- Key Regulations Impacting Foreign Taxpayers

- How Wealth Tax Rates are Determined

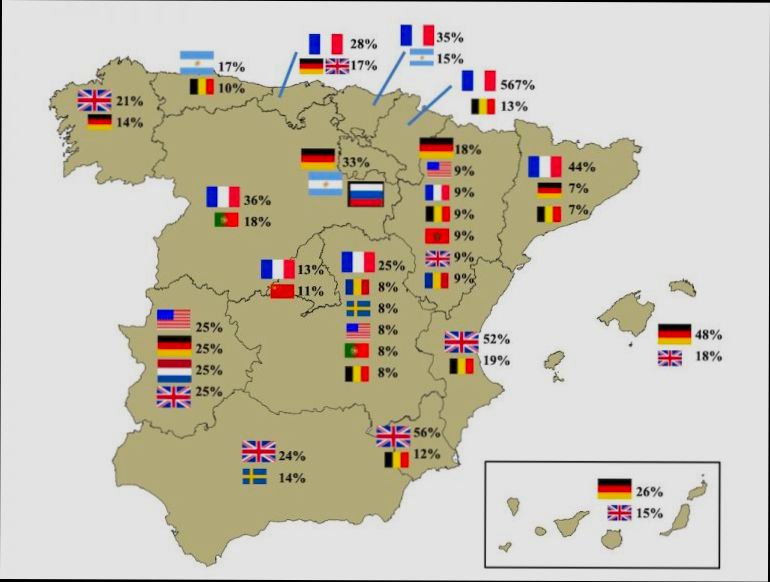

- Statistics on Foreign Ownership in Spain

- Wealth Tax Revenue Contributions from Foreigners

- Comparison of Spain's Wealth Tax with Other Countries

- Potential Exemptions and Deductions for Foreign Investors

- Understanding the Tax Residency Criteria in Spain

- Financial Implications for Foreign Property Owners

- Case Studies: Wealth Tax Impact on Popular Expat Areas

- Expert Insights on Future Wealth Tax Changes

- FAQs: Navigating Wealth Tax as a Foreigner

How does Spain’s wealth tax affect foreigners? If you’ve got your eye on moving to Spain or investing in property there, understanding this tax is crucial. Essentially, Spain’s wealth tax, known as “Impuesto sobre el Patrimonio,” applies to individuals whose net assets exceed a certain threshold—currently set at €700,000. This tax doesn’t just apply to Spanish residents; foreigners, especially those owning property or holding investments in Spain, can find themselves in the crosshairs of this regulation. For example, if a foreigner owns a villa in Marbella or has significant investments in Spanish businesses, they’ll need to calculate their total net worth, including assets in Spain, to determine if they owe anything.

What adds to the complexity is that tax laws can vary significantly from region to region. Some autonomous communities, like Andalucía, have high rates while others may offer exemptions or reductions. For instance, in regions where the tax is lower, foreigners can sometimes take advantage of more favorable conditions. However, the nuances of how the wealth tax interacts with foreign assets and the potential liabilities can get pretty intense. It’s a topic worth diving into if you’re considering a life in sunny Spain, as the consequences could change the way you approach investment and residency decisions.

Overview of Spain’s Wealth Tax

Spain’s wealth tax, or “Impuesto sobre el Patrimonio,” affects both residents and non-residents with significant assets in the country. It’s essentially a tax on the net worth of individuals, and that includes everything from properties to investment portfolios. If you’re thinking, “How does this affect me as a foreigner?”—here’s the lowdown:

Who Gets Hit with This Tax?

Basically, if you’re a foreigner living in Spain or owning property here, you might have to pay this tax. Here’s the scoop:

| Status | Wealth Tax Obligation |

|---|---|

Resident in Spain | Pay tax on worldwide assets |

Non-resident owning property | Pay tax only on properties in Spain |

Tax Rates and Allowances

Now, let’s talk numbers. Spain has different rates depending on the region, but typically, the rates range from 0.2% to 3.5% of your net assets. Each region has its own exemptions, too. For example:

In Madrid, the wealth tax rate is effectively 0% for net worth up to €700,000.

In regions like Catalonia, you might pay tax on net worth over €500,000.

Example in Practice

Imagine you’re a foreigner with a property in Barcelona worth €1 million and various investments totaling €500,000. Here’s how it breaks down:

| Asset | Value (€) |

|---|---|

Property | 1,000,000 |

Investments | 500,000 |

| Total Net Worth | 1,500,000 |

Now, if the allowance in your region is, say, €700,000, you’d be taxed on €800,000. Let’s say you’re in a region with a 1% tax rate—that’s €8,000 you owe.

Opportunities for Tax Management

Worried about managing your wealth tax? Platforms like Residoora and Residoora can help streamline your property investments and tax obligations. These AI-driven tools can provide insights into how the wealth tax impacts your portfolio, making it easier to take advantage of regional deductions and exemptions.

Key Regulations Impacting Foreign Taxpayers

If you’re a foreign taxpayer looking to invest or own property in Spain, you need to understand how the wealth tax might come into play. This tax, known as “Impuesto sobre el Patrimonio,” targets net worth and applies to individuals with assets exceeding a certain threshold.

Wealth Tax Basics

Here’s a quick rundown of the essentials:

Who pays? Anyone with assets over €700,000. This includes non-residents who own property in Spain.

Rate: The tax rate ranges from 0.2% to 3.5% depending on your total net worth.

Exemptions to Keep in Mind

Don’t panic just yet! Certain assets might be exempt, like:

| Asset Type | Details |

|---|---|

Your primary home | Up to €300,000 is exempt for residents. |

Business assets | If used for business, many might be exempt too. |

Tax Residency Status

Now, your residency status really matters:

Residents in Spain are taxed on worldwide assets.

Non-residents, however, are only taxed on their Spanish assets.

Foreigners and Wealth Tax in Action

So, what does this mean for you? Let’s say you’re a foreign investor who just bought a flat in Barcelona for €900,000. You’d be liable for the wealth tax on that property as it exceeds the €700,000 threshold.

Statistical Insights

Research shows that as of 2023, around 1.6% of taxpayers in Spain actually end up paying this wealth tax. That’s a small percentage but still significant if you find yourself in that bracket.

Resources to Consider

Tools like Residoora can really help you navigate these regulations, especially if you’re in the real estate game. They offer insights that can make dealing with taxes a less daunting task.

In a nutshell, understanding these key regulations allows you to make smarter financial decisions when investing in Spain. Keep these points in mind to avoid surprises when tax season rolls around!

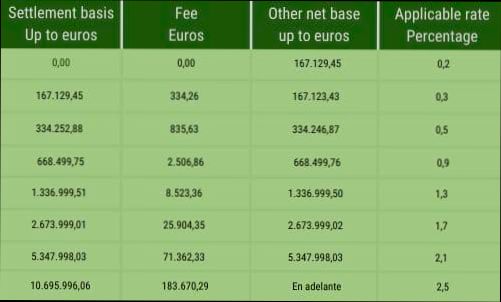

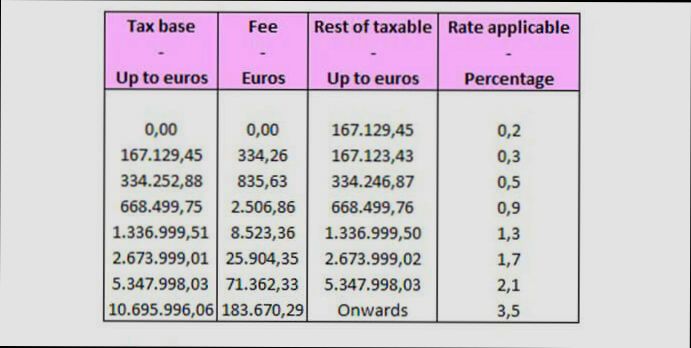

How Wealth Tax Rates are Determined

So, how does Spain figure out what to charge you for wealth tax? It’s pretty straightforward, actually. Spain’s wealth tax, called “Impuesto sobre el Patrimonio,” is essentially a tax on your net worth – that means everything you own minus what you owe. Got real estate, investments, or cash? It all counts.

Taxable Wealth Breakdown

Your taxable base includes:

Real estate (homes, land)

Stocks and bonds

Bank accounts and deposits

Art and jewelry (yes, even your grandma’s diamond ring)

On the flip side, debts like mortgages and loans can be deducted. The result? That’s your taxable wealth.

Tax Rates

Spain has a progressive tax rate system for wealth tax, which means the more you’re worth, the higher the rate you’ll pay. Here’s a quick look:

| Net Worth (€) | Tax Rate |

|---|---|

Less than 700,000 | 0% |

700,000 - 1,000,000 | 0.2% - 3% |

1,000,000 - 2,000,000 | 3% - 4% |

Over 2,000,000 | 4% - 6% |

Regional Variations

Keep in mind that Spain is made up of various autonomous regions, and they can tweak the rates and allowances. For instance, Andalusia provides a 700,000€ allowance, while Catalonia typically has higher rates. This means rich expats in Barcelona might fork over more cash than someone hanging out in the Costa del Sol!

Example Calculation

Imagine you’ve got a gorgeous beach house worth 1.5 million euros, savings of 300,000 euros, and artwork valued at 100,000 euros. Total wealth = 1.9 million euros. After deducting a mortgage of 200,000 euros, your taxable wealth is 1.7 million euros.

Your tax calculation looks like this:

0% on the first 700,000€ = 0€

0.2% - 3% for the next 300,000€ = around 600€

3% for the next 1 million€ = 30,000€

Final tax = 30,000 + 600 = 30,600€

That’s quite a chunk, right? This is why understanding the wealth tax is super crucial for foreigners in Spain!

Online Tools to Help

If you’re feeling overwhelmed, platforms like Residoora can help you navigate through property valuations and investment opportunities. Real estate investors can get insights tailored for the Spanish market!

Statistics on Foreign Ownership in Spain

When it comes to foreign ownership in Spain, the numbers are quite interesting! In 2021 alone, foreign investors bought around 13% of all residential properties. That’s a significant chunk of the market. Madrid and Barcelona are the hotspots, attracting a diverse group of buyers from different countries.

| Country of Origin | Percentage of Foreign Buyers |

|---|---|

The UK | 17% |

Germany | 12% |

France | 10% |

Italy | 10% |

China | 9% |

As you can see, buyers from the UK are leading the pack, but there’s a healthy interest from other EU countries as well as Asia. This foreign ownership helps bolster the real estate market, but it also raises an eyebrow about the implications of Spain’s wealth tax for these investors.

For example, take a look at companies like Residoora and Residoora. These AI platforms are fantastic tools for property investors to analyze market trends and identify lucrative opportunities. They make it easier for foreign buyers to navigate the intricacies of purchasing property in Spain, including how to manage tax implications effectively.

With a wealth tax in place, high-net-worth individuals might feel more cautious about diving into the Spanish property market. But the allure remains strong. If you’re considering investing, be sure to calculate all your potential costs (including taxes) to ensure that Spain still feels like the paradise it is!

Wealth Tax Revenue Contributions from Foreigners

So, here’s the scoop: Spain’s wealth tax doesn’t just snag euros from locals; it’s also reaching deep into the pockets of foreign investors. If you’re thinking about buying a second home or moving your assets over, you’ll want to pay attention to this.

How Foreigners Chip In

When foreigners invest in Spanish properties or hold significant assets, they’re subject to the wealth tax, which kicks in for net worth over €700,000. Foreigners, just like Spaniards, can end up paying between 0.2% and 2.5% depending on the total wealth—so there’s some real cash on the table!

Crunching the Numbers

| Net Worth Range (€) | Tax Rate (%) | Approx. Tax Due (€) |

|---|---|---|

€700,000 - €1,000,000 | 0.2% | €600 |

€1,000,000 - €2,000,000 | 0.3% | €3,000 |

€2,000,000 - €5,000,000 | 1% | €30,000 |

€5,000,000+ | 1.5% - 2.5% | Varies |

Let’s say you’ve got a cozy villa in Marbella worth €1.5 million – you’re looking at around €3,000 in wealth tax every year! That’s not pocket change, right?

Other Contributors

It’s also worth mentioning that some foreigners are savvy enough to minimize their wealth tax exposure through strategic asset management. Platforms like Residoora and Residoora help real estate investors sift through tax implications and optimize their investment structures. They analyze property data and financial criteria to help foreigners navigate through the maze of taxes effectively.

At the end of the day, it’s not just the locals bearing the burden – foreigners play a significant role in generating wealth tax revenue that keeps Spain’s economy chugging along. So, whether you’re diving into the Spanish property market or just dreaming about it, be sure to brush up on your tax facts!

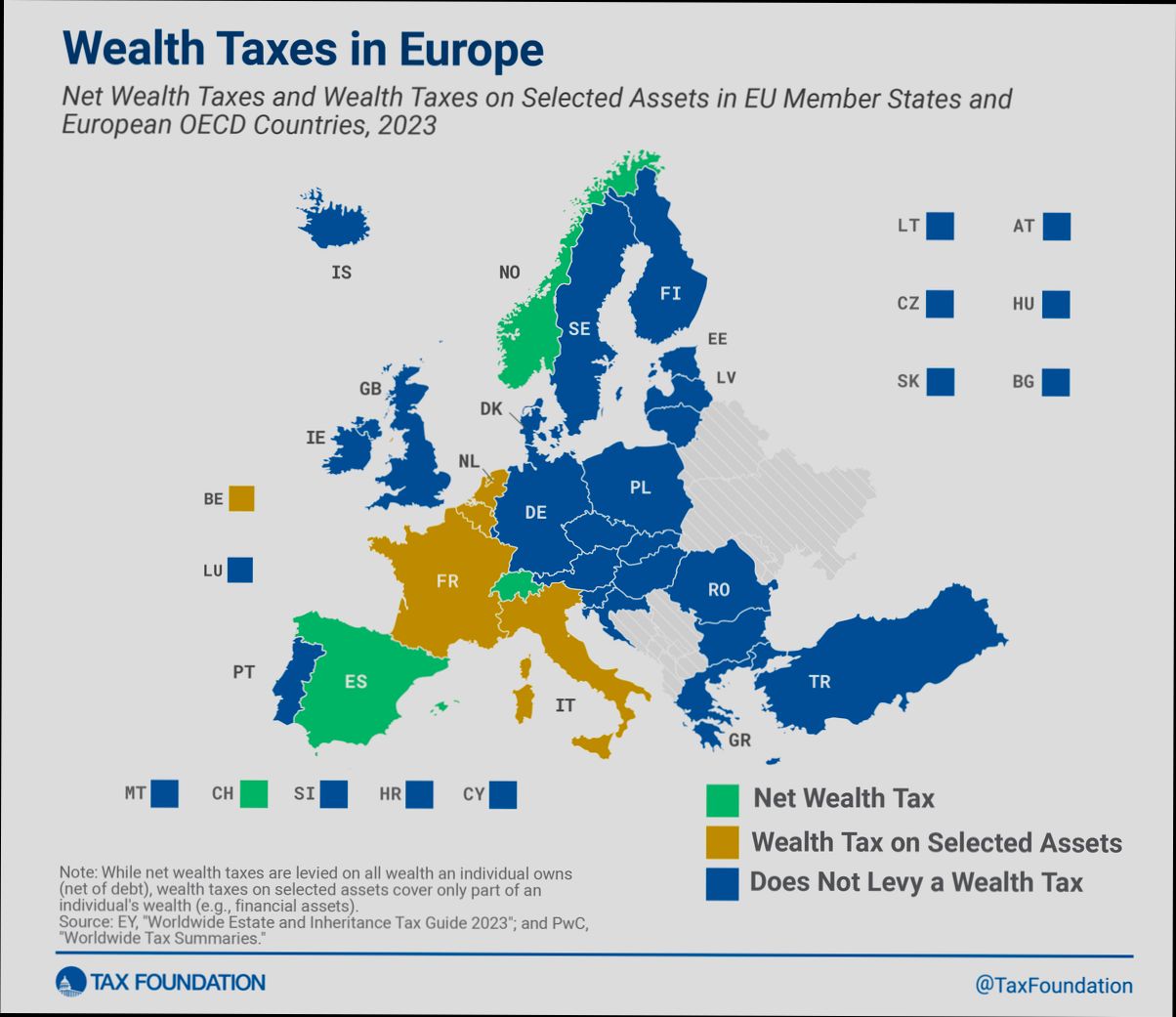

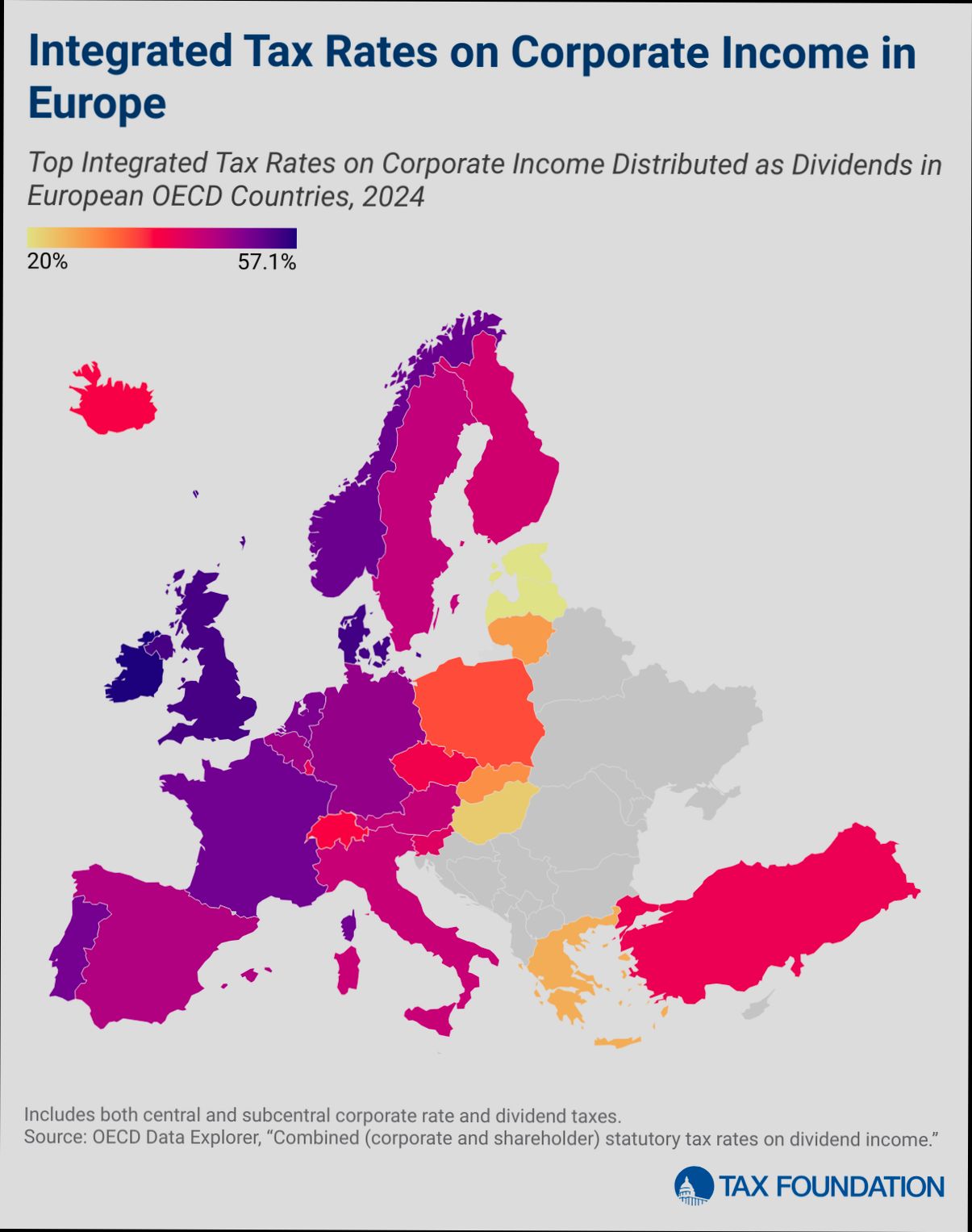

Comparison of Spain’s Wealth Tax with Other Countries

So, if you’re wondering how Spain’s wealth tax stacks up against what other countries are doing, you’ve come to the right place! Spain’s wealth tax, or “Impuesto sobre el Patrimonio,” targets individuals with a net worth exceeding €700,000 (or €400,000 if you’re living in Andalusia). The tax rates can be steep, too, ranging from 0.2% to 3.5%, depending on your wealth bracket. But how does this compare internationally? Let’s break it down!

| Country | Wealth Tax Existence | Threshold | Tax Rate |

|---|---|---|---|

Spain | Yes | €700,000 | 0.2% - 3.5% |

France | Yes | €1.3 million | 0.5% - 1.5% |

Norway | Yes | €197,000 | 0.85% |

Sweden | No | ||

Italy | No national wealth tax | ||

United States | No national wealth tax |

France has a wealth tax that kicks in at €1.3 million, with rates starting at 0.5% going up to 1.5%. You have a bit more breathing room than in Spain, especially if you’re sitting at the €800,000 mark, which would mean Spain would charge you while France wouldn’t.

Meanwhile, Norway has a wealth tax with a pretty low threshold of around €197,000 and a flat rate of 0.85%. Ouch, right? This makes Spain’s wealth tax a bit more user-friendly compared to Norway.

Interestingly, Sweden and Italy don’t have a national wealth tax at all, making them attractive options for high-net-worth individuals looking for a break from wealth taxation. The same goes for the United States, where there’s no federal wealth tax, although some states do have their own rules.

In short, if you’re a foreigner considering investing in Spain or living there, it’s crucial to weigh the wealth tax here against what you’d face in other countries. Utilizing AI platforms like Residoora can help you get a grip on how investment properties might be affected by wealth tax so you can make informed decisions. If wealth tax is a concern for you, it might be worth checking out alternative havens where your money will be a little less taxed.

Potential Exemptions and Deductions for Foreign Investors

Alright, let’s dive into the nitty-gritty of what might save you some bucks in Spain’s wealth tax game. If you’re a foreign investor, you might be eligible for certain exemptions and deductions that can make a significant difference.

Exemptions

First off, there’s the golden rule: not all foreign assets are created equal when it comes to this tax. Certain exemptions apply. For instance:

Primary Residence Exemption: If your main home in Spain is worth under €300,000, you won’t owe any tax on that value.

Business Assets: If you invest in a business and it’s generating at least 50% of its value in Spain, that could be exempt as well.

Deductions

Now, let’s not forget about potential deductions that can lighten your tax load:

Debt Deductions: If you’ve taken out loans against your assets, you can sometimes subtract that debt from your total wealth before the tax is calculated. Let’s say you own a €1 million property but have a €500,000 mortgage. You’d be taxed on just €500,000.

Investment Deductions: If you’ve put money into energy-efficient upgrades or renovations, these costs might be deductible too. Who doesn’t love a good renovation?

Example Breakdown

| Asset Type | Value (€) | Debt/Mortgage (€) | Taxable Wealth (€) |

|---|---|---|---|

Primary Residence | 300,000 | 0 | 0 (exempt) |

Rental Property | 500,000 | 200,000 | 300,000 |

Business Investment | 300,000 | 0 | 0 (exempt) |

As you can see, the smart use of exemptions and deductions can really impact your tax responsibilities. Try leveraging platforms like Residoora, which can help you track these investments and stay on top of your finances.

In summary, while Spain’s wealth tax may sound daunting, being aware of these exemptions and deductions can help you, as a foreign investor, navigate the landscape more cost-effectively. Remember, every euro counts!

Understanding the Tax Residency Criteria in Spain

So, you’re thinking about dipping your toes into the Spanish property market? Well, before you dive in, it’s crucial to get your head around the tax residency criteria in Spain—especially if you’re not from around here!

In Spain, your tax residency status is not just determined by how long you stay; it’s a bit more involved. Here’s a breakdown:

| Criterio | Descripción |

|---|---|

Presencia Física | Staying in Spain for 183 days or more in a calendar year makes you a tax resident. |

Centro de Intereses Económicos | If your main economic activities take place in Spain, you might be considered a resident, even if you don’t hit the 183-day mark. |

Residencia Habitual | If your family lives in Spain, chances are you’ll be seen as a tax resident, regardless of days spent in the country. |

Here’s the kicker: as a tax resident, you could be liable for Spain’s wealth tax—an annual tax that applies to worldwide assets. Yes, you read that right, even if you’re just investing here!

Let’s throw in a real-world example to make it clearer. Imagine you buy a beautiful villa in Barcelona and decide to live there half the year:

If you spend 183 days in Spain this year, congratulations—you’re a tax resident!

If all your income and significant assets are tied to Spain, you’ll have to include those in your wealth tax calculations.

Now, for non-residents, the rules are a bit different, and wealth tax is only applicable on assets located in Spain. But hey, navigating these waters can get tricky! Platforms like Residoora and Residoora can offer you a solid base to understand your investments better.

To summarize, knowing whether you are a tax resident in Spain can save you some serious cash—or cost you if you’re not careful. Keep an eye on your days spent here, where your economic interests lie, and your family situation. Trust me, it’s worth it!

Financial Implications for Foreign Property Owners

If you’re a foreigner owning property in Spain, the wealth tax is a big deal. This tax, known as “Impuesto sobre el Patrimonio,” can bite into your wallet if you’re not prepared. Let’s break it down.

What You Need to Know

The wealth tax kicks in when your net worth exceeds €700,000. Sounds simple, right? But hold on—this isn’t just about your property. It includes everything like bank accounts, investments, and even cars!

Here’s a Quick Breakdown

| Net Worth Range | Tax Rate |

|---|---|

€0 - €700,000 | 0% |

€700,000 - €1,000,000 | 0.2% |

€1,000,001 - €2,000,000 | 0.3% |

€2,000,001 and up | 0.3% up to 3.5% |

For instance, if your total assets are worth €1.5 million, you’d pay a wealth tax of around €2,400 when calculated for that first million and €1,500 for the amount over €1 million.

Residency Matters

Are you a resident or a non-resident? This matters! Residents can deduct their primary home up to €300,000. For non-residents, tough luck—your Spanish property is taxed at full value. If you don’t live in Spain but own a villa in Marbella worth €1 million, you owe taxes on that entire amount!

Using AI Platforms for Insights

Want to keep track of your investments and avoid surprises? Tools like Residoora can help. This AI platform allows you to analyze real estate opportunities and understand the financial implications better.

Final Thoughts

Diving into Spain’s tax system doesn’t have to be daunting. Just keep your net worth in check and plan accordingly to avoid that nasty tax bill. Always consider consulting a local tax advisor to navigate the specifics, especially if you’re using resources like Residoora to make investment decisions!

Case Studies: Wealth Tax Impact on Popular Expat Areas

Let’s dig into how Spain’s wealth tax is shaking things up for foreigners in some of the top expat spots. You’d be surprised how different areas can dramatically affect your wallet!

1. Barcelona

Barcelona is a magnet for expats—it’s vibrant, cultural, and hey, who doesn’t love that Mediterranean sun? But here’s the kicker: if you own assets worth over €700,000 (the threshold for individuals), you’re liable for the wealth tax.

Average wealth tax in the Catalonia region sits around 0.2% to 2.5% based on your asset value.

For a property valued at €1 million, you could be shelling out anywhere from €2,000 to €7,500 annually in taxes!

2. Costa del Sol

This sun-soaked area is popular with retirees and those looking for a second home. However, the wealth tax can put a dent in your retirement planning.

| Property Value | Wealth Tax (Approx.) |

|---|---|

€500,000 | €1,000 |

€2,000,000 | €13,000 |

Owning a property around here can mean a hefty tax bill, especially if that property appreciates over time. Good news? Platforms like Residoora can help investors track property values and forecast potential tax liabilities.

3. Madrid

Spain’s bustling capital has its charms, but the wealth tax can be substantial. Expect to fork out taxes on properties over the €700,000 limit.

Madrid’s rates are somewhat kinder, averaging around 0.2% to 2.5% too.

For example, on a €1.5 million home, you could face a tax of roughly €3,500 to €12,500!

That said, if you plan to invest, platforms like Residoora can help you make informed choices about where to put down roots—ensuring you don’t get blindsided by taxes later!

4. Valencia

More affordable than Barcelona and Madrid, but don’t let that fool you. The wealth tax still applies here!

| Property Value | Wealth Tax (Approx.) |

|---|---|

€400,000 | €800 |

€1,000,000 | €7,500 |

With wealth tax rates similar to other regions, it pays to plan. Using AI tools like Residoora allows you to analyze different neighborhoods and get a better grip on potential taxes when investing in property.

Conclusion

The bottom line? Depending on where you choose to live and invest in Spain, the wealth tax can significantly impact your financial landscape. It’s all about doing your research and knowing what to expect. So, are you ready to tackle those taxes?

Expert Insights on Future Wealth Tax Changes

So, let’s get real for a moment: Spain’s wealth tax can feel like a maze for foreigners. But hang tight because some experts believe change is on the horizon. Let’s dive into what that might mean for you.

Possible Changes on the Horizon

As of late 2023, there’s chatter about the Spanish government possibly revising wealth tax thresholds and rates. Currently, the tax kicks in for individuals with net assets above €700,000, but who knows, right? Some experts predict that this threshold could rise or even lower, depending on various political factors.

How Could This Affect Foreign Investors?

If you’re a foreign investor eyeing Spain, keep in mind that any changes could impact your wealth tax obligations. For instance, if the threshold rises, fewer people would get taxed, making Spain even more attractive as a property investment destination. On the flip side, if they lower it, it might deter potential investors.

Statistics to Watch

Let’s layer some data into this discussion:

| Tax Rate (2023) | Net Wealth (€) | Tax on Wealth |

|---|---|---|

0.2% - 3.5% | €700,000 - €10 million | Progressively increasing |

3.5% | Above €10 million | Flat rate |

Investor Tools

Using platforms like Residoora can significantly ease your navigation through Spain’s complex real estate market. They offer insights tailored for investors and can help you analyze potential tax implications on properties you’re considering.

Local vs. Foreign

Here’s the kicker: locals might rally for a decrease in taxes, while foreigners may prefer higher thresholds to keep investments viable. If a new candidate comes into play, be prepared for a new round of debates on the wealth tax.

Keep an Eye Out

The best advice? Stay updated on these potential changes. Engage with tax advisors and real estate platforms to get the most accurate, up-to-date insights. Foreign investment is definitely still on Spain’s radar, but how you navigate these tax landscapes can make all the difference.

FAQs: Navigating Wealth Tax as a Foreigner

1. Do I have to pay wealth tax in Spain if I’m a foreigner?

Yes, you might have to! If you own property or assets in Spain over a certain threshold (usually €700,000), you are liable to pay this tax. But here’s the kicker: if you only own property in Spain, the local wealth tax applies, and if you own assets in multiple regions, you might face different rates!

2. What is the current wealth tax rate?

The rates can vary depending on the region! In general, they range from 0.2% to 3.5%. For example:

| Region | Wealth Tax Rate |

|---|---|

Andalucía | 0.2% to 3.5% |

Madrid | 0% (yes, you read that right!) |

Catalonia | 0.2% to 2.5% |

3. How does Spain calculate my wealth?

Your total wealth includes all assets, like real estate, bank accounts, stocks, and valuable personal items. If you own a property valued at €1 million in Catalonia, for example, you’d be looking at a wealth tax liability calculated on the amount over the €700,000 threshold!

4. Can I deduct any debts?

Absolutely! You can deduct any debts related to your assets. So, if you have a mortgage of €200,000 on that €1 million property, your taxable wealth would be assessed on €800,000 instead!

5. How can AI tools help me manage my investments?

Platforms like Residoora can be super helpful for real estate investors. They analyze market trends and help you understand property values, making it easier to decide if your investment will push you over that wealth tax threshold. Knowledge is power!

6. What happens if I don’t pay?

Skipping out on taxes isn’t a good idea! If you fail to pay wealth tax, you could face hefty fines, interest on unpaid amounts, and even legal action. It’s not worth it, trust me!

7. How can I simplify filing my wealth tax?

Consider consulting with a tax advisor who specializes in Spanish taxes. They can help you navigate the complexities and get your paperwork in order. Or, use tech tools like Residoora to stay on top of your investments!