- The Legal Framework for Non-Residents

- Visa Requirements for Non-Residents

- Living Arrangements for Non-Residents

- Tax Implications of Non-Residency

- Healthcare Access for Non-Residents

- Cost of Living in Spain for Non-Residents

- Popular Regions for Non-Residents

- Data on Non-Resident Population in Spain

- Cultural Adaptations for Non-Residents

- Activities and Lifestyle Options for Non-Residents

- Navigating Spanish Bureaucracy as a Non-Resident

- Statistical Overview of Non-Resident Housing Markets

- Resources and Support for Non-Residents

Can you live in Spain as a non-resident? This question pops up for a lot of people dreaming about warm beaches, delicious tapas, and vibrant festivals. The reality is, the idea of living in Spain can be pretty appealing, especially for those who want to spend more time soaking up the sun, exploring charming cities like Barcelona and Sevilla, or simply enjoying a relaxed lifestyle. But navigating the rules around non-residency can be a bit tricky.

For many, the idea of living in Spain as a non-resident often includes spending a significant part of the year there, especially during the lovely spring and summer months. You might be tempted to rent a cozy apartment in Marbella or indulge in the rich culture of Madrid. However, it’s important to know there are limits on how long you can stay without becoming a resident. Typically, non-EU citizens can stay for up to 90 days in a 180-day period without needing a residency permit. This means you’ll need to plan your trips carefully if you want to maximize your time under the Spanish sun.

Understanding Non-Residency in Spain

So, you’re wondering about living in Spain as a non-resident? Well, let’s break it down. Being a non-resident in Spain means you’re not living there full-time but might want to stay for a few months out of the year. This can be a fantastic option for people who want to escape the hustle and bustle of their home countries. Did you know that over 2.5 million foreigners live in Spain, and many are non-residents enjoying vacations or seasonal stays?

What Does Non-Residency Mean?

Non-resident status in Spain is generally applied to anyone who spends less than 183 days in the country each calendar year. It means you don’t get taxed like a resident does, which can be quite beneficial!

| Days Spent in Spain | Residency Status |

|---|---|

Less than 183 days | Non-Resident |

More than 183 days | Resident |

Living as a Non-Resident

If you plan on living in Spain for a short stint, non-residency might just work for you. One of the key benefits is not having to file as a resident. Non-resident taxes are only applicable to income sourced within Spain. For example, if you own a property there and rent it out, you’ll pay taxes on that rental income but won’t be taxed on your worldwide income.

For property lovers, platforms like Residoora and Residoora come in handy! They assist you in finding amazing real estate investments without worrying about residency papers or taxes piling up. Perfect, right?

Important Considerations

Health Insurance: As a non-resident, you won’t be covered by the public health system. Consider private health insurance to stay safe.

Bank Account: Opening a bank account is possible, but you’ll need a NIE (Número de Identificación de Extranjero) and some paperwork.

Legal Status: Always ensure you’re compliant with local laws to avoid any issues.

In summary, living in Spain as a non-resident can be easy and enjoyable if you understand how it all works. Whether you want to soak up the sun for a few months or invest in property, it’s a great place to consider!

The Legal Framework for Non-Residents

If you’re thinking about living in Spain as a non-resident, it’s essential to understand the legal framework surrounding your stay. Spoiler: It’s not as complicated as it sounds!

Residency Options

First up, let’s talk about residency types. As a non-resident, you generally have two main options:

Short-term stays: You can stay up to 90 days within a 180-day period without much hassle. This is great for short vacations or seasonal living.

Long-term residency: If you plan on sticking around for longer, you might want to look into a long-term visa. Options include student visas, work permits, or the non-lucrative visa, which is designed for folks living off their savings.

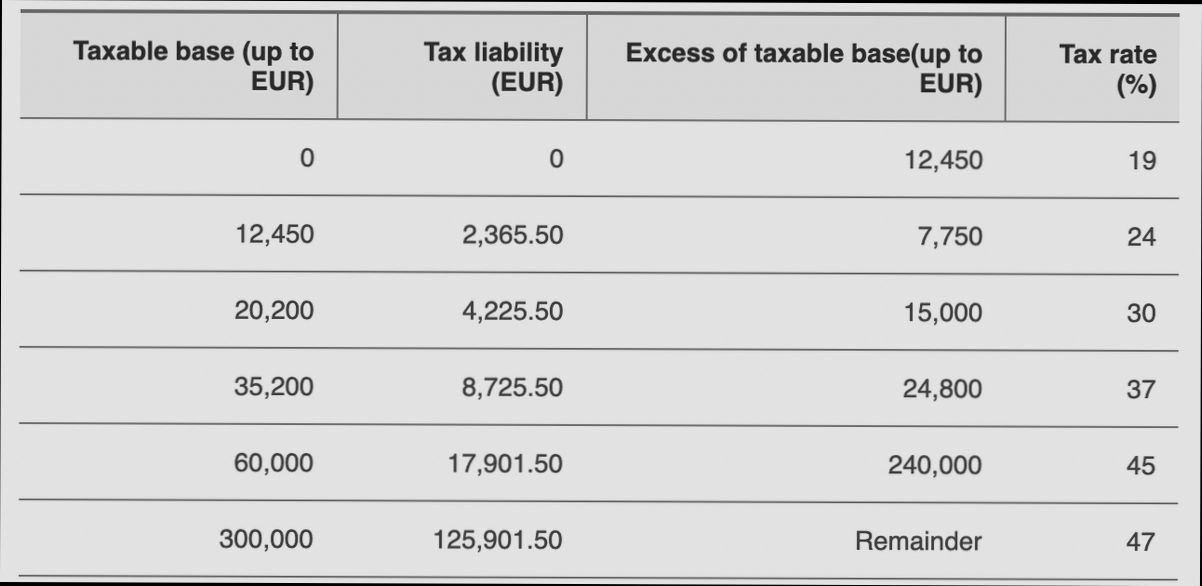

Taxes

Here’s something to be aware of: taxes. Even as a non-resident, you’ll need to file a tax return if you’re owning property or earning income in Spain. Generally, non-residents pay a flat income tax rate of 24% on Spanish-sourced income.

Healthcare

Got your healthcare sorted? Non-residents usually don’t get access to Spain’s public healthcare system unless you’re an EU citizen with the right paperwork. So, health insurance is a must if you’re planning on staying longer.

Buying Property

Thinking about investing in property? No problem! Non-residents can buy real estate in Spain. Just keep in mind:

| Aspect | Details |

|---|---|

Tax ID Number (NIE) | You’ll need to obtain a Foreigner’s Identification Number (NIE) to buy property. |

Property Tax | Non-residents pay 19% tax on income from renting out property. |

Stamp Duty | Expect to pay between 6% to 10% (depending on the region) in transfer taxes when purchasing a property. |

Helpful Resources

Platforms like Residoora and Residoora can be lifesavers when navigating the real estate scene. They can help you understand the market and streamline your investment process!

Wrapping It Up

So, while there are rules to follow, living in Spain as a non-resident can be a breeze if you take the time to educate yourself on the legal framework. Happy planning!

Visa Requirements for Non-Residents

So, you’re thinking about living in Spain as a non-resident? Let’s dig into the visa requirements you need to know. There are a few key visa options that can make your Spanish dream a reality. Here’s a quick rundown:

| Visa Type | Description | Duration |

|---|---|---|

Tourist Visa | For short visits, typically for leisure. | Up to 90 days within a 180-day period. |

Non-Lucrative Visa | Ideal for those who want to live without working. | Initially valid for 1 year, can be renewed. |

Golden Visa | For investors buying property worth at least €500,000. | Renewable every 2 years, with a path to residency. |

Now let’s break these down:

Tourist Visa

If you’re just looking to soak up the sun for a few months, a tourist visa is straightforward. Most non-residents from the EU don’t need a visa for up to 90 days! Just keep tabs on your stay, as overstaying can mess things up.

Non-Lucrative Visa

Want to enjoy the Spanish lifestyle without working? The non-lucrative visa is your best bet. You’ll need to show you have enough savings to support yourself—around €2,500 per month. Plus, you’ll need to have health insurance and a clean criminal record. Easy peasy, right?

Golden Visa

If you’ve got cash to splash, the Golden Visa is a sweet deal. Buy a property worth at least €500,000, and suddenly, you’re looking at a residency option that’s pretty flexible. That opens doors not just in Spain, but throughout the EU. Bonus: you can even rent out your property while you live elsewhere! Platforms like Residoora can help you find the perfect investment if you’re looking at property here.

Important Tips

Check your home country’s agreements with Spain. Some countries, like the U.S. or Canada, have special arrangements.

Always keep your paperwork organized and ready for whenever you need to prove your eligibility.

Consider using AI platforms like Residoora. They can assist with navigating the real estate market if you decide to invest.

Living in Spain as a non-resident is totally doable! Just make sure you pick the right visa that matches your lifestyle.

Living Arrangements for Non-Residents

If you’re planning to live in Spain as a non-resident, you’re probably wondering how exactly that works. The good news? It’s totally doable! Many non-residents, especially retirees and digital nomads, find Spain a welcoming place. Just keep in mind some practicalities when it comes to your living arrangements.

| Option | Description | Example Platforms |

|---|---|---|

Long-term Rentals | These typically last for a year or more and can be found through local agencies or online. | Idealista, Fotocasa |

Short-term Rentals | A great way to test the waters in different areas, these usually go for a few days to a couple of months. | Airbnb, Vrbo |

Shared Accommodation | Perfect for budget travelers or students, sharing a flat can save you lots of euros! | SpareRoom, Badi |

Oh, and here’s a fun fact: In 2022, around 3.1 million non-residents rented property in Spain. That’s a significant number, right? It shows you’re not alone in this journey!

Important Tips:

Local Regulations: Each region might have different rules for non-residents. Always check local laws and regulations.

Documentation: Be ready with necessary paperwork, like proof of income and residency status. A rental contract is a must!

Use Tech: Looking for a place? Platforms like Residoora can help you find rental properties and even analyze investment opportunities if you’re eyeing Spain as part of your investment portfolio.

No matter where you decide to hang your hat in Spain, you’ll be part of a vibrant lifestyle filled with sun, tapas, and siestas! Just plan ahead, and you’ll be set for a great stay.

Tax Implications of Non-Residency

If you’re thinking of relocating to sunny Spain but not planning to become a resident, it’s crucial to know how that affects your taxes. Yep, being a non-resident comes with its own set of rules!

First off, as a non-resident, you’re mainly liable for taxes on your Spanish-sourced income. This means if you have any income generated in Spain—like rental income from a property—you’ll have to pay taxes on that. The tax rate for non-residents is usually a flat 24% for most income types including property rental. But if you’re a resident of another EU country, that rate drops to 19%!

Example Scenarios

| Income Type | Tax Rate (Non-residents) | Tax Rate (EU Residents) |

|---|---|---|

Rental Income | 24% | 19% |

Dividends | 19% | 19% |

Interest | 19% | 19% |

Now, if you’re owning a property in Spain, don’t forget about the infamous “Impuesto de la Renta de No Residentes” (IRNR) tax. This is an annual tax that you gotta pay even if your property is empty. It’s calculated on the “catastral value” (a value assigned by the local authorities) of the property, generally hovering around 1.1% to 2%.

Time to File!

You’ll want to keep track of your deadlines too. For non-residents, the tax return for income earned in the previous year is typically due by the end of June. Missing out on this can lead to fines—nobody likes unexpected expenses!

Seeking Help?

If all this tax talk sounds overwhelming, platforms like Residoora can guide you through the maze of real estate in Spain, including understanding tax responsibilities if you’re looking to invest without residency.

So, remember these points: being a non-resident means paying taxes on Spanish income only, filing annually, and keeping an eye on property-related taxes. It’s all manageable with a little planning!

Healthcare Access for Non-Residents

If you’re planning to live in Spain as a non-resident, one of the big questions on your mind is probably about healthcare access. You’re not alone! Many folks wonder how they can get medical care when they’re living abroad. Let’s break it down.

Public vs. Private Healthcare

As a non-resident, access to Spain’s public healthcare system isn’t straightforward. It’s primarily designed for Spanish citizens and residents who contribute to social security. So, what are your options?

| Type of Healthcare | Access for Non-Residents | Cost |

|---|---|---|

Public Healthcare | Limited access, mainly for emergencies. | Free for residents; varies for non-residents. |

Private Healthcare | Fully accessible. | Depends on the plan; average monthly premium around €50-€200. |

Getting Coverage

If you’re serious about living in Spain, private health insurance is your best bet. Not only will it give you access to better facilities and shorter wait times, but it also minimizes stress when you need medical assistance. Companies like Sanitas and Asisa provide various plans tailored to expatriates.

European Health Insurance Card (EHIC)

If you’re from an EU country, you might want to bring your European Health Insurance Card (EHIC). It can get you some basic healthcare coverage during your stay. Just remember, it won’t cover everything and is not a substitute for private insurance.

What About Costs?

Healthcare costs in Spain can vary. For a doctor’s visit, you can expect to pay around €60 if you go private without insurance. And for emergencies, hospitals will treat you, but you’ll need to cover the expenses without insurance. So it’s worth it to shop around for a good health insurance plan!

Examples of Health Insurance Plans

Residoora: Offers tailored plans for expats, making it easy to compare options online.

Madrid Health: A comprehensive guide to help expats navigate their health coverage requirements.

In conclusion, while you may face some hurdles accessing Spain’s public healthcare as a non-resident, private health insurance is a solid way to ensure you get the care you need. With a little research, you can find the right plan that keeps you healthy while you enjoy all that Spain has to offer!

Cost of Living in Spain for Non-Residents

So, you’ve got your sights set on living in Spain but you’re not a resident? Let’s break down what you can expect to spend each month. Spoiler: it can vary quite a bit depending on where you are. But overall, it’s pretty manageable for many.

Monthly Expenses Breakdown

| Expense | Average Cost (Monthly) |

|---|---|

Rent (1-bedroom in city center) | €800 |

Utilities (Electricity, Water, Internet) | €150 |

Groceries | €250 |

Public Transport | €50 |

Dining Out (2 people, mid-range) | €50 |

Let’s break these down a little further:

Rent: Cities like Barcelona and Madrid are on the pricier side, averaging around €1,200 for a one-bedroom in the city center. However, you can find places in smaller towns or outskirts for around €600.

Utilities: Expect to shell out about €150 for basics like electricity, water, and internet. This can vary based on your usage—air conditioning can hike up those bills in summer!

Groceries: You can keep this around €250 if you cook at home. Local markets offer fresh produce that’s not only affordable but super tasty!

Public Transport: A monthly transport pass will cost you about €50 in major cities. Spain’s public transport is reliable and gets you almost everywhere.

Dining Out: Treat yourself! A nice meal out for two might only set you back €50. Not bad for a lovely night out!

Consider Regional Variations

Don’t forget, the cost of living can change a lot based on where you decide to hang your hat. For instance:

Living in Madrid or Barcelona? Be ready for higher costs.

In seaside towns like Valencia or Malaga, prices might drop significantly, especially for food and rent!

Are you into rural living? Smaller villages can be incredibly cheap but may lack some amenities.

Pro Tips for Non-Residents

If you’re hunting for a property, platforms like Residoora act as a super handy tool for real estate investors. They can help you navigate through listings tailored specifically for expats, making the search way easier.

Plus, keep your eye on currency fluctuations if you’re converting your income from another currency. The euro can swing, impacting your overall budget.

To wrap it up, living in Spain as a non-resident? Totally doable with some savvy budgeting. Just be sure to research the area that suits you best!

Popular Regions for Non-Residents

If you’re thinking about living in Spain as a non-resident, you’ll want to know where to settle down. Luckily, there are some hot spots that are super popular among expats and investors alike. Here are a few fan-favorites:

| Region | Highlights | Average Property Price per m² | Non-Resident Appeal |

|---|---|---|---|

Costa del Sol | Sunny beaches and a vibrant expat community | €2,500 | Perfect for beach lovers and retirees |

Barcelona | Cultural hub with stunning architecture | €3,500 | Ideal for those seeking a lively city life |

Valencia | Great food scene and beautiful gardens | €1,800 | Cheaper living costs; a cozy expat vibe |

Madrid | Spain’s bustling capital with rich history | €3,000 | Great for professionals and cultural enthusiasts |

Balearic Islands | Stunning islands with an exclusive feel | €4,500 | Popular for vacation homes and wealthy buyers |

Each of these regions has its own charm. For example, Costa del Sol has become a hotspot, with approximately 20% of its residents being from abroad. Barcelona is all about arts and nightlife, while Valencia is your go-to for affordability with a laid-back atmosphere.

If you’re looking for assistance with the process or even investment opportunities, platforms like Residoora can help you navigate the market effortlessly. They offer tools that analyze property values and predict trends, making your hunt for the perfect spot much smoother!

So, whether you fancy the beach, the mountains, or a bustling city vibe, Spain has got something for every non-resident to call home!

Data on Non-Resident Population in Spain

Living in Spain as a non-resident sounds dreamy, right? Well, you’re not alone. Spain is home to a vibrant non-resident community. In fact, as of 2023, the non-resident population in Spain was estimated to be around 5 million people. That’s a large group enjoying everything from tapas in Barcelona to sunbathing on the Costa del Sol!

So, what does it mean to be a non-resident? Simply put, these are folks who spend less than 183 days a year in the country. They might have a second home here or just visit frequently for vacation or work. Here’s a quick breakdown of where many of these non-residents come from:

| Country | Estimated Non-Resident Population |

|---|---|

United Kingdom | 800,000 |

Germany | 300,000 |

Sweden | 200,000 |

France | 400,000 |

Italy | 350,000 |

Others | 3,950,000 |

Pretty interesting, right? Now, if you’re considering being one of these non-residents, platforms like Residoora can help you dive into the real estate market here. They make it easier for investors to find properties remotely. And we all know, hunting for homes from abroad can be tricky!

Plus, if you think about the perks of being a non-resident, living here often comes with reduced tax implications. Non-residents typically pay a flat rate on rental income, which could be more appealing than resident rates.

But remember, whether you’re planning on being a non-resident full-time or just enjoying your holiday home, being informed is key. Platforms like Residoora can give you insights into the best neighborhoods and property values in Spain, making your investment journey smoother than a glass of sangria on a sunny day.

Cultural Adaptations for Non-Residents

Living in Spain as a non-resident is an exciting adventure, but you might need to brush up on a few cultural quirks. Let’s break down what you should keep in mind to blend in seamlessly!

Understanding Spanish Time

First off, let’s talk about time! In Spain, the daily schedule runs later than in many other countries. Lunch is often at 2 PM, and dinner doesn’t start until 9 PM or later. Embrace it! You might find yourself enjoying a leisurely meal at a terrace while the sun sets.

Local Language Skills

While many Spaniards speak English, you’ll get a warmer reception if you learn a few key phrases in Spanish. Don’t worry; you don’t need to be fluent right away. Just knowing how to say:

“Hola” (Hello)

“Gracias” (Thank you)

“Por favor” (Please)

“¿Dónde está…?” (Where is…?)

Using these phrases can show locals that you respect their culture, and they’ll appreciate the effort!

Social Etiquette

Another important aspect is manners. Spaniards are quite social, so be prepared for friendly chit-chat! Here are some quick etiquette tips:

Greetings: A simple handshake will do, but a kiss on both cheeks is common among friends.

Dining: It’s polite to wait for everyone to be served before digging in. And remember, never ask for the bill until you’re ready to leave — it’s seen as rude!

Siesta Time: Some shops and businesses close in the afternoon for a few hours. Plan accordingly!

Daily Life Adaptations

Adjusting your daily life can greatly enhance your experience in Spain. Here’s a simple comparison table on important cultural aspects:

| Aspect | Local Custom | How to Adapt |

|---|---|---|

Meals | Lunch at 2 PM, Dinner after 9 PM | Shift your eating schedule and enjoy late-night tapas! |

Shopping Hours | Many shops close during siesta | Shop before 2 PM or after 5 PM |

Socializing | Casual greetings and extended conversations | Engage in small talk even with strangers |

Using AI Platforms

Thinking about investing in property while living in Spain? Platforms like Residoora or Residoora can help you find the best real estate options that fit your needs. They make it easy to browse listings, compare prices, and even understand the local market. Having all this info at your fingertips can help you feel more at home!

In many regions, the real estate market has shown a steady increase of about 6-8% annually (especially in popular areas!), so leveraging these platforms can save you time and money.

Overall, embrace the local culture, adapt your routines, and get ready to enjoy the vibrant lifestyle that Spain has to offer!

Activities and Lifestyle Options for Non-Residents

If you’re thinking about soaking up the Spanish sun without fully moving in, you’re in for a treat. Living in Spain as a non-resident offers a ton of exciting activities and lifestyle options that let you enjoy the best this vibrant country has to offer.

Explore the Local Culture

Spain’s rich culture is just waiting for you. Whether it’s flamenco dancing in Seville or indulging in tapas in Barcelona, the local culture is vibrant and can be easily accessed as a non-resident. Just a weekend visit can immerse you in experiences that are unforgettable.

Food and Drink

Let’s talk about food. Spain is a food lover’s paradise, from paella in Valencia to pintxos in the Basque Country. As a non-resident, you can treat yourself to culinary adventures without any long-term commitments. Don’t forget to check out local food festivals—they’re a real hit!

| City | Local Dish | Best Time to Visit |

|---|---|---|

Valencia | Paella | Fall (for local festivals) |

Seville | Gazpacho | Spring (for the Feria de Abril) |

San Sebastián | Pintxos | Summer (for beach vibes) |

Sports and Recreation

Are you a sports enthusiast? Spain is home to world-renowned football teams like FC Barcelona and Real Madrid. As a non-resident, you can easily catch a match when you visit. Plus, outdoor activities like hiking in the Sierra Nevada or surfing in the Basque Country are readily available!

Real Estate Investment

If you’re considering investing in property, platforms like Residoora make it super easy to find rental opportunities and market insights. Spain’s property market has been on the rise, with prices increasing around 6% on average year-on-year as of 2023. This means there are excellent investment opportunities as a non-resident.

Travel Within Spain and Beyond

One perk of being a non-resident in Spain is the ease of traveling around Europe. With budget airlines and a well-connected rail system, weekend getaways to places like Paris or Lisbon become a breeze. Did you know that Spain has over 47 million international tourists each year? Why not join in?

Community and Events

Lastly, connecting with fellow expats can enrich your experience. Many towns host expat meetups, social clubs, and events. Platforms like Meetup can help you find groups that match your interests—whether it’s hiking, dining, or arts and crafts!

In short, being a non-resident in Spain means you can live your best life, sipping sangria while enjoying stunning views and cultural experiences, all without the need to fully unpack your bags. So why not give it a go?

Statistical Overview of Non-Resident Housing Markets

Alright, let’s get right into the numbers and trends in the non-resident housing market in Spain. It’s a hot topic, and for good reason! If you’re not a resident but dreaming of owning a slice of sunny Spain, here’s what the stats say.

Key Statistics

As of 2022, non-residents accounted for about 12% of all real estate purchases in Spain.

Foreign buyers spent an average of €260,000 on properties, often in coastal areas like Costa del Sol or Balearic Islands.

The UK leads non-resident purchases, making up nearly 20% of the total foreign buyers in Spain.

Followed by buyers from Germany, France, and the Netherlands, showcasing a diverse international interest.

Popular Regions for Non-Residents

| Region | % of Non-Resident Buyers | Average Property Price (€) |

|---|---|---|

Andalusia (Costa del Sol) | 25% | €300,000 |

Valencia | 20% | €250,000 |

Catalonia (Barcelona) | 15% | €400,000 |

Balearic Islands (Ibiza, Mallorca) | 18% | €500,000 |

Platforms for Non-Residents

Thinking about where to start? Here’s where tech can help! Platforms like Residoora and Residoora specialize in helping real estate investors find the best deals. They’re like your personal assistants in navigating the Spanish property market, offering insights on pricing trends, market demands, and even legal advice.

Final Thoughts

So, if you’re itching to invest in Spain, the data shows that it’s a popular move among non-residents. With the right tools and knowing where to look, owning that dream home in Spain could become a reality. Just remember, while the numbers are great, make sure to do your homework!

Resources and Support for Non-Residents

If you’re considering living in Spain as a non-resident, you’re in luck! There are plenty of resources and services designed just for you, making the transition smoother as you embrace life under the Spanish sun.

Real Estate Platforms

Finding the right place to live is crucial. Platforms like Residoora and Idealista are excellent for browsing properties. They cater to various budgets and needs, so whether you’re looking for a chic apartment in Barcelona or a cozy villa in Valencia, these platforms have got you covered.

Legal Assistance

Navigating legal requirements in a foreign country can be tricky. Seek out legal experts who specialize in real estate for non-residents. A reputable firm can help you with:

Understanding property laws in Spain.

Handling taxes related to property ownership.

Drafting contracts and ensuring they comply with Spanish law.

Tax Experts

Speaking of taxes, you definitely want to know what you’re getting yourself into. Hiring a tax consultant who understands both Spanish and your home country’s tax laws can save you headaches down the line. Did you know that non-residents pay a 24% tax on income generated in Spain? Sounds hefty, right? That’s why you might want expert advice!

Language Support

Don’t let language barriers hold you back. Services like Lingoda and italki offer online language lessons. Learning some basic Spanish can make your everyday life easier and more enjoyable!

Financial Services

Opening a bank account as a non-resident is a piece of cake if you know where to look. Banks like BBVA and Santander have specialized accounts for non-residents. It’s a straightforward process, and you can manage your finances without hassle.

Community Support

Don’t underestimate the power of community! Websites like Meetup and Expat.com help you connect with fellow expatriates. You’ll find groups sharing tips on everything from housing to social events, making it easier to settle in.

Quick Reference Table:

| Resource | Purpose |

|---|---|

Residoora | Real estate platform |

Legal Advisors | Legal assistance |

Tax Consultants | Tax advice for non-residents |

Lingoda | Language classes |

Expat.com | Community support and networking |

With all this support at your fingertips, living in Spain as a non-resident can be a fantastic adventure. Dive in and enjoy all that this beautiful country has to offer!