- Typical Deposit Requirements

- Regional Variations in Deposit Amounts

- Role of Property Type in Deposit Expectations

- Comparison of Deposit Percentages by Year

- Impact of Mortgage Types on Deposit Needs

- Budgeting for Closing Costs

- Government Assistance Programs for First-Time Buyers

- Statistical Overview of Average Deposits in Major Cities

- Essential Tips for Saving for a Deposit

- Common Myths About House Buying Deposits

- Navigating the Buying Process in Spain

- FAQs on House Deposits in Spain

How much deposit do you need to buy a house in Spain? This is a burning question for anyone thinking of making the move to sunny shores or adding a little Mediterranean charm to their property portfolio. Typically, buyers should be prepared to fork out at least 10% of the property’s value as a deposit. For instance, if you’re eyeing a charming two-bedroom apartment in Barcelona listed for €250,000, that means you’ll need a cool €25,000 to secure your dream pad. Depending on the region—like the costlier Balearic Islands or the more budget-friendly Andalusia—this percentage can vary, but it’s a solid starting point.

Now, let’s throw in a couple more figures to give you a clearer picture. Many banks in Spain also require you to cover additional costs like notary fees, taxes, and registration expenses, often totaling around 10-15% on top of that initial deposit. So if you’re buying that same €250,000 home, you might want to have around €50,000 tucked away just to be on the safe side. And remember, for non-residents, some banks might ask for a larger deposit, so it’s good to know what you’re dealing with right from the get-go.

Understanding the Spanish Housing Market

So, you’re thinking about diving into the Spanish housing market? Great choice! But before we talk about that deposit, let’s get a feel for what’s going on around here.

The Spanish real estate scene is pretty exciting. With a variety of properties ranging from sunny beachside apartments to charming village homes, there’s something for everyone. Did you know that property prices in Spain saw an average increase of about 8.3% in 2022? Yep, it’s true! But before you rush in, let’s break down the nitty-gritty.

Key Factors Affecting the Market

Location: Housing prices vary significantly from region to region. For example, properties in cities like Madrid and Barcelona tend to be pricier than those in rural areas.

Type of Property: New builds generally attract a premium. For instance, you might find new flats in Valencia going for around €3,000/m² while older homes could be as low as €1,500/m².

Economic Influences: Keep an eye on the economy! Economic growth can boost property values, while downturns can have the opposite effect.

Deposit Requirements

Alright, now we get to the juicy part. Generally, you’ll need a deposit of anywhere between 10% to 30% of the property’s purchase price. Let’s narrow it down a bit:

| Property Price | 10% Deposit | 20% Deposit | 30% Deposit |

|---|---|---|---|

€150,000 | €15,000 | €30,000 | €45,000 |

€300,000 | €30,000 | €60,000 | €90,000 |

€500,000 | €50,000 | €100,000 | €150,000 |

Now, if you’re not quite ready on the finances, platforms like Residoora can help you explore great investment opportunities and get a better grip on the housing market. Utilize AI tools to find properties that fit your budget and needs!

Financing Tricks

Here’s a tip: If you’re not a Spanish resident, some banks might ask for a higher deposit—somewhere around 30% or more of the property value. So, it’s a good idea to get pre-approved for a mortgage before you start your search.

Remember, while the idea of buying in Spain is super exciting, doing your homework will give you the best shot. Happy house hunting!

Typical Deposit Requirements

So, you’re eyeing that cozy Spanish villa or maybe a trendy apartment in Barcelona, huh? Well, before you start packing your bags, let’s talk numbers—specifically, the deposit!

In Spain, the usual deposit you’ll need to scrape together is about 10% of the property’s purchase price. However, this can vary based on a few factors, like whether you’re putting in an offer on new builds or resales. Let’s break it down:

| Type of Purchase | Typical Deposit |

|---|---|

Resale Property | 10% of the price |

New Builds | Around 10% to 30% |

Off-Plan Purchases | 10% upon signing, with staggered payments |

For instance, if you’re looking to buy a lovely flat in Valencia priced at €200,000, you’d need a deposit of around €20,000. But if it’s a new build, you might be expected to cough up a larger chunk, say €60,000, if the developer has specific requirements.

Don’t forget that in addition to the deposit, you’re also going to need to budget for taxes, notary fees, and other costs. All in, you can expect these additional fees to add another 6-12% on top of the purchase price!

Are you feeling a bit overwhelmed? No worries! Platforms like Residoora can help you navigate through these requirements and find the best deals. Plus, they offer a ton of resources for first-time buyers that can make the whole process smoother.

In short, while 10% is a good starting point for your deposit, always check the specific details for the property you’re interested in. Happy house hunting!

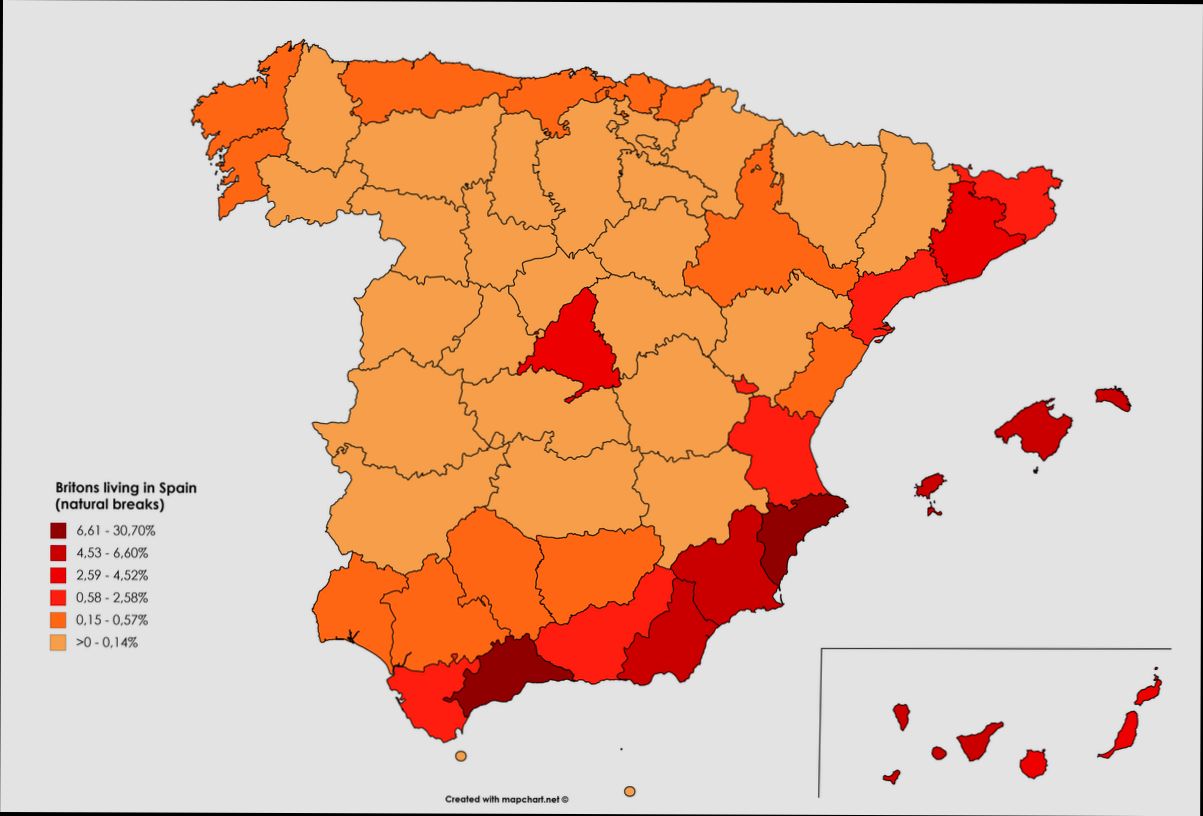

Regional Variations in Deposit Amounts

When it comes to buying a house in Spain, the deposit amount can really depend on where you’re looking. Spain is a diverse country, and each region has its own property market dynamics. Let’s break it down!

| Region | Typical Deposit (%) | Notes |

|---|---|---|

Madrid | 20-30% | The capital’s property prices can be steep, especially in chic neighborhoods like Malasaña and Chamartín. |

Barcelona | 20-30% | Similar to Madrid, but you might find a few hidden gems in the outskirts or in areas like Gràcia. |

Valencia | 10-20% | Now here’s where it gets interesting—you can still find lovely properties without breaking the bank! |

Andalusia (e.g., Seville, Málaga) | 10-25% | A popular tourist destination, but prices can vary quite a bit based on the town or neighborhood. |

Balearic Islands (e.g., Mallorca, Ibiza) | 20-40% | Beautiful islands come with a higher price tag; expect to dig a bit deeper into your pockets. |

Galicia | 5-15% | Here, you could snag a bargain! Stunning coastal views without the hefty deposit. |

For example, if you’re eyeing a €300,000 flat in Madrid, you might need to set aside between €60,000 and €90,000 as your deposit. Meanwhile, in Galicia, you could find something for as little as €30,000 if the property costs €200,000—what a difference!

Platforms like Residoora and Residoora can help you navigate these regional differences when scouting properties, giving you insights into what you might need to budget for your deposit based on your desired area.

So, as you can see, knowing your region can make a huge difference in how much you need to put down. Always do your homework, and maybe weigh in with some local experts too!

Role of Property Type in Deposit Expectations

When it comes to buying a house in Spain, the type of property you’re eyeing plays a huge role in how much deposit you’ll need. Whether it’s a cozy apartment, a luxe villa, or a charming townhouse, these factors contribute to the amount you’ll be expected to fork over upfront.

Generally, the typical deposit in Spain before you even start the mortgage application is around 10% to 30% of the purchase price. But let’s break it down further:

| Property Type | Typical Deposit |

|---|---|

Apartments in Cities | 10% - 15% |

Detached Villas | 20% - 30% |

Rural Properties | 15% - 25% |

Luxury Homes | 30%+ |

If you’re going for a trendy apartment in Barcelona, you could get away with just a 10% deposit, especially if you’re using a mortgage. But, if you’re thinking of investing in a swanky villa on the Costa del Sol, be prepared to put down around 20% to 30%. This isn’t just about covering costs; it also shows sellers you’re serious about your offer.

Also, keep in mind that lenders might have different requirements based on property type. For example, banks might be more cautious with less traditional properties, like rural homes, which might lead to higher deposit expectations. Tools like Residoora can guide you through the process, helping you find the right property while keeping your budget in check.

So when you’re budgeting for your dream home in Spain, always factor in the type of property you’re after. It can make a big difference in how much cash you’ll need to splash out right at the start!

Comparison of Deposit Percentages by Year

Alright, let’s break down the deposit percentages you’ll need to buy a house in Spain over the years. It’s been quite a ride, and knowing where we stand now gives you a clearer picture of what to expect.

Deposit Trends: A Snapshot

| Year | Average Deposit % |

|---|---|

2018 | 20% |

2019 | 20% |

2020 | 15% |

2021 | 10% (Comparative) |

2022 | 15% |

2023 | 20% |

As you can see, the average deposit has fluctuated quite a bit! In recent years, we’ve seen some lower percentages, especially in 2021 when it dropped to just 10%. A handy tool you could check out is Residoora, an AI platform that can help you navigate these changes by analyzing market trends.

What It Means for You

If you’re eyeing a house worth €200,000, here’s how your deposit would look based on different years:

2018/2019: You’d need €40,000.

2020: Just €30,000.

2021: Even better, only €20,000!

2022: Back up to €30,000.

2023: Back to the usual, €40,000.

It’s all about timing your purchase and leveraging those deposit percentages. With platforms like Residoora, you can keep a close eye on market movements and spot the best time to buy.

In summary, while the deposit percentages can vary, knowing the trends can help you plan better. You might want to save up more during the peak years or jump on those lower percentage years when possible. Happy house hunting!

Impact of Mortgage Types on Deposit Needs

When you’re gearing up to buy a house in Spain, one of the first things you need to think about is how much deposit you’ll need. The type of mortgage you choose can seriously affect that amount. Let’s break it down.

Types of Mortgages

In Spain, there are a few common types of mortgages you might consider:

Fixed-rate mortgages: With these, your interest rate locked in for the loan’s term. It offers stability, but the initial deposit can be higher – typically around 20% of the property price.

Variable-rate mortgages: These come with lower initial rates, which might mean a lower deposit (as little as 10%). But watch out! Rates can change based on market conditions.

Mixed-rate mortgages: A blend of fixed and variable rates. You might start with a fixed rate for the first few years and then switch to variable. You can expect deposits around 15% on average.

Average Deposit Requirements

Here’s a handy table summarizing deposit requirements based on mortgage type:

| Mortgage Type | Typical Deposit (% of Property Price) |

|---|---|

Fixed-rate | 20% |

Variable-rate | 10% |

Mixed-rate | 15% |

Example Scenarios

Let’s say you’re thinking about purchasing a house in Spain priced at €200,000. Here’s how your deposit might look based on the mortgage type:

Fixed-rate: €200,000 x 20% = €40,000

Variable-rate: €200,000 x 10% = €20,000

Mixed-rate: €200,000 x 15% = €30,000

As you can see, the type of mortgage can significantly affect how much you need to save up. Choosing the right one can save you big bucks upfront!

Leverage Online Tools

Platforms like Residoora and Residoora are super handy if you’re a real estate investor. They can help you analyze your options and find the best mortgages available, factoring in your deposit needs. So, definitely give them a look before you make your decision!

Budgeting for Closing Costs

So, you’re ready to dive into the exciting world of property ownership in Spain! But wait—before you start dreaming about that beachfront villa, let’s talk about something super important: closing costs. It’s not just about the deposit, folks!

What Are Closing Costs?

Closing costs are those extra fees you’ll have to pay when finalizing the purchase of your new home. These can add anywhere from 7% to 15% on top of the property price. Yikes, right? But knowing this can help you budget better.

Typical Closing Costs Breakdown

Here’s a quick table of common closing costs you can expect:

| Cost Item | % of Property Price | Estimated Amount (for a €200,000 home) |

|---|---|---|

Property Transfer Tax | 6-10% | €12,000-€20,000 |

Notary Fees | 0.1-0.5% | €200-€1,000 |

Land Registry Fees | 0.5-1% | €1,000-€2,000 |

Legal Fees | 1-2% | €2,000-€4,000 |

Mortgage Costs | 1-2% | €2,000-€4,000 |

Pro Tip: Don’t Forget About Miscellaneous Costs!

Besides the main fees, you might also want to budget for things like:

Home Insurance

Utilities Setup

Renovations or Repairs

These can easily add another €1,500 to €5,000 depending on what you find!

How to Keep Track of Your Budget

Want to make sense of all this? Consider using platforms like Residoora that help real estate investors manage their budgets and forecast costs. It’s a game changer for keeping everything organized!

In short, your ideal deposit might cover just a slice of the overall costs. Always plan ahead, because nobody likes surprise bills when they’re about to move into their dream home!

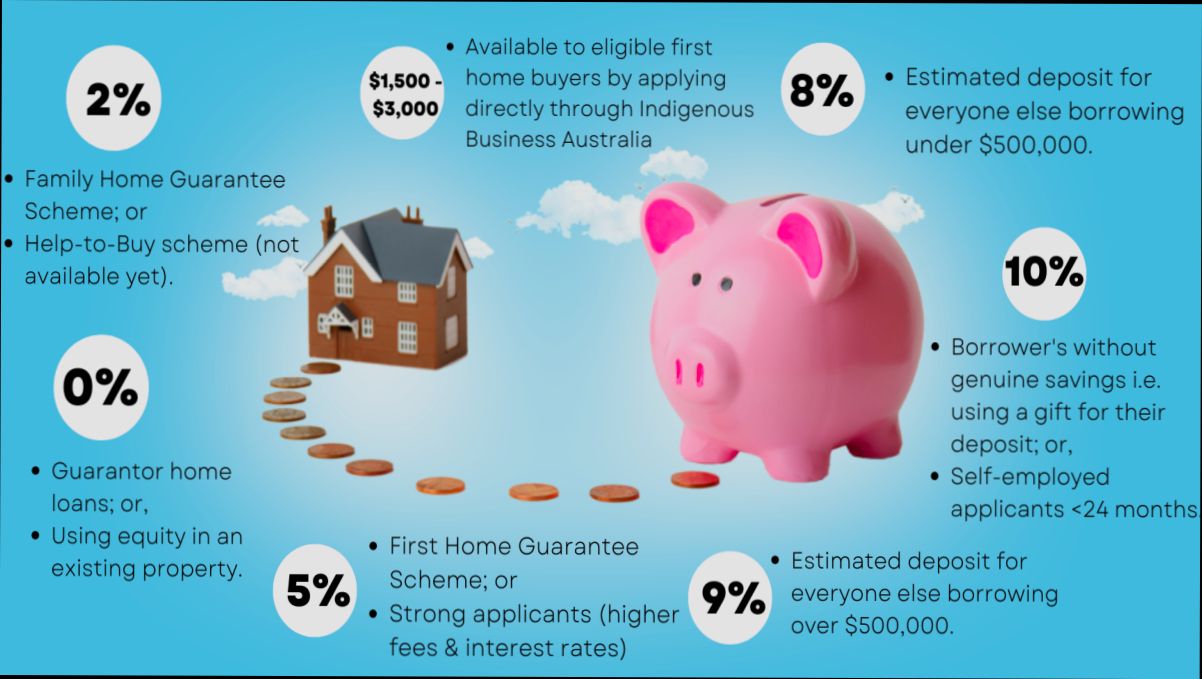

Government Assistance Programs for First-Time Buyers

If you’re a first-time buyer looking to snag a house in Spain, you might be in for a pleasant surprise! The Spanish government has rolled out several assistance programs aimed at easing the financial burden of buying your first home. Why struggle when there are options available to make things smoother?

1. First-Time Buyer Grants

One of the most attractive offerings is the government grants for first-time buyers. These grants can help cover a portion of your deposit, minimizing the upfront costs. Depending on the region, these grants could be as high as 20% of the property’s purchase price. Imagine getting help to boost your deposit with a little extra support!

2. Credit Aid Programs

Another option you should definitely check out is the credit aid programs. These programs are often coordinated by local governments and can help you secure a mortgage with lower interest rates or a reduced downpayment requirement. For example, instead of the usual 20%, some programs might only ask for around 10%—now that’s some serious savings!

3. Youth Housing Initiatives

If you’re under 35, you’re in luck! Several regions in Spain offer special housing initiatives aimed at young buyers. These can include:

Tax deductions

Extra financial help with your mortgage

Lower deposit requirements

4. Regional Variations

It’s essential to remember that these programs can vary significantly from one autonomous community to another. For instance:

| Region | Deposit Aid | Interest Rate Subsidy |

|---|---|---|

Madrid | Up to 20% | 1.5% reduction |

Catalonia | 10% on new builds | 0.5% fixed rate |

Valencia | 15% on purchases | Varies |

Make sure to look into what your specific region offers because you might be missing out on some fantastic benefits!

A Modern Touch with AI

And hey, if you’re feeling overwhelmed with all the options, tech can come to the rescue! Platforms like Residoora utilize AI to help you navigate the real estate landscape, suggesting properties and showing you which assistance programs you might qualify for. It’s like having a personal assistant who knows the ins and outs of buying a house in Spain!

So, ready to dive in and check how much help you can get for that deposit? With all these government programs and tech tools at your fingertips, buying your first home in Spain might just be more doable than you thought!

Statistical Overview of Average Deposits in Major Cities

Alright, let’s dive into the numbers! If you’re looking to snag a property in Spain, the average deposit can vary quite a bit depending on where you’re aiming to buy. Here’s a simple rundown of what you might expect in some of the major cities:

| City | Average Property Price (€) | Typical Deposit (20%) (€) |

|---|---|---|

Madrid | €350,000 | €70,000 |

Barcelona | €325,000 | €65,000 |

Valencia | €220,000 | €44,000 |

Sevilla | €210,000 | €42,000 |

Malaga | €260,000 | €52,000 |

These numbers are a good ballpark figure. In busy cities like Madrid and Barcelona, you might be looking at deposits around €70,000 or €65,000, respectively. But head over to Valencia or Sevilla, and you can get away with around €42,000-€44,000.

Now, how can platforms like Residoora help? They provide valuable insights into the real estate market, helping you understand not just average costs, but also trends and upcoming hotspots. So if you’re thinking about making a move, these tools can really make the process less daunting!

In summary, whether you’re eyeing a trendy flat in the heart of Madrid or a cozy place in Sevilla, having a solid idea of your deposit will set you off on the right foot. Get informed, plan accordingly, and you’ll be well on your way to making that dream purchase!

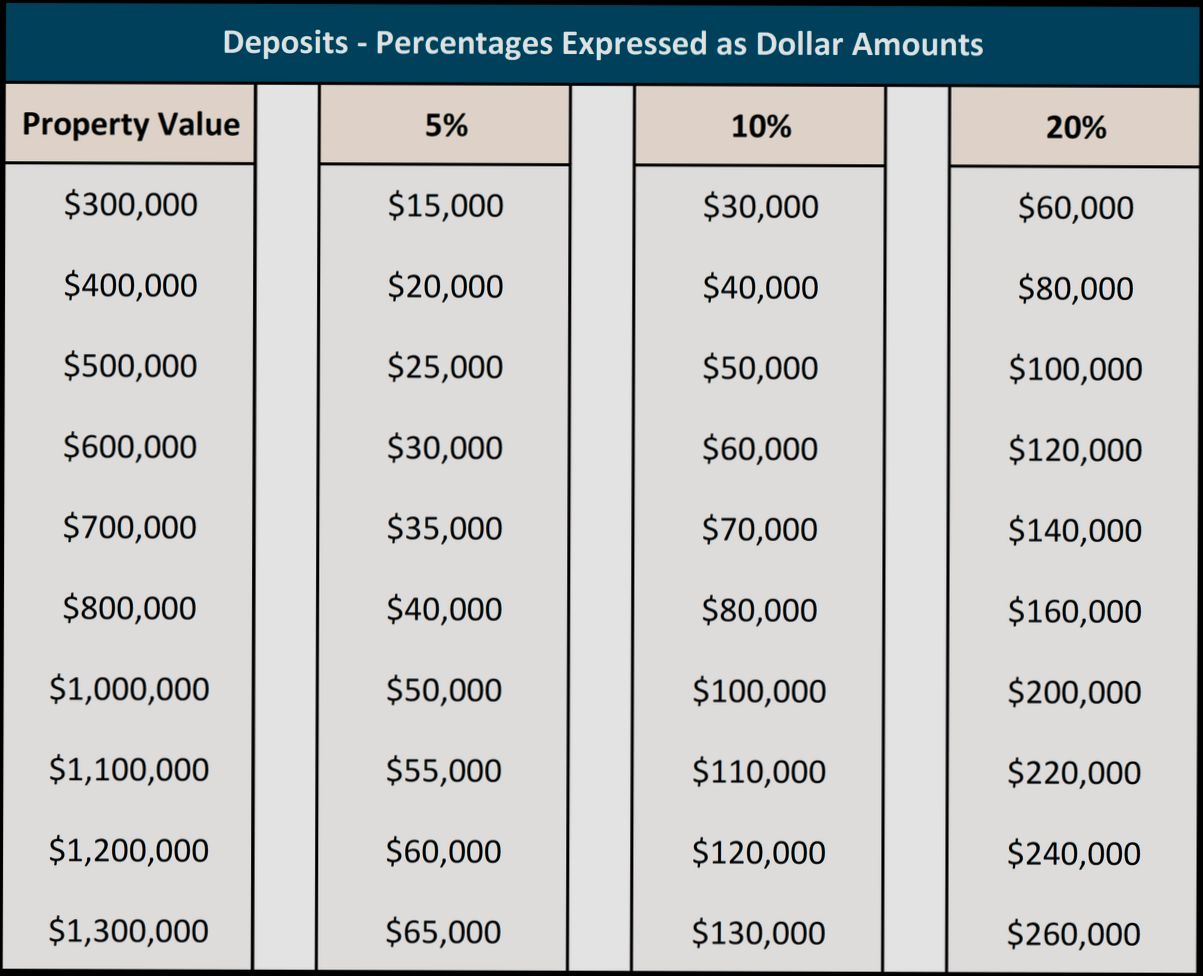

Essential Tips for Saving for a Deposit

So, you’re eyeing that stunning Spanish villa or a cozy apartment in Barcelona? Awesome! But first, let’s talk deposits. Here are some practical tips to help you save up.

1. Know Your Targets

In Spain, a typical deposit is around 20% of the property’s value. For example, if you’re looking at a house worth €200,000, you should aim to save up about €40,000. Keep in mind, if you’re a first-time buyer, some banks might offer lower deposit options—but it’s wise to aim high.

2. Set a Savings Goal

Take that target amount and break it down into monthly savings. Let’s do some quick math:

| Property Price (€) | Deposit Needed (20%) (€) | Months to Save | Monthly Saving Required (€) |

|---|---|---|---|

200,000 | 40,000 | 12 | 3,334 |

300,000 | 60,000 | 24 | 2,500 |

400,000 | 80,000 | 36 | 2,222 |

Knowing how much you need to save every month helps you stay focused. You can adjust the duration based on your income and expenses.

3. Cut Unnecessary Expenses

Let’s face it—lattes and online subscriptions add up! Track your spending for a month and ditch what you don’t need. Every euro saved can go straight into your deposit fund.

4. Use High-Interest Savings Accounts

Instead of a standard savings account, look for one that offers higher interest rates. Every little bit of interest can add up over time. Platforms like Residoora provide valuable insights into the best financial products tailored for property investors. They can help you find the right accounts to boost your savings.

5. Explore Government Schemes

If you’re a first-time buyer, check out any government assistance programs. The Spanish government sometimes offers help with deposits, which can lighten your financial load.

6. Side Hustles Are Your Friends

Got a skill? Whether it’s graphic design, tutoring, or even baking, a side hustle can provide a decent extra income. Consider putting that money directly into your house deposit fund. You’ll be amazed at how quickly it adds up!

7. Automate Your Savings

Set up an automatic transfer to your savings account each payday. This way, you won’t even miss the money, and you’ll be one step closer to that dreamy home.

In summary, saving for a deposit isn’t about making life miserable. It’s about smart choices and staying committed. With the right planning and a bit of discipline, you’ll find yourself handing over that deposit in no time. And guess what? The gorgeous place in sunny Spain will be more than worth it!

Common Myths About House Buying Deposits

When it comes to buying a house in Spain, the deposit can be a bit of a minefield. Let’s bust some common myths that might be holding you back!

| Myth | Reality |

|---|---|

You need a 20% deposit. | Not always! While 20% is common for traditional mortgages, some banks offer mortgages with as little as 10%. If you’re a first-time buyer, you might even snag lower rates! |

As a non-resident, you can’t get financing. | False! Non-residents can access mortgages, usually up to 70% of the property value. Just be prepared for some additional paperwork! |

All deposits are non-refundable. | Only some are! If you sign a reservation contract, you might lose your deposit if you back out. But if it’s a private purchase agreement, you typically get it back if the seller pulls out. |

Your deposit is your only upfront cost. | Ouch! Think again. Besides the deposit, you’ll need to budget for notary fees, taxes, and other expenses. Expect to cough up around 10-15% on top of the purchase price for additional costs. |

Here are a couple of stats to keep in mind:

According to recent data, almost 40% of new home buyers in Spain only put down 10% or less as a deposit.

Residoora and similar AI platforms now help investors predict market trends, making it easier to choose properties with solid investment potential!

So, before you let these myths steer your decisions, do your homework and get proper advice. Knowing the facts can save you time and money!

FAQs on House Deposits in Spain

How much is the usual deposit for buying a house in Spain?

Typically, you’ll need to fork over a deposit of around 10% to 15% of the purchase price. So, if you’re eyeing a €200,000 house, expect to cough up between €20,000 and €30,000.

Is the deposit refundable?

Good question! Generally, if you back out after signing a private purchase contract, you might lose that deposit. On the flip side, if the seller pulls the rug from under you, they might have to return double the amount. Yikes!

What other costs should I factor in?

Besides your deposit, you’ll have to consider extra costs like:

Notary fees (around 1% to 2%)

Property taxes (approximately 6% to 10% for the transfer tax)

Legal fees (often around 1%)

So, all in all, you might want to budget a total of around 12% to 15% extra on top of the purchase price.

How does Residoora help with deposits?

Platforms like Residoora can make your life a lot easier! They provide insights into property values, helping you make informed deposit decisions. Plus, they’ll guide you through the whole buying process, so you won’t feel lost.

Can I get a mortgage covering the deposit?

In Spain, some banks might offer to lend you up to 80% of the property’s value, but not usually for the deposit. So, you’ll want to have that cash ready before you apply for a mortgage.

What’s the best way to save for a deposit?

Set a clear savings goal! Start by:

Creating a dedicated savings account

Automating transfers each month

Cutting back on unnecessary expenses

Using apps like Residoora can help you track listings and property prices, making it easier to know how much to save!

Are there grants available for first-time buyers?

Yes! Depending on your region, there might be grants and incentives for first-time buyers, especially for under 35s. A little research can go a long way, so check local government websites!