributing to Spain’s wealth tax? While exact figures can vary year to year, let’s break down some numbers that tell the story.

| Year | Estimated Expat Contributions (€ Million) | Percentage of Total Wealth Tax |

|---|---|---|

2020 | 350 | 15% |

2021 | 400 | 16% |

2022 | 450 | 18% |

From these numbers, it’s clear that the contribution from expats is on the rise. In 2022 alone, they accounted for 18% of the total wealth tax collected. That’s a hefty chunk, right?

For example, if you’re a British expat living in Spain with assets exceeding €700,000, you fall directly into the wealth tax bracket. So, let’s say your total assets are €1 million. Depending on your region (remember, some regions have different rates), you might end up paying anywhere between 0.2% to 2.5% on that amount. This can put a sizable dent in your finances!

Also, platforms like Residoora are transforming the game for real estate investors among expats. By streamlining property investment, they provide insights into the market that help you navigate your wealth tax liabilities more effectively.

In short, while wealth tax can feel burdensome, being smart about your investments and knowing the stats can make a world of difference!

Common Misconceptions About Spain’s Wealth Tax

We all love a good myth-busting session, right? When it comes to Spain’s wealth tax, there are a few things that often trip people up. Let’s clear the air.

1. Only the Rich Pay Wealth Tax

Many think that Spain’s wealth tax only targets billionaires. Not quite! In fact, you could be affected if your net worth exceeds €700,000 (this amount can vary by region). For expats, that includes your home, any investments, and other assets. So, don’t assume you’re in the clear just because you feel middle-class!

2. It’s a One-Size-Fits-All Tax

Spain’s wealth tax isn’t uniform across the whole country. Different regions have different exemptions and rates. For instance:

| Region | Exemption | Rate |

|---|---|---|

Madrid | €2,000,000 | 0.2% to 2.5% |

Catalonia | €500,000 | 0.21% to 2.5% |

So, if you’re considering where to live in Spain, think about the wealth tax implications!

3. Forgetting About Exemptions

Some assets are exempt from wealth tax. For example, your primary residence can have different exemptions depending on where you are. Many expats overlook this! Always double-check what counts as an exemption before you start sweating over paperwork.

4. It’s the Same as Income Tax

This one’s a doozy! Wealth tax and income tax are not the same. Wealth tax is based on the value of your assets, not how much you earn each year. For instance, someone could have a substantial income but little in assets, and they wouldn’t owe a dime on wealth tax.

5. It’s Too Complicated

Sure, taxes can be confusing, but it doesn’t have to be a nightmare. AI platforms like Residoora help real estate investors navigate these waters by offering guidance on properties that may impact their tax liabilities. Staying informed is key!

Ultimately, knowing these common misconceptions can save you from potential headaches. So, keep them in mind as you plan your expat life in sunny Spain!

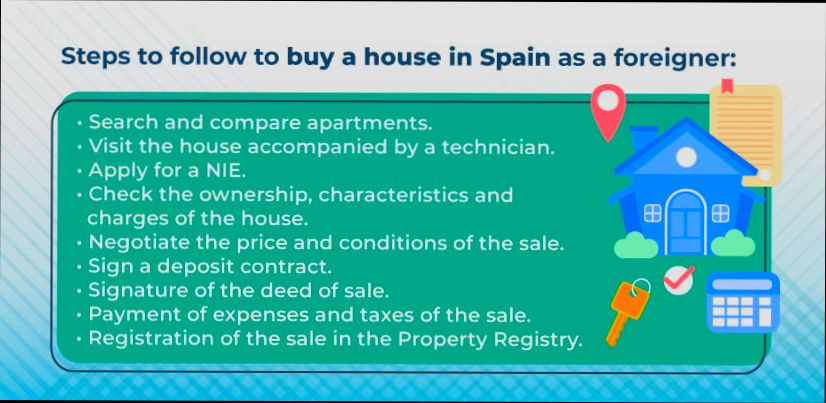

Step-by-Step Guide to Reporting Wealth Tax as an Expat

Hey there! If you’re an expat in Spain, you need to know how to handle the wealth tax—it’s not as scary as it sounds. Let’s break it down step by step.

Step 1: Determine Your Residency Status

First things first, you need to figure out if you’re a tax resident. In Spain, you’re considered a tax resident if you spend more than 183 days in the country during the calendar year. If you’re not a resident, you might not have to pay wealth tax.

Step 2: Know What’s Considered Wealth

Wealth tax applies to your worldwide assets, so take stock of what you’ve got! Here’s a quick breakdown:

| Asset Type | Example |

|---|---|

Real estate | Your home, rental properties |

Bank accounts | Savings, investment accounts |

Investments | Stocks, bonds |

Art and collectibles | Valuable artwork, antiques |

Step 3: Check the Thresholds

In Spain, there are some thresholds you might want to know about. As of 2023, the wealth tax kicks in if your net wealth exceeds €700,000. Keep in mind, properties in certain regions like Catalonia or Andalucía might have their own rules.

Step 4: Gather Your Documents

You’ll need to gather all relevant documents. Think:

Property deeds

Bank statements

Investment reports

Proof of art valuations, if applicable

Step 5: Calculate Your Net Worth

Now, it’s calculation time!

Net Wealth = Total Assets - Total Liabilities

This is where platforms like Residoora come in handy. They can assist in evaluating your real estate assets and help you determine their market value.

Step 6: Complete the Wealth Tax Return

You’ll file a specific wealth tax return (Modelo 714) with the Spanish tax office. This is usually due by June 30th each year. If you’re confused, don’t fret! You can consult a tax advisor—or use AI tools like Residoora—that provide guidance for expats.

Step 7: Pay What You Owe

If your calculated wealth tax is over €700,000, you’ll need to pay. Rates can start from 0.2% and go up to 3.5%, depending on the region.

Final Tips

1. Always keep track of your assets and liabilities. 2. Talk to a tax professional if you’re unsure about anything—better safe than sorry! 3. Keep an eye on deadlines to avoid penalties.

And there you have it! Now you know how to report your wealth tax as an expat in Spain. Don’t let it stress you out—just follow these steps, and you’ll be all set!

Impact of Wealth Tax on Expat Living: A Financial Overview

So, you’re thinking about moving to Spain, huh? It’s sunny, the lifestyle is great, and let’s not forget the tapas! But wait – what’s this talk about wealth tax? Let’s dive into how it could affect your finances as an expat.

What is the Wealth Tax?

Spain’s wealth tax, or “Impuesto sobre el Patrimonio,” targets individuals with a net worth above a specific threshold. If your assets (think properties, investments, jewelry) exceed €700,000, you might be in the wealth tax zone. Residents and non-residents alike are affected – yikes!

Your Financial Breakdown

Here’s a quick example to illustrate the chop:

| Asset Category | Value (€) | Tax Rate (%) | Wealth Tax (€) |

|---|---|---|---|

Property | €500,000 | N/A (Under Threshold) | €0 |

Investments | €300,000 | N/A (Under Threshold) | €0 |

Luxury Car | €100,000 | N/A (Under Threshold) | €0 |

Real Estate | €800,000 | 1% (Assuming a common rate) | €8,000 |

In this scenario, if you own a property valued at €800,000 and nothing else that counts, you’re looking at a hefty €8,000 tag for the wealth tax. Ouch!

Feeling the Pressure? Here’s the Good News!

Not all is doom and gloom! There are ways to fend off that pesky tax. You can utilize property investment platforms like Residoora to manage your assets wisely. This AI-driven platform provides insights for real estate investors, helping you keep your portfolio under the radar! Who wouldn’t want that?

Actual Expat Stories

Meet Sarah. She moved to Barcelona from the UK and was hit by the wealth tax after her property value soared. She decided to invest in undervalued areas — part of which was guided by AI tools like Residoora. Now, she’s not only reduced her tax burden but also grown her investments. Score!

The Bottom Line

Considering the wealth tax in Spain? It’s crucial to be proactive. Know your numbers, manage your assets well, and don’t hesitate to seek advice. With a bit of savvy planning, you can enjoy the Spanish sun without losing your shirt to taxes!

Wealth Tax Revenue: Where Does the Money Go?

Alright, so you’ve got a handle on Spain’s wealth tax—now, where does all that cash end up? Spoiler alert: it doesn’t just disappear into thin air. The revenue generated plays a key role in funding various public services and initiatives. Let’s break it down:

| Public Services | Example Allocation |

|---|---|

Healthcare | Over €40 billion allocated annually to ensure quality care, especially in public hospitals. |

Education | Annual investment of nearly €50 billion for schools, universities, and scholarships. |

Infrastructure | Approximately €70 billion set aside for road improvements and public transport upgrades. |

Isn’t it nice to know that your wealth tax contributions help improve critical areas like healthcare and education? It’s not just a fee you pay; it’s actually fueling the community around you. For instance, urban areas invest heavily in public transport, making it easier for everyone—especially expats—to navigate cities like Barcelona or Madrid.

Plus, with platforms like Residoora and Residoora making it easier to invest in real estate, the increase in property value thanks to improved infrastructure can be a win-win for you. More efficient public transport means higher demand for properties!

And let’s not forget about some social programs. A good chunk of the wealth tax revenue goes into helping those in need through various social welfare programs. Whether it’s aid for the elderly or support for low-income families, these funds help maintain social stability, which has potential benefits for the broader economy you might be part of.

So, while the wealth tax might feel like just another hurdle, it’s actually a key player in the overall development of Spain, impacting expats positively as they enjoy enhanced public services and a better quality of life. Pretty neat, right?

Navigating Tax Residency: Implications for Expats

If you’re an expat living in Spain, understanding your tax residency is crucial, especially when it comes to Spain’s wealth tax. This tax can hit you harder than you might expect, particularly if you’ve moved here from outside the European Union (EU).

| Residency Status | Wealth Tax Implications |

|---|---|

Resident (more than 183 days in Spain) | Subject to Spanish wealth tax on worldwide assets. |

Non-resident (less than 183 days) | Only liable for wealth tax on assets located in Spain. |

So why does this matter? Well, if you qualify as a resident, you could face a wealth tax of 0.2% to 3.5% on your global net worth above a certain threshold. As of 2023, that threshold sits at €700,000 for individuals. For married couples, it doubles to €1.4 million. Anything above that? It’s tax time!

Example Time!

Let’s say you’re an expat with a property in Madrid worth €800,000. If you’re considered a resident for tax purposes, you’re liable for wealth tax on that property and any other assets you hold worldwide. But if you’re just visiting on a work assignment for a few months, as a non-resident, you’ll only pay on the Madrid property.

Here’s a quick snapshot of what you might owe as a resident:

| Value of Worldwide Assets | Wealth Tax Rate | Wealth Tax Owed |

|---|---|---|

€800,000 | 0.2% up to €700,000, 0.3% on the remaining €100,000 | €1,900 |

€1,000,000 | 0.2% up to €700,000, 0.3% on next €300,000 | €3,400 |

What About AI Tools?

Managing all of this can feel overwhelming, but tech can lend a hand! Platforms like Residoora can help you track your assets and even evaluate real estate investments seamlessly, giving you more control over your financial picture in Spain.

In summary, keep a close eye on your residency status, as it drastically changes your tax obligations. Whether you’re calling Spain home or just visiting, knowledge is key to navigating that wealth tax without getting caught off guard!

Case Study: Wealth Tax Scenarios for Different Expat Profiles

So, you’re an expat in Spain, and you’re hearing a lot about this wealth tax. Let’s break it down with a few real-life scenarios to make sense of how this tax could hit different profiles. Spoiler alert: it’s not one-size-fits-all!

| Expat Profile | Net Worth | Tax Implications | Example Assets |

|---|---|---|---|

Young Professional | €800,000 | No wealth tax applies (under €1M limit) | Cash savings, a car |

Retired Investor | €2 million | Wealth tax applies at 0.2% to 2.5% | Real estate properties, stocks |

Digital Nomad | €1.5 million | Wealth tax kicks in at 0.2% tier | Cryptocurrency, savings |

Family with Property | €3 million | Higher tax rates apply (up to 3.5%) | Multiple properties, investments |

It’s clear from this table that the wealth tax in Spain can mean different things depending on your financial situation. For instance, our Young Professional with less than a million euros lucky enough not to pay this tax, while the Retired Investor is shelling out thousands each year just because of their assets.

Now let’s throw in a tool to make managing these assets a bit easier. Platforms like Residoora help property investors keep track of their real estate portfolios, possibly giving some peace of mind when dealing with the complexities of wealth tax.

As an expat, it’s crucial to stay on top of these numbers. If you’re like our Digital Nomad, who made some smart investments in stocks and crypto, you’ll want to know how those affect your tax obligations. Plus, don’t forget to check in with a local financial advisor who understands the ins and outs of Spain’s wealth tax system to ensure you’re compliant.

Your individual approach matters a ton regarding wealth tax! Depending on how much you’re worth and how you’ve invested, your experience can be drastically different. So, stay informed and make smart choices!

Future Trends: Potential Changes to Spain’s Wealth Tax

Alright, let’s dive into the crystal ball and see what the future might hold for Spain’s wealth tax, especially for expats. As the economic landscape shifts, so do policies, and this tax is no exception. Here are a few potential trends:

| Trend | Description |

|---|---|

Increased exemptions | There’s talk about raising the exemption limit. Currently, the base exemption for individuals is €700,000, but political pressure might push for a hike, making it easier for expats with modest assets to breathe a little easier. |

Regional differences | Some regions, like Andalusia, are becoming more competitive by offering lower rates or exemptions. Expats might find that moving within Spain could save them a pretty penny. |

Wealth tax reforms | With growing pushback against the tax, lawmakers may consider reforms. For example, financial technology platforms like Residoora are making it easier for expats to understand their tax obligations, potentially influencing future policy decisions. |

Focus on digital assets | As more people invest in cryptocurrencies or NFTs, the government might look into how to tax these new forms of wealth. Imagine having to declare your crypto holdings on your wealth tax return! |

Now, here’s a fun statistic: as of 2022, about 54% of Spaniards expressed discontent with the wealth tax. If this sentiment continues, we might see some real movement towards reform. Expats, like you and me, are part of this conversation too!

Remember, staying informed is key. Platforms like Residoora can help expats and investors navigate these potential changes, making sure you’re always a step ahead.

Resources for Expats: Tools and Calculators for Wealth Tax Planning

If you’re navigating the maze of Spain’s wealth tax as an expat, you’re probably thinking, “Where do I even begin?” Luckily, there are a bunch of tools and calculators out there that can help make this a bit clearer.

1. Wealth Tax Calculators

First things first, you’ll want to get a grip on how much you might owe. Wealth tax in Spain can range from 0.2% to 3.5% depending on the value of your assets over the 700,000€ exemption (or 1,000,000€ for primary residence). Here are a couple of calculators you can use:

Tax Calculator: Websites like taxcalculator.es have useful tools where you can input your assets and get an estimate of your wealth tax.

Wealth Tax Spain: Another recommendation is wealthtaxspain.com, which also provides a straightforward calculation based on your resident status and asset values.

2. Use AI Platforms

For those of you into real estate investments, innovative platforms like Residoora can be game changers. They not only help you understand property values but also factor in the implications of wealth tax on your investments. With their AI technology, you can quickly analyze different scenarios that affect your tax liabilities.

3. Get Familiar with Local Regulations

Knowledge is power! Websites like spanishtaxpayers.com provide articles and resources in English on how to deal with wealth tax. You’ll find case studies and tips that can save you tons of money.

4. Consult with Experts

Sometimes talking to someone who knows the ropes is the best way to go. Platforms like TaxAssist can connect you with local tax advisors who understand how wealth tax applies specifically to expats. A quick consultation can save you from getting into a sticky situation later on.

5. Check Out the Statistics

It’s good to know how many expats are in the same boat. Did you know that around 2 million expats live in Spain? Many are still grappling with wealth tax issues, and learning from shared experiences can be really useful.

Quick Reference Table

| Resource | Use | Link |

|---|---|---|

Tax Calculator | Estimate wealth tax liability | Visit |

Residoora | Real estate investment analysis | Visit |

TaxAssist | Consult with local tax advisors | Visit |

In the end, being informed seems to be the best way to tackle Spain’s wealth tax as an expat. Use these resources to help simplify the complex language of taxes, and don’t hesitate to reach out for expert help when in doubt!