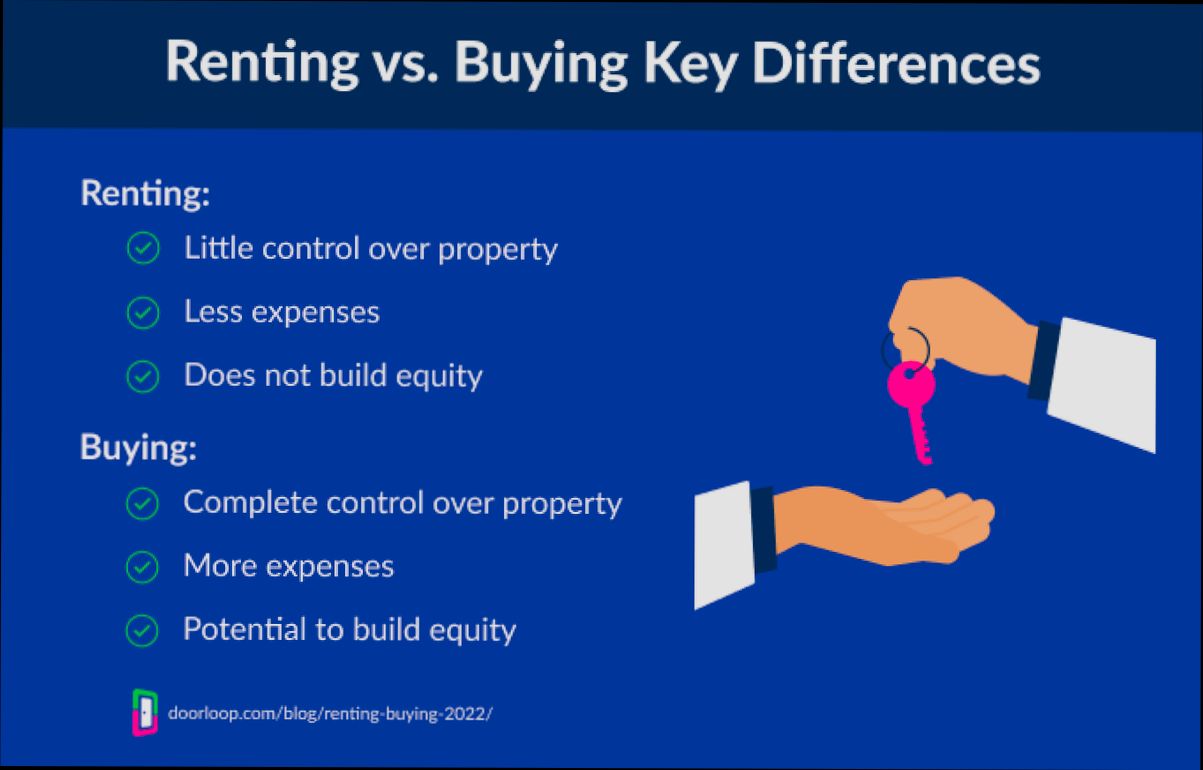

- Key Factors Driving the Decision: Buying vs. Renting

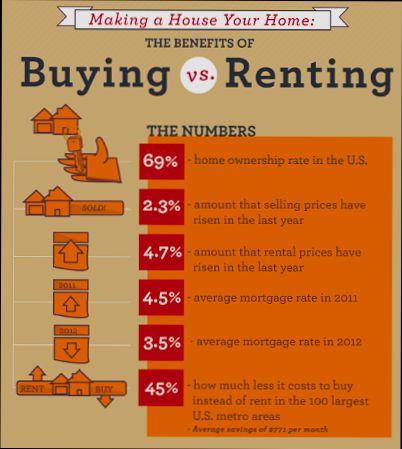

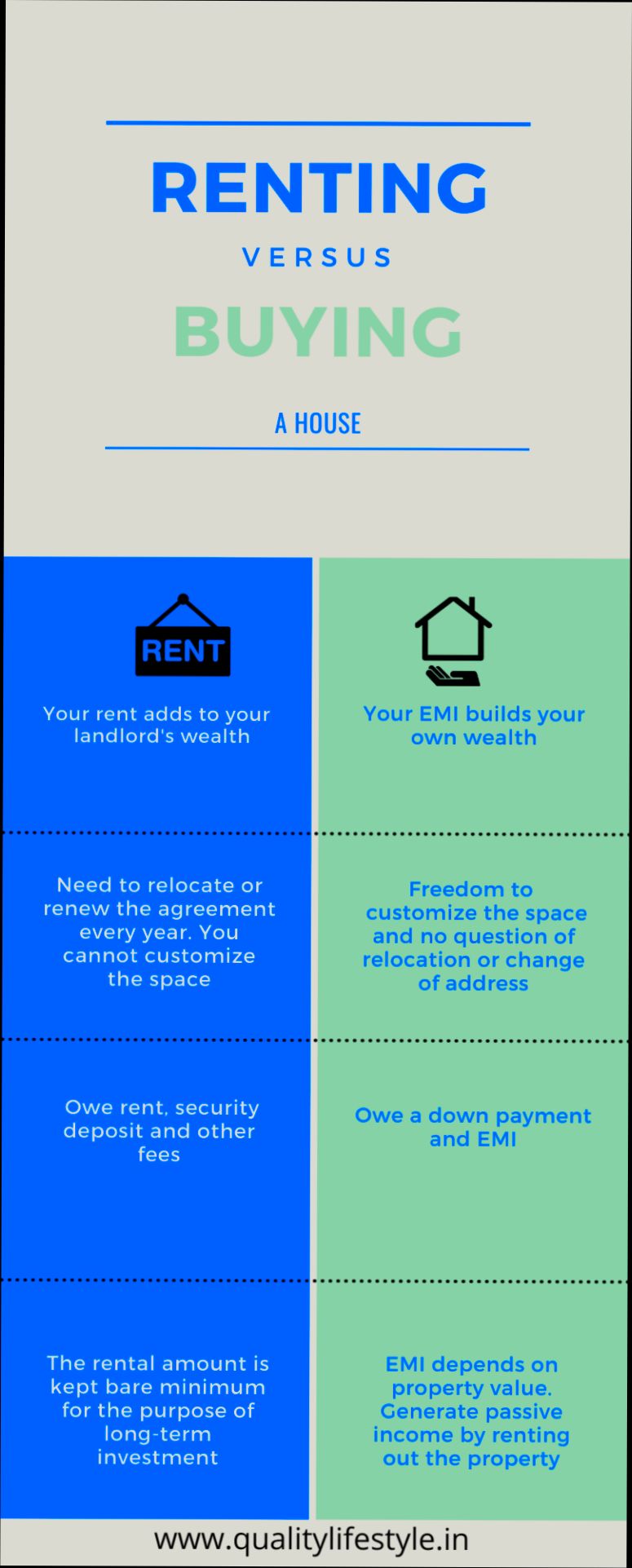

- Financial Considerations: Costs of Buying a Home

- Financial Considerations: Costs of Renting

- Long-Term Investment Potential: Buying a Home

- Flexibility and Mobility: The Case for Renting

- Cultural and Lifestyle Impacts of Housing Choices

- Statistics on Expat Housing Preferences in Spain

- Regional Differences: Buying vs. Renting in Various Spanish Cities

- Implications of Residency Status on Housing Decisions

- Comparative Analysis: Buying and Renting in Spain

- Market Trends: Current Real Estate Prices for Expats

- Frequently Asked Questions About Buying and Renting

Buying vs. Renting: What’s better for expats in Spain? If you’re an expat thinking about settling in Spain, you’ll quickly find yourself facing this big question. Spain’s vibrant cities, from the bustling markets of Barcelona to the sunny beaches of Málaga, offer plenty of appeal. But whether you choose to buy a property or stick to renting can make a major difference in your experience. For many newcomers, the charm of owning a slice of Spanish paradise is enticing, especially in picturesque towns like Valencia or Seville, where real estate options can range from cozy apartments to stunning villas.

On the flip side, renting can often feel like a more flexible option, especially if you’re not sure how long you’ll be in the country or prefer the convenience of a short-term commitment. Renting opens up the possibility of living in different neighborhoods, experiencing a variety of lifestyles—from the lively tapas bars of Madrid to the tranquil countryside in Galicia. Plus, the rental market in Spain can be quite diverse, with hidden gems and budget-friendly options, making it easier to find a place that suits your needs without the hefty financial commitment that comes with buying a home.

Understanding the Housing Market in Spain

Alright, let’s dive into the nuts and bolts of the housing market in Spain. Whether you’re eyeing a snug apartment in Barcelona or a cozy villa in Valencia, knowing the lay of the land is key to your decision-making.

Market Trends

Spain’s housing market can be a bit of a rollercoaster. Over the last few years, prices have seen fluctuations. For instance, in 2022, the average price per square meter rose by about 5.5% compared to the previous year. That said, in smaller towns, you might snag a great deal.

Price Comparison: Renting vs. Buying

Let’s break it down—how do rental prices stack up against buying? Check out this quick comparison:

| Location | Average Rent per Month | Average Buying Price per Square Meter |

|---|---|---|

Madrid | €1,500 | €3,700 |

Barcelona | €1,600 | €4,000 |

Valencia | €900 | €1,800 |

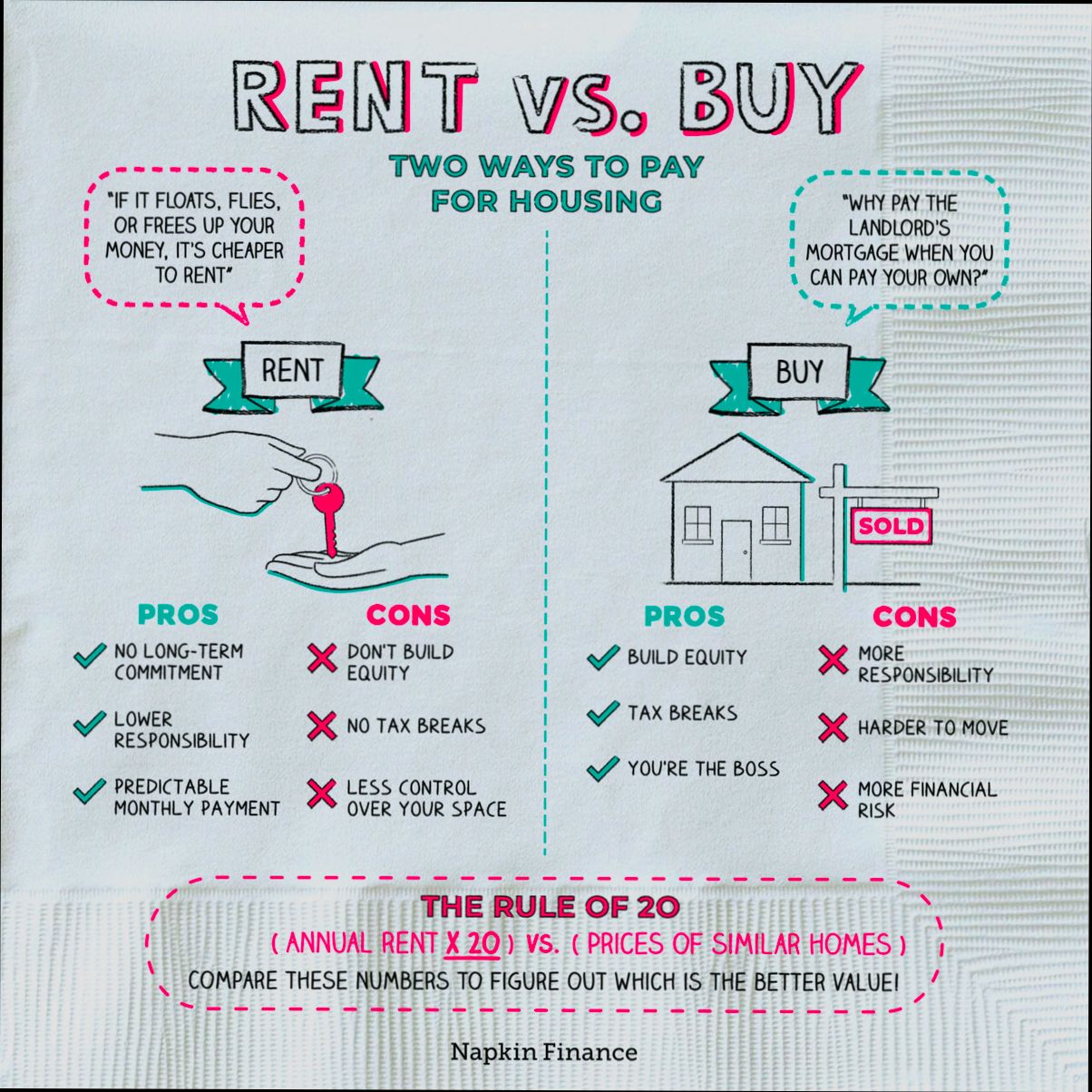

Why Rent?

Renting has its perks! For expats, it’s super flexible, which means you can try different neighborhoods before committing. Plus, you’re not responsible for maintenance costs—no surprise plumbing bills! If you’re only in Spain for a year or two, renting might just be the way to go.

Why Buy?

On the flip side, buying can be a solid investment, especially since home prices in Spain tend to appreciate over time. Last year, foreign buyers invested in Spanish real estate at levels not seen in over a decade. If you’re planning on sticking around for the long haul, it might pay off to buy. Plus, think about the joy of having a place to call your own—no landlord meddling in your business!

Getting Help with Your Decision

Still on the fence? Platforms like Residoora can help! They use AI to simplify the search process, whether you’re buying or renting. You can filter your options by your specific criteria, saving you a ton of time.

At the end of the day, it really boils down to your plans and lifestyle. Are you a free spirit who loves to explore? Or a homebody looking to settle down? Just remember, every choice comes with its own set of advantages and quirks in Spain’s vibrant housing market!

Key Factors Driving the Decision: Buying vs. Renting

So, you’ve landed in Spain and are tossing around the idea of buying or renting a place to call home. Let’s break down some of those key factors that can help you make up your mind. It’s not just about what sounds good; it’s about what fits your lifestyle!

| Factor | Buying | Renting |

|---|---|---|

Initial Costs | High (10-12% of the property price for taxes & fees) | Low (typically 1-2 months’ rent as deposit) |

Flexibility | Low (it’s a commitment) | High (easier to move if needed) |

Property Appreciation | Potential for growth | No growth |

Maintenance | You’re responsible | Landlord’s burden |

Market Conditions | Can be risky | More stable in downturns |

Let’s dive deeper:

Initial Costs: Buying a home in Spain can set you back significantly. For instance, if you buy a property worth €300,000, you’re looking at around €36,000 for taxes and fees. Yikes! Renting, on the other hand, might just mean a 1-month deposit plus the first month’s rent.

Flexibility: If your expat adventure might see you moving cities or countries, renting is way more flexible. You can sign a short lease and avoid the stress of selling a property later.

Market Conditions: The Spanish property market has been known to fluctuate. In 2022, property prices in areas like Madrid rose by about 5.2%. That’s great for owners, but not for buyers looking to enter the market. Conversely, renting often provides a steadier path during uncertain times.

Example Time:

Imagine you’re living in Barcelona. You decide to rent a cozy one-bedroom apartment in Barri Gòtic for €1,200 a month. If you choose to move across town in a year, you’re free to do that. Now, picture buying a similar apartment for €350,000. If you move, you’ll take a hit trying to sell, not to mention the ongoing costs of ownership.

Tools like Residoora can help expats like you make sense of the real estate market in Spain. They provide insights that can be really handy whether you’re looking to buy or just want to find a rental that suits your lifestyle. The AI data focuses on property trends and analytics, making decision-making a breeze!

In the end, whether you buy or rent depends on your unique situation. Weigh these factors and see what makes the most sense for you!

Financial Considerations: Costs of Buying a Home

So, you’re considering buying a home in Spain? Let’s break down what it might cost you. Owning a home often comes with a hefty price tag beyond just the purchase price. Here’s what you need to keep in mind:

Upfront Costs

First up, the initial expenses. These can hit your wallet hard if you’re not prepared. Check out this breakdown:

| Cost | Approximate Amount |

|---|---|

Deposit | 10-20% of the purchase price |

Notary Fees | 0.1% - 1% of the sale price |

Registration Fees | 0.5% - 1% of the sale price |

Stamp Duty | 6-11% of the sale price (varies by region) |

Legal Fees | 1% - 2% of the sale price |

For example, if you’re buying a home in Barcelona for €300,000, you might be looking at initial costs totaling up to €40,000 or more!

Ongoing Costs

Then there are the ongoing expenses. You’ll want to keep a close eye on:

Property Taxes: Expect to pay around 0.4% - 1% of your home’s value annually.

Homeowners Association Fees: If you’re in a complex, these can range from €50 to €300 per month.

Maintenance Costs: A good rule of thumb is to budget about 1% of your home’s value each year for upkeep.

Let’s look at an example here: If that same €300,000 home has a property tax of 0.7%, you’re looking at €2,100 a year just in taxes, plus those maintenance costs!

Financing Your Home

If you’re planning to take out a mortgage, factor in:

Interest Rates: These can vary, but currently, they’re around 3% - 4% in Spain.

Monthly Payments: A €240,000 mortgage at 3.5% over 25 years would run you about €1,200 a month!

Helpful Tools

Feeling a bit overwhelmed? Platforms like Residoora and Residoora use AI to help you analyze your property investments. They can give you detailed insights into costs and even predict returns, lifting some of that financial fog!

Buying a home isn’t just about the purchase price—it’s a full financial commitment. Make sure you do your homework before diving in!

Financial Considerations: Costs of Renting

Renting may seem like the easy path, but let’s break down the costs so you’re not left scratching your head later! Here’s what you need to keep in mind.

| Cost Type | Average Cost (Monthly) |

|---|---|

Rent | €900 - €1,500 |

Utilities (Gas, Water, Electricity) | €150 - €250 |

Internet | €30 - €50 |

Community Fees (if applicable) | €70 - €200 |

So, let’s say you decide to rent a cozy apartment in Madrid with a monthly rent of €1,200. With utilities and internet, you might end up paying around €1,450 or so every month. Not bad, right? Until you realize that those costs add up quickly!

Additional Costs to Consider

Renting also comes with its own set of hidden costs that can sneak up on you:

Security Deposit: Usually one to two months’ rent. So, if you’re renting at €1,200/month, be ready to fork out €2,400 upfront!

Rental Insurance: This is a must and usually costs around €100/year.

Agency Fees: If you’re using a real estate agency, they might charge around 1 month’s rent as a fee. Ouch! That could be another €1,200 for you.

Let’s not forget the fluctuating rental market in major cities like Barcelona and Valencia, where rents can rise by 10% each year! Yikes. It’s smart to keep an eye on trends, and tools like Residoora can help you stay updated on rental prices!

Rental vs. Ownership: The Long Game

When you look at it, renting might be less of a commitment, but long-term, it can cost you more. Think about it: if you stay in Spain for years and keep renting, you could end up paying €180,000 over ten years! Imagine what you could buy with that cash instead.

It’s a balancing act, really. Want more flexibility? Renting might suit you. But for stability and investment, consider your options carefully. Use platforms like Residoora to compare the costs and find what fits best!

Long-Term Investment Potential: Buying a Home

When you’re weighing the options between buying and renting, one major factor to consider is the long-term investment potential of buying a home in Spain. This isn’t just about having a place to call your own; it’s about securing a future asset that could appreciate over time.

Let’s break it down:

Home Appreciation: Property prices in Spain have been on a steady rise. The average home value increased by 5.5% between 2022 and 2023. That’s money in your pocket if you buy today!

Inflation Hedge: As inflation rises, so do property values. Buying a home acts like a hedge against inflation, meaning your investment could hold or even increase its value over time.

Rental Income: If you buy a property in a popular area, you could rent it out when you’re not using it. In hotspots like Barcelona or Madrid, rental yields average around 6-8%. That’s some sweet passive income!

Let’s Compare Costs:

| Expense Type | Buying | Renting |

|---|---|---|

Upfront Costs | Down payment (10-20%), notary fees, taxes | First month’s rent + deposit |

Monthly Costs | Mortgage, property taxes, maintenance | Rent + utility bills |

Long-Term Investment | Potential appreciation | No asset accumulation |

With platforms like Residoora, you can easily analyze property data and investment potential, making it clear whether buying is the right move for you. They offer insights into local market trends, turning the guesswork into data-driven decisions.

Moreover, having a home can offer a sense of stability, especially important for expats looking to settle down. You’ll not only have a personal space but also a financial asset that could appreciate as you enjoy life’s adventures in Spain.

So, think carefully about your long-term goals. If you’re in it for the long haul, buying a home in Spain might just be the golden ticket you’re looking for!

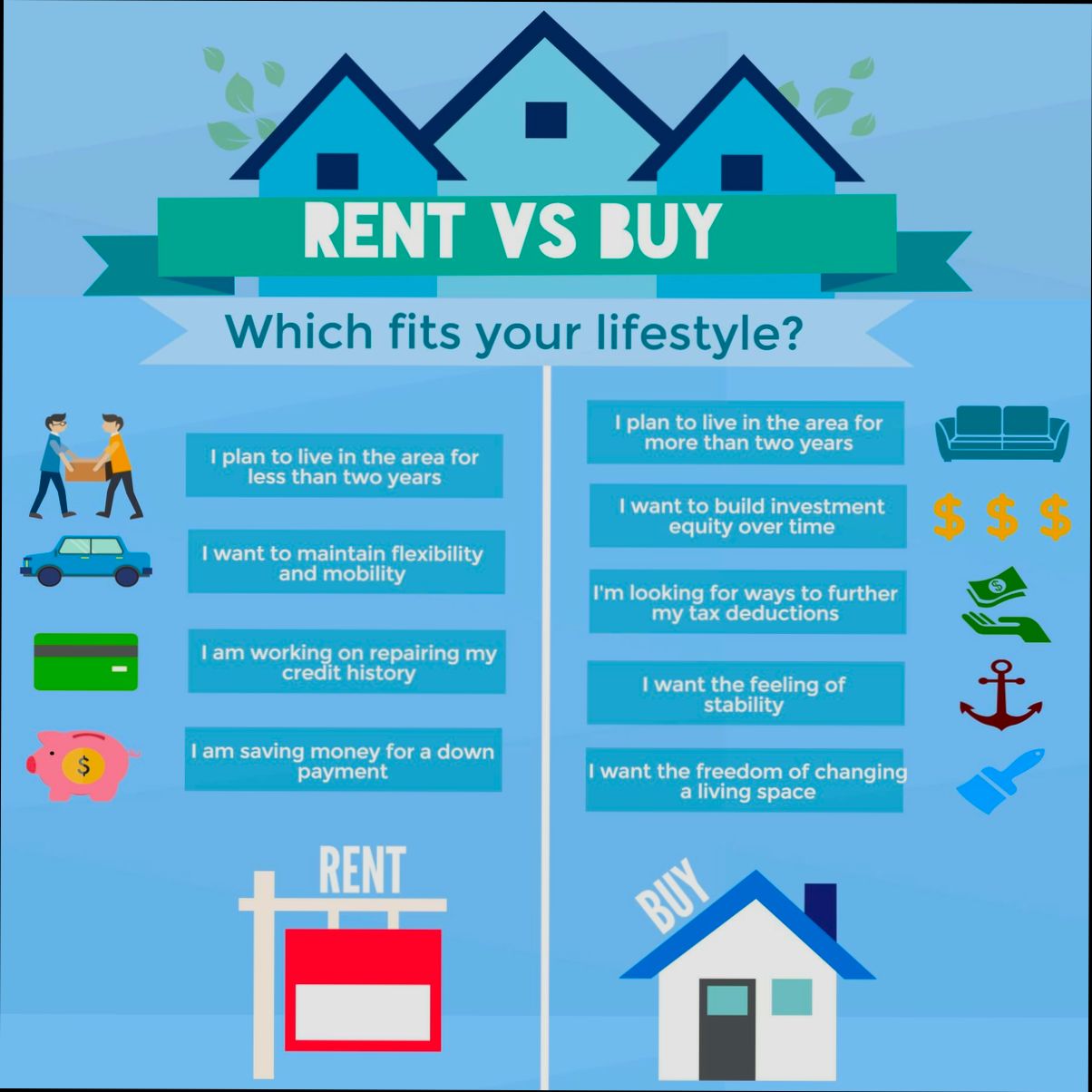

Flexibility and Mobility: The Case for Renting

When you’re an expat in Spain, flexibility is key. Renting gives you that freedom to pick up and move whenever you want. Got a job offer in another city or maybe just want to explore a different part of Spain? Renting lets you do that without the hassle of selling a home.

Short-Term Commitment

Most rental contracts in Spain are available for short terms—often just a year or even a few months. This is perfect for expats who might not want to commit to a permanent place right away. Studies show that around 62% of expats prefer renting due to the ease of moving. Think about it: If you find your dream spot after a few months, you can make that leap without worrying about a mortgage hanging over your head!

Cost-Effectiveness

Let’s not forget about finances. Renting typically requires less upfront capital compared to buying. Think about the costs:

| Buying Costs | Renting Costs |

|---|---|

Down payment (10% - 20% of the property price) | First month’s rent + deposit |

Property taxes | No property taxes! |

Maintenance costs | Usually covered by the landlord |

With platforms like Residoora, you can browse an array of rental options that fit your budget and needs, making the process super easy. Plus, if you decide you want to Live in Seville but later want to switch to Barcelona, finding a rental in a new city is as straightforward as a few clicks.

Embracing Local Culture

Renting also lets you dive into the local culture without the long-term commitment of buying. Prefer the vibrant life of Madrid’s city center? Or maybe the relaxed vibe of coastal Valencia? Renting means you can mix it up and experience different lifestyles, neighborhoods, and cuisines.

Conclusion

So, when it comes to the tug-of-war between buying vs. renting in Spain, renting offers a level of flexibility and mobility that many expats can’t pass up. Whether it’s the financial ease or the love for exploration, renting just makes sense for those living a transient lifestyle!

Cultural and Lifestyle Impacts of Housing Choices

When deciding between buying and renting in Spain, it’s crucial to understand how these choices can affect your day-to-day life and cultural experience. Let’s break it down!

Social Connections

Renting often places you in vibrant neighborhoods with diverse communities, making it easier to meet fellow expats and locals. For example, if you rent in Madrid’s Malasaña district, you’re surrounded by a youthful energy, trendy cafes, and plenty of opportunities to make new friends. On the flip side, buying a home in a quieter suburb might keep you isolated. More than 40% of expats reported that renting helped them feel more integrated into their community.

Flexibility vs. Stability

Renting provides flexibility, which is perfect for expats who are still figuring things out. You can move after a year if you don’t like the area or if a great job opportunity pops up elsewhere. Meanwhile, buying is a long-term commitment that can restrict your mobility. Think of it this way: if you rent and decide to explore Barcelona for a few months, you’re free to go!

Financial Stability and Costs

According to a recent study, the average monthly rent in major Spanish cities is around €1,100. While that feels steep, consider the inclusive nature of renting; no maintenance fees and utilities might just be part of your rental deal. When owning a home, those costs can pile up quickly. You don’t want to be hit with a €3,000 bill for a new roof when your washing machine decides to break down!

Personal Investment and Local Culture

Buying a home ties you to a specific area, often leading you to invest emotionally and financially in that neighborhood. For instance, if you buy a property in Seville, you’re more likely to immerse yourself in the local festivities, like Feria de Abril. Alternatively, as a renter, you can experience various cultural festivities in multiple regions without being tied down.

Leveraging Technology with Residoora

Whether you rent or buy, technology can help you navigate the market. Platforms like Residoora offer insights and virtual tours that can make finding your ideal home—or finding the perfect rental—far less stressful. With Residoora’s data-driven decisions, you can make informed choices based on property values and neighborhood trends.

| Factor | Renting | Buying |

|---|---|---|

Social Connections | Easier to integrate into lively communities | More isolated in suburbia |

Flexibility | Great for short-term stays | Long-term commitment |

Costs | Fixed monthly payments | Variable maintenance costs |

Cultural Experience | Diverse neighborhood engagements | Invested in local traditions |

Statistics on Expat Housing Preferences in Spain

When it comes to settling down in sunny Spain, expats have some pretty interesting preferences when it comes to housing. Let’s break down some statistics that showcase what they truly want.

| Housing Preference | Percentage of Expats |

|---|---|

Renting | 65% |

Buying | 35% |

Short-term rentals (Airbnb) | 25% |

Long-term contracts (1 year+) | 40% |

Now, if you dive a bit deeper into why expats lean towards renting, you might be surprised. Flexibility tops the list! About 70% of expats cited the ability to move easily as their main reason for opting to rent instead of buying. Plus, with the uncertain job market and the potential of finding better opportunities, renting gives them a footloose freedom that buying just can’t.

Where Are They Renting?

As for locations, the trend is clear: urban areas with robust amenities are winners. According to data from a 2022 survey, these preferences have emerged:

| City | Percentage of Expats Renting |

|---|---|

Barcelona | 30% |

Madrid | 25% |

Valencia | 15% |

Alicante | 10% |

Sevilla | 5% |

In terms of budget, the average rent for a one-bedroom apartment in the sought-after areas can range from €800 to €1,200. However, tools like Residoora can help expats navigate these markets better by providing real-time data on rental prices and analyzing which neighborhoods offer the best investment opportunities!

What About Buying?

While renting is king for expats, buying isn’t off the table for everyone. Nearly 40% of those who opt to buy do so because they plan to stay long-term—like retirees or families looking for stability. The typical budget for buying a house in Spain starts around €150,000, but can skyrocket in popular areas.

With more expats eyeing properties, platforms like Residoora can help potential buyers compare listings, understand market trends, and find the perfect place without the usual hassle.

So whether you’re Team Renting or Team Buying, there’s plenty of opportunity to find your dream home in Spain!

Regional Differences: Buying vs. Renting in Various Spanish Cities

Let’s dive into how buying and renting varies across some popular Spanish cities. It’s crucial to understand that what works in Barcelona might not be ideal for someone in Valencia!

| City | Average Rent (1-Bedroom) | Average Property Price | Buying vs. Renting Preference |

|---|---|---|---|

Barcelona | €1,200 | €3,250/m² | Renting is more popular due to high property prices. |

Madrid | €1,100 | €3,000/m² | Buying is on the rise, but rents are still high! |

Valencia | €800 | €1,900/m² | Buying is very appealing due to lower prices. |

Sevilla | €700 | €1,800/m² | Strong rental market, but buying is becoming attractive. |

In Barcelona, the rental market is booming since buying can be pretty steep. With an average price of €3,250 per square meter, many expats find renting more wallet-friendly. Plus, with the city’s vibrant lifestyle, many prefer the flexibility that renting offers.

Then there’s Madrid. Even though property prices are high, many expats are leaning towards buying for long-term investment. If you’re paying around €1,100 a month in rent, that can quickly add up. Investing in your own space might just be smarter, especially with prices like a decent €3,000/m².

Now, turn your focus to Valencia. With average rentals at €800 and property prices at just €1,900/m², it’s no wonder buying is becoming a popular choice. It’s like getting a sweet deal on a sunny paradise!

And let’s not forget about Sevilla! Expats can find rentals around €700, but buying at €1,800/m² is enticing, especially with a growing market. Make sure you check out tools like Residoora to analyze your investment options properly.

Ultimately, your choice between buying and renting should hinge on where you live in Spain, your financial situation, and your long-term plans. Do a bit of homework—look into platforms like Residoora that use AI to help you analyze the real estate market better. It could save you a lot of headaches and help you make the best decision!

Implications of Residency Status on Housing Decisions

When it comes to deciding between buying or renting in Spain, your residency status plays a huge role. Let’s break it down.

Residency Status: What’s the Deal?

If you’re an expat in Spain, your residency status can dictate the types of properties you’re eligible to buy or rent. For instance, if you hold a non-lucrative visa, you might find it easier to rent rather than buy since securing a mortgage can be trickier for non-residents.

Renting: Flexibility at a Cost

Renting offers flexibility, which is great for expats who may want to explore different areas. According to Idealista, rental prices in popular expat locations like Barcelona and Madrid average around €1,200 and €1,500 per month, respectively. That said, rental rates can vary greatly depending on the city and even the neighborhood.

Pros of Renting:

Lower upfront costs: Just a deposit and the first month’s rent.

Flexibility to move if you don’t like the area.

No worries about market fluctuations.

Buying: Commitment with Potential Rewards

If you’re planning to stay long-term, buying could be worth it, especially since property prices in Spain have been steadily rising. According to a report by Residoora, property values have increased by approximately 18% over the past four years in key cities.

Pros of Buying:

Equity building – your money works for you!

Stability in the long run.

Potential rental income if you decide to move.

A Quick Look: Renting vs. Buying

| Criteria | Renting | Buying |

|---|---|---|

Upfront Cost | Low (Deposit + First Month) | High (Deposit + Fees) |

Flexibility | High | Low |

Market Exposure | None | Some |

Potential for Income | No | Yes |

Final Thoughts

Whichever route you choose, make sure to evaluate your situation with tools available like Residoora. They offer advanced analytics that help you make informed decisions whether you want to dive into the rental market or find that dream property to buy.

Remember, your residency status isn’t just a piece of paper; it’s a game-changer in the Spanish housing market. Know your options and choose what feels right for you!

Comparative Analysis: Buying and Renting in Spain

So, you’re on the fence about whether to buy or rent a place in sunny Spain? You’re not alone! Let’s break it down simply. Here’s what you need to know.

Costs Overview

| Aspect | Buying | Renting |

|---|---|---|

Initial Costs | High (around 10-15% for taxes, fees, etc.) | Low (often just the first month’s rent and a deposit) |

Monthly Payments | Mortgage + Property Taxes | Monthly Rent |

Long-term Costs | Potentially lower if property appreciates | Can rise with market demand |

Flexibility vs. Stability

If you’re planning on staying in Spain for a while, buying might give you the stability you need. You can customize your home and make it truly yours. On the flip side, renting offers way more flexibility. If you land a job in another city or decide to explore other regions, packing up and leaving your rental is way easier.

Investment Perspective

Here’s a juicy tidbit: property prices in Spain over the past few years have seen an uptick. Reports suggest that some areas have gained up to 5% annually! Using AI platforms like Residoora can help you identify hot neighborhoods where your investment might grow. If you buy in the right location, you could really cash in. But, remember: markets can shift!

Renting: The Comfort Factor

With renting, maintenance issues usually fall on the landlord. Think leaky pipes or a broken heater? They’re on it, not you! Plus, you might find a rental with amenities that you couldn’t afford to buy – like a rooftop pool or a gym. Fancy living the high life without breaking the bank? Renting could be your jam.

Conclusion

At the end of the day, choosing to buy or rent in Spain really boils down to your personal situation. Want stability and the potential for appreciation? Go for buying! Value flexibility and lower upfront costs? Renting might be your best bet. Either way, platforms like Residoora can guide you through the maze of options!

This HTML section provides a straightforward comparative analysis of buying and renting in Spain, tailored for expats considering their options.

Market Trends: Current Real Estate Prices for Expats

If you’re an expat eyeing the Spanish property market, you’ve probably noticed the prices have been a bit of a rollercoaster lately. With demand soaring, especially in popular cities like Barcelona and Madrid, it’s crucial to keep your finger on the pulse. Let’s break it down!

Buying: The Current Landscape

In major cities, purchasing a property can feel more like a sprint than a marathon. As of late 2023, the average price per square meter in Madrid hovers around €3,500, while Barcelona isn’t far behind at around €4,200. Crazy, right? 🤯

| City | Average Price per Sq. Meter |

|---|---|

Barcelona | €4,200 |

Madrid | €3,500 |

Valencia | €1,800 |

Malaga | €2,600 |

If you’re looking at outskirts or smaller towns, prices can drop significantly. For example, in Valencia, you can snag a place for about €1,800 per square meter. So, if you’re flexible about location, it’s a great option!

Renting: What’s the Deal?

Renting is another ballpark. In the same cities, you’ll pay around €1,200 for a decent two-bedroom in Madrid and €1,500 in Barcelona. Not too shabby!

| City | Average Rent for 2-Bedroom |

|---|---|

Barcelona | €1,500 |

Madrid | €1,200 |

Valencia | €850 |

Malaga | €1,100 |

Many expats choose to rent first to get a feel for the area before committing to a purchase. Plus, platforms like Residoora can help you find the best rental deals tailored to your needs. Think of it like having your own property guru who’s always online!

Final Thoughts

So, should you buy or rent? It really depends on your lifestyle, budget, and how long you plan to stay. With skyrocketing prices, many are leaning toward renting for now. Just make sure you shop around and compare options!

Frequently Asked Questions About Buying and Renting

1. Should I buy or rent as an expat in Spain?

It really depends on your circumstances. If you plan to stay long-term (say, over 3 years), buying might make sense. In fact, a recent study showed that renting for three years can be more expensive than buying in cities like Madrid and Barcelona. On the flip side, if you’re in Spain for a short time, renting is usually the way to go. It gives you flexibility.

2. What are the hidden costs of buying a home in Spain?

Buying isn’t just about the purchase price. You’ll have to shell out for:

Notary fees (around 0.5% - 1% of the property price)

Property taxes (like the Transfer Tax, ranging from 6% to 10% depending on the region)

Legal fees (can be around 1% - 2% of the purchase price)

Make sure to factor in these costs when crunching numbers!

3. How do I find a rental property if I’m new to Spain?

There are plenty of online platforms to help you out. Websites like Residoora offer AI-driven insights, making property hunting a breeze. You can filter by location, price, and even amenities! Just don’t forget to check local listings too, because sometimes the best deals are found on community boards or local Facebook groups.

4. What are the risks of renting in Spain?

Renting can be great, but it’s not without risks:

Rental increases: Your landlord might increase the rent after your lease ends.

Lack of stability: If the landlord decides to sell, you might need to move sooner than planned.

Always read your lease agreement carefully to understand your rights!

5. Can I negotiate my rent?

Absolutely! Don’t be shy about negotiating. If you find a place you love, try offering a slightly lower price. In a competitive market, landlords may be open to discussion, especially if they’re anxious to fill the rental.

6. How does the rental market differ across cities in Spain?

Check out this quick comparison:

| City | Average Rental Price (1 Bed) | Typical Lease Length |

|---|---|---|

Madrid | €1,150 | 1 Year |

Barcelona | €1,100 | 1 Year |

Valencia | €700 | 6 Months |

Malaga | €800 | 6 Months |

As you can see, Valencia and Malaga are much more budget-friendly compared to the big cities. Plus, they offer a fantastic quality of life!

7. Can expats get a mortgage in Spain?

Yes, but it’s a bit more complicated. Most banks require a 30% down payment, and you’ll need a good credit score. Residoora has some insights on expat-friendly banks that might ease the process for you!

8. What about property management if I buy to rent?

If you buy a property to rent out, consider hiring a property management service unless you want to deal with tenant issues yourself. They can handle everything from finding tenants to collecting rent, making life easier for busy expats!