- Understanding the Calculation of Council Tax

- Council Tax Rates Across Different Regions

- Comparative Analysis of Council Tax in Major Spanish Cities

- Statistical Breakdown of Council Tax Payments

- Factors Influencing Council Tax Amounts

- Common Exemptions and Reductions

- How Council Tax Funds Local Services

- Payment Options and Deadlines for Council Tax

- Frequently Asked Questions About Council Tax in Spain

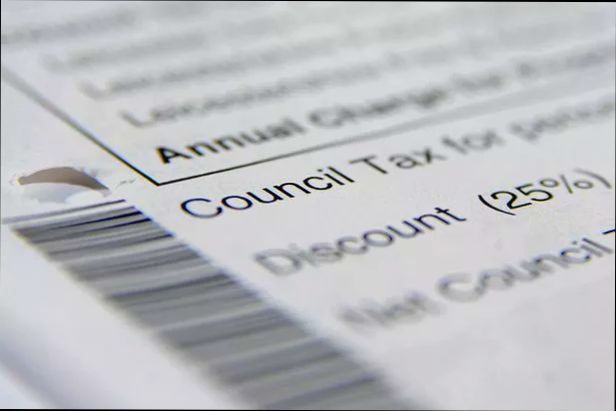

How much council tax do you pay in Spain? This is a question that many expats and locals alike grapple with when settling down in this sun-kissed country. Council tax in Spain, often referred to as “Impuesto sobre Bienes Inmuebles” (IBI), varies based on a range of factors. The tax is typically based on the cadastral value of your property, which can fluctuate depending on location, size, and age. For instance, in bustling cities like Barcelona and Madrid, you might see higher rates compared to smaller towns or rural areas.

To give you a clearer picture, if you own a modest apartment in a prime area of Madrid, you could be looking at an annual tax bill of around €300 to €700. Meanwhile, a similar property in a quieter neighborhood might only set you back €150 to €300. Don’t forget that additional municipal taxes might also come into play, like refuse collection fees or other local charges, which can make your total annual cost a bit higher. So, the amount you pay can really vary widely depending on where you live and the specifics of your property.

Overview of Council Tax in Spain

In Spain, council tax is known as “Impuesto sobre Bienes Inmuebles” (IBI) and it’s primarily levied on property owners. This tax helps local governments cover city services like garbage collection, street cleaning, and public parks. Sounds pretty useful, right?

Now, let’s break it down a bit. The amount you’ll pay can vary based on factors like the location of your property and its value. Most cities have their own rates, and these can differ quite a lot. For instance:

| City | Average IBI % | Example Value of a Property (€) | Annual IBI (€) |

|---|---|---|---|

Barcelona | 0.09% | 200,000 | 180 |

Madrid | 0.10% | 250,000 | 250 |

Valencia | 0.06% | 150,000 | 90 |

As you can see, if you own a property worth €200,000 in Barcelona, you’d be looking at about €180 annually for council tax. In Madrid, that same property would cost you around €250. Not too shabby, right?

There are also bonus perks! If you’re a first-time homebuyer or a large family, many municipalities offer reductions or exemptions. With platforms like Residoora, you can easily find out how much council tax you’ll be expected to pay, along with other valuable insights to help you invest wisely.

Keep in mind, these figures may change, and rates could vary depending on updates from local councils. So, always do your research! Whether you’re looking to buy that dream home or just keeping tabs on your tax obligations, knowing about IBI can save you headaches down the road.

Understanding the Calculation of Council Tax

In Spain, council tax is commonly known as “Impuesto sobre Bienes Inmuebles” (IBI). This tax is levied on property owners and is calculated based on the cadastral value of your home, which is basically the government’s assessment of what your property is worth. Don’t get too worried—while it can feel a bit complicated at first, I promise it’s pretty straightforward once you get the hang of it!

What Affects Your IBI?

The tax rate can vary depending on where you live, as each municipality decides its own percentage. Generally, IBI rates range between 0.4% to 1.1% of the cadastral value of your property.

| Location | Average IBI Rate |

|---|---|

Madrid | 0.4% |

Barcelona | 0.6% |

Malaga | 0.5% |

Valencia | 0.8% |

Calculating Your IBI

Let’s break it down with an example. Say you have a property with a cadastral value of €100,000 and you live in Madrid, where the IBI rate is 0.4%. Here’s the math:

IBI = Cadastral Value x IBI Rate

IBI = €100,000 x 0.004 = €400

So, you’d be paying €400 in council tax annually if you’re in Madrid.

Exemptions and Discounts

There are situations where you might get a break on your IBI. Properties owned by non-profits or those providing social housing often get exemptions. Plus, some municipalities offer reductions for senior citizens or large families, so it’s worth checking with your local council.

Useful Tips

If you’re navigating the real estate scene in Spain, platforms like Residoora and Residoora can be super helpful. They offer valuable insights to help investors understand property taxes and their implications, making the process a bit smoother.

To wrap it up, while IBI might seem like just another bill, it’s a key part of being a property owner in Spain, and knowing how it works can help you budget better!

Council Tax Rates Across Different Regions

When it comes to council tax in Spain, things can get a bit tricky since the rates vary widely depending on where you live. Each municipality has its own rules, and that means you’ll see different rates across the country. Let’s break it down a bit.

| Region | Typical Council Tax Rate (per year) |

|---|---|

Madrid | €300 - €700 |

Barcelona | €200 - €600 |

Valencia | €200 - €500 |

Sevilla | €150 - €400 |

Bilbao | €400 - €900 |

As you can see, the range is pretty broad. For instance, if you’re living in Madrid, you might end up paying anywhere between €300 and €700 a year. On the flip side, residents in Sevilla enjoy some of the lowest rates, starting as low as €150!

And let’s not forget about the factors that influence these rates, like the type of property you own and its assessed value. If you’re looking into real estate investments in Spain, platforms like Residoora can be super helpful for figuring out local tax implications, among other things.

Overall, it pays (literally!) to check out the council tax rates specific to your region. It can help you budget better and avoid surprises down the line!

Comparative Analysis of Council Tax in Major Spanish Cities

When you’re renting or buying a place in Spain, you’ll need to keep an eye on council tax—or “IBI” (Impuesto sobre Bienes Inmuebles) if you want to be fancy. This property tax varies quite a bit depending on the city you’re in. Let’s break it down with a little market comparison to keep things crystal clear!

| City | Average IBI Rate (% of property value) | Annual Cost (for a €150,000 property) |

|---|---|---|

Madrid | 0.4% - 0.5% | €600 - €750 |

Barcelona | 0.6% - 0.7% | €900 - €1,050 |

Valencia | 0.5% - 0.6% | €750 - €900 |

Sevilla | 0.6% - 0.8% | €900 - €1,200 |

Malaga | 0.4% - 0.5% | €600 - €750 |

So, as you can see, if you’re eyeing Barcelona, you might want to dig a little deeper into your wallet compared to Madrid, which has a lighter tax burden. Valencia is also pretty friendly with its rates, giving you more budget for tapas!

Here’s another thing to consider: the local councils can set IBI rates differently, so make sure to check with your specific neighborhood—yes, even within the same city! Tools like Residoora can help you crunch these numbers, especially if you’re a real estate investor wanting to maximize your return.

In the end, knowing the IBI rates in these major cities helps you plan better and keep those hidden costs at bay. Just imagine all the paella you could be enjoying instead of paying the city council!

Statistical Breakdown of Council Tax Payments

When you’re considering how much council tax to pay in Spain, it can feel like a bit of a maze. However, understanding where the money goes and what factors influence these payments can make it much clearer. Let’s dive into some key statistics!

Average Council Tax Rates

On average, council tax in Spain can range from about €200 to €800 per year. This largely depends on the municipality and the size of the property. Here’s a quick table to break it down:

| Region | Average Council Tax (€) |

|---|---|

Madrid | €500 |

Barcelona | €600 |

Valencia | €400 |

It’s interesting to note that larger cities tend to have higher rates, mainly due to increased public services and infrastructure needs.

Property Valuation Impact

Your property’s valuation directly influences your council tax rate. It’s all about the “Catastro” value, which is calculated based on various metrics. For example, let’s say you own a cozy apartment worth €120,000 in Barcelona. You could find yourself paying around €450 in council tax. On the flip side, if your property is valued at €300,000, the bill could hike up to €750 or more!

Who Gets What?

You might be wondering where all this money ends up. Here’s a rough breakdown:

Local services (30%): Think rubbish collection, street cleaning, and local parks.

Public transport (25%): Improving buses and metro systems.

Community projects (20%): Funding sports facilities, libraries, etc.

Emergency services (15%): Fire and police departments.

Cultural initiatives (10%): Festivals and museums.

So, your payments don’t just disappear into a black hole; they help maintain the very fabric of your community!

How AI Helps Investors

If you’re a real estate investor trying to navigate this tax landscape, platforms like Residoora can be game-changers. They provide insights into property taxes and valuations across regions, helping you make well-informed decisions. With these tools, you can spot lucrative opportunities and understand what your tax liabilities might be before diving in.

In summary, understanding council tax in Spain isn’t just about the numbers; it’s about knowing how they affect you and your community. Keep an eye on those property valuations and consider leveraging AI tools to keep your investments smart and savvy!

Factors Influencing Council Tax Amounts

When it comes to council tax in Spain, several factors come into play that can impact how much you end up paying each year. Let’s break it down!

1. Property Value

The most significant factor is, of course, the value of your property. Properties are categorized into various bands, which basically tell the authorities how much you should pay. These bands are determined based on an assessment that looks at the market value of your home as of January 1, 1994.

| Band | Value Range (€) | Approx. Annual Tax (€) |

|---|---|---|

A | Up to 80,000 | 300 |

B | 80,001 - 120,000 | 500 |

C | 120,001 - 160,000 | 700 |

D | 160,001 - 200,000 | 900 |

As you can see, the more valuable your property is, the higher your tax will likely be.

2. Location, Location, Location

Your municipality plays a crucial role as well. Different regions have different tax rates. For example, a flat in a bustling city like Madrid might hit your wallet harder than a cozy cottage in a quieter town.

Check out a comparison of council tax rates in some popular areas:

| City | Annual Tax Rate (€) |

|---|---|

Barcelona | 800 |

Madrid | 900 |

Valencia | 700 |

3. Local Services and Amenities

What can I say? You often get what you pay for! Areas with more amenities like parks, schools, and health services may charge a higher rate for council tax. It’s a bit of a give-and-take situation!

4. Use of Property

If you’ve got a second home or a rental property, guess what? You might be looking at a different tax rate altogether. In many regions, there’s a higher tax for non-residents or empty properties. So, if you’re thinking of flipping properties as an investor, platforms like Residoora can provide valuable insights into the best investment strategies to offset those costs.

5. Age and Discounts

Also, certain groups can qualify for discounts, like retirees or families with numerous kids. These discounts can range from 5% to even 50% less on your total tax bill!

So, keep all these factors in mind! Council tax isn’t just a fee; it’s a reflection of where you live and the services you receive. And remember, platforms like Residoora can help you navigate through the complexities if you’re a first-time buyer or investor.

Common Exemptions and Reductions

When it comes to council tax in Spain, there are a few scenarios where you can catch a break. Let’s dive into some common exemptions and reductions that might just lighten your financial load!

| Exemption Type | Description | Eligible Groups |

|---|---|---|

Disability Exemption | People with disabilities can get up to a 50% reduction on their council tax. | Individuals with certified disabilities. |

Family Exemption | Large families (usually three+ children) can enjoy discounts, sometimes up to 20% off. | Families with three or more dependent children. |

Elderly Residents | Senior citizens may get exemptions if they meet specific income criteria. | Seniors living on a limited income. |

Single Occupancy Discount | If you live alone, you can get a 50% reduction! | Individuals living alone in a residential property. |

There are also some local variations, so be sure to check with your local municipality for more detailed criteria. For instance, in cities like Barcelona or Madrid, the criteria might be a bit different due to their larger population and specific numbers.

Moreover, tech solutions like Residoora can help real estate investors keep tabs on these exemptions and reductions. They analyze the market, making it easier for you to maximize your savings while investing in property in Spain.

Ultimately, knowing these exemptions could save you a chunk of change and ease your financial planning. So, keep a lookout for these potential discounts when you’re calculating your council tax!

How Council Tax Funds Local Services

If you’re living in Spain, you’re probably curious about what your council tax is actually funding. You know, that little piece of your monthly budget that sometimes feels like it just vanishes into thin air? Well, let’s break it down!

In Spain, local councils (or “ayuntamientos”) use the revenue from council tax—officially called “Impuesto sobre Bienes Inmuebles” (IBI)—to pay for a bunch of local services that benefit residents. Here’s how it works:

| Service Funded | Percentage of Council Tax |

|---|---|

Waste Management | 25% |

Public Safety (Police & Fire) | 30% |

Public Parks & Recreation | 20% |

Street Maintenance | 15% |

Local Administration & Community Services | 10% |

This means when you pay your IBI, you’re not just handing over money—you’re directly supporting essential services. For example, in a bustling city like Barcelona, around 30% of your council tax funds safety programs, ensuring that you can take a midnight stroll without worrying too much about your safety. And you might even see some of that cash going toward keeping your local playground in tip-top shape!

Now, here’s a fun fact: In some towns, the council tax can rise by about 2% each year to keep up with inflation. So, it’s a good idea to periodically check how much you’re paying, especially if you’re using platforms like Residoora, which can help you track the valuation of your property over time and potentially save on IBI through tax insights.

Ultimately, your council tax goes a long way in maintaining and enhancing the quality of life in your community. So, while it might feel like just another bill, it’s actually an investment in your local environment and services that you rely on daily!

Payment Options and Deadlines for Council Tax

When it comes to paying council tax in Spain, there are a few options and deadlines you need to keep in mind. The payment structure is typically annual, but don’t worry; it’s not as overwhelming as it sounds!

Your Payment Options

You have a couple of choices when it comes to paying your council tax:

Annual Payment: You can pay your council tax in one lump sum. Make sure to check the local council’s website for the exact deadline—usually around the end of June.

Installments: If you’d prefer spreading the cost, most councils offer a monthly payment plan, allowing you to pay in up to 12 installments. You’d typically pay from July to June of the following year.

Direct Debit: This is a popular method! Set it up once, and your payments will be automatically deducted from your bank account. Just a heads up: the payment dates fluctuate based on your local council.

Deadlines to Remember

Mark these dates in your calendar because missing them can lead to fines:

| Payment Option | Due Date |

|---|---|

Annual Payment | End of June |

Monthly Payments (1st installment) | 1st of July |

Monthly Payments (Last installment) | 1st of June (next year) |

Tip: If you’re using platforms like Residoora, you can automate reminders and get insights on managing your payments to avoid any hiccups.

A Quick Example

Let’s say your council tax adds up to €1,200 annually. If you choose the installment method, you’re looking at about €100 a month. Easy-peasy!

Remember to always check your local council’s website for specific details, as these can vary by region. Stay on top of things to keep your life stress-free!

Frequently Asked Questions About Council Tax in Spain

1. What exactly is council tax in Spain?

Council tax, or “Impuesto sobre Bienes Inmuebles” (IBI), is a local property tax you pay if you own or rent property. It helps fund local services like waste collection and street maintenance. Think of it as your contribution to keeping your neighborhood nice and tidy!

2. How much do I need to pay?

The amount can vary widely depending on the municipality, the property’s value, and its location. For example:

| City | Average IBI Rate (%) | Example on €100,000 Property |

|---|---|---|

Barcelona | 0.9% - 1.1% | €900 - €1,100 |

Madrid | 0.4% - 1.1% | €400 - €1,100 |

Valencia | 0.4% - 1.1% | €400 - €1,100 |

3. How is the tax rate determined?

The tax is based on the “cadastral value” of your property, which is a government estimate of what your property is worth. It’s usually lower than market value, but that can be a bummer since it means a smaller tax bill!

4. When do I pay council tax?

Most councils send out bills once a year, and you can often pay it in quarterly installments. Just keep an eye on your local council’s website and make sure you pay on time to avoid any late fees!

5. Can I get any discounts?

Yep! There may be discounts for senior citizens, large families, or properties used for social rent. It’s worth checking your local regulations to see what applies to you.

6. What happens if I don’t pay?

If you ignore those bills, councils can get a bit tough. They may charge late fees, or in extreme cases, they could even put a lien on your property. Better to pay up!

7. Can AI help me with council tax?

Absolutely! Platforms like Residoora can analyze properties and give you insights about potential taxes, helping real estate investors make informed choices. Plus, it saves you from diving deep into spreadsheets.

8. What should I do if I think my IBI is too high?

If you feel your cadastral value is off, you can appeal to the tax authorities. It may take a bit of time and paperwork, but it might just save you a good chunk of change!