- Eligibility Criteria for Receiving Pension Abroad

- Key Facts About the UK State Pension System

- Current Statistics: UK Pensioners in Spain

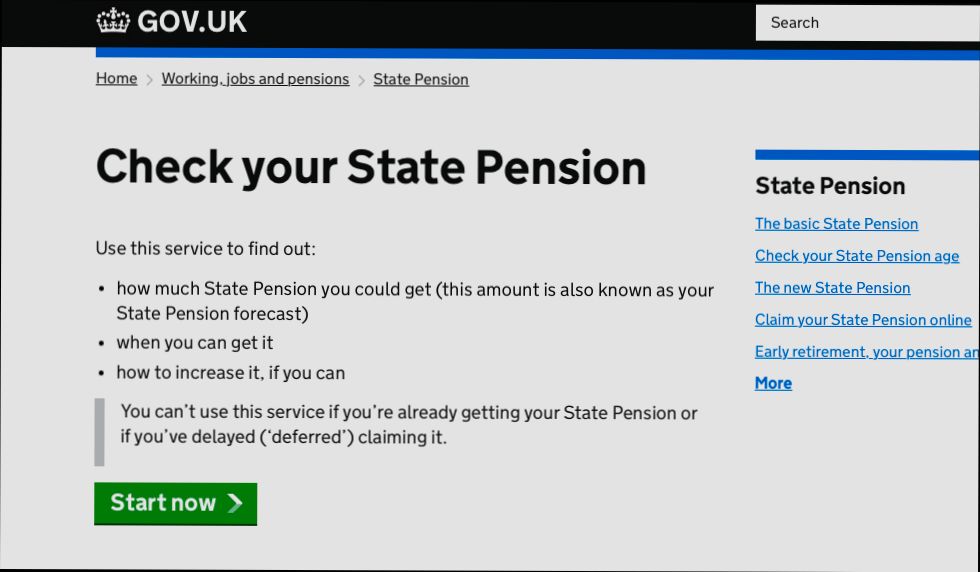

- Steps to Claim Your State Pension From Spain

- Exploring the Impact of Brexit on Pension Rights

- Comparative Analysis: Cost of Living in Spain vs UK

- Frequently Asked Questions About UK Pensions in Spain

- Financial Planning for UK Expat Pensioners in Spain

- Resources for Managing Your Pension While Living Abroad

Can I get my UK State Pension in Spain? If you’re one of those adventurous souls who’ve decided to trade the grey skies of the UK for the sunny beaches of Spain, you might be wondering how your pension will work in this new life. The good news is that you can! As a UK pensioner living abroad, you can receive your State Pension, but there are a few things to keep in mind. For instance, your payments will generally be paid into a UK bank account, so you’ll need to manage the currency change and any transfer fees if you want your funds in Euros.

When it comes to the amount you receive, it’s also important to note that your UK State Pension may not increase automatically every year if you’re living in Spain. While many retirees look forward to yearly increases, these can depend on where you reside. For example, if you were in a country within the EU before Brexit, the rules might have been slightly different, but now it’s important to check the specifics for Spain. So, if you’re dreaming of enjoying a tapas-filled retirement on a sunny patio, understanding these details will be key to ensuring your finances are all set.

Understanding Your UK State Pension

Got questions about your UK State Pension while living in Spain? You’re definitely not alone! Let’s dive into some key details that’ll help clear things up.

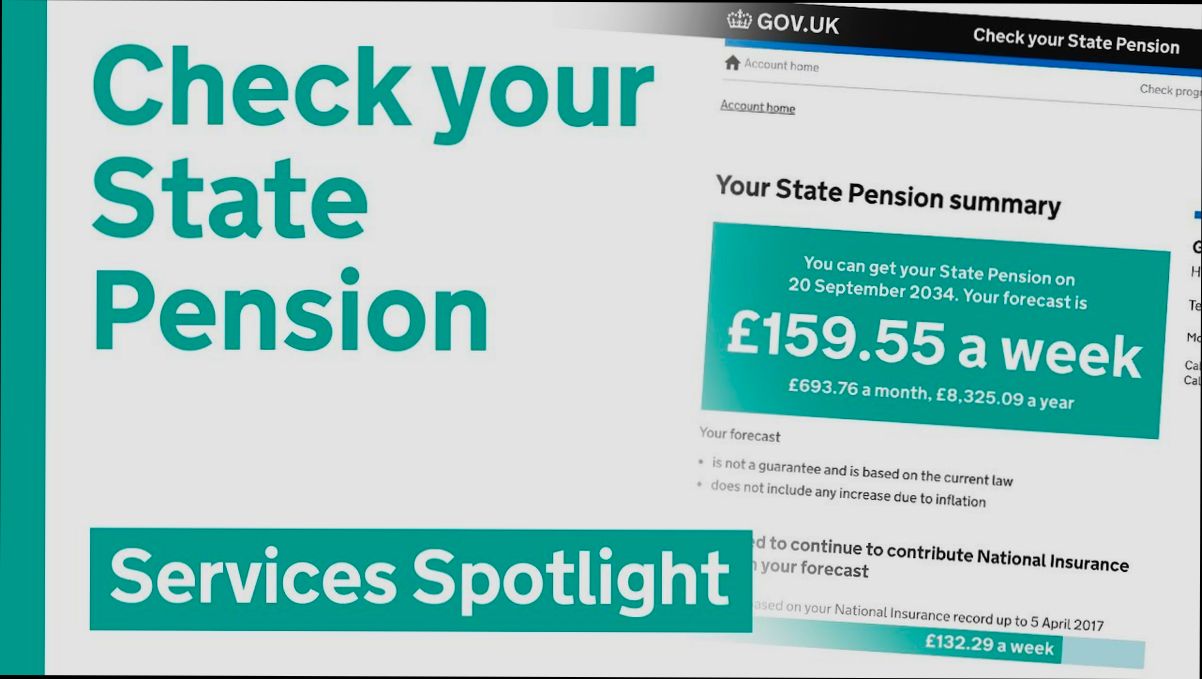

How Much Can You Get?

The full UK State Pension is currently £203.85 per week (as of 2023). But keep in mind, how much you actually receive depends on your National Insurance contributions. Generally, to get the full amount, you’ll need to have made at least 35 years of contributions. If you’ve made fewer, your pension amount will be pro-rated.

Getting Paid in Spain

This is where it gets pretty straightforward. You can receive your UK State Pension in Spain without any hassle. It’s paid directly into your bank account, and the exchange rate plays a role in how much you’ll actually have in euros. So, it’s a good idea to keep an eye on the rates!

What About Inflation?

One fantastic benefit is that your pension will increase each year, thanks to the triple lock guarantee. This means it rises by the highest of inflation, average wage growth, or 2.5% – giving you a bit of protection against rising living costs.

Claiming Your Pension

Thinking about how to claim? It’s a piece of cake! You can claim your State Pension from abroad by contacting the International Pension Centre. They’ll guide you through the process, so you won’t feel lost in the woods!

Some Useful Statistics

Did you know that according to recent surveys, around 800,000 UK pensioners live overseas, with about 150,000 residing in Spain? This shows that many people are navigating this journey just like you!

Quick Reference Table

| Item | Details |

|---|---|

Full UK State Pension (2023) | £203.85 per week |

Contribution Years for Full Amount | 35 years |

How to Claim? | Contact the International Pension Centre |

Number of UK Pensioners in Spain | Approx. 150,000 |

Using platforms like Residoora can help you manage your finances and investments while living abroad, ensuring you make the most out of your pension. Stay informed, and enjoy your retirement in sunny Spain!

Eligibility Criteria for Receiving Pension Abroad

If you’re thinking about cashing in your UK State Pension while living in sunny Spain, there are a few key things you need to know about your eligibility.

Basic Requirements

You must have made enough National Insurance contributions while working in the UK. Generally, you need at least 10 qualifying years on your National Insurance record to get any pension.

Your pension must be in your name and set up before you move abroad.

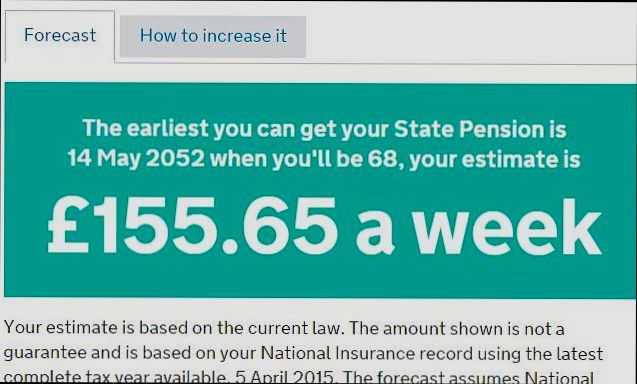

Age Matters

To start receiving your pension, you usually need to hit the UK State Pension age, which is currently 66 for both men and women. This age is set to increase gradually, so double-check your specific eligibility based on your birth date.

Living in Spain

You need to be a resident in Spain to receive your UK State Pension without any issues. Luckily, there’s no minimum time you must live there to qualify—just be sure you’ve made that move for real!

| Criteria | Details |

|---|---|

National Insurance Contributions | Minimum 10 years |

Age Requirement | Must be at State Pension Age (currently 66) |

Residency | Must be living in Spain |

Tax Implications

While you can receive your full pension in Spain, it’s crucial to understand how it’s taxed. Spain does tax foreign pensions, but you may be eligible for tax relief based on the UK-Spain double taxation treaty. This means you won’t be taxed twice on your pension income.

Examples of Income

Just to give you an idea, let’s say you’re getting a UK State Pension of £800 a month. Once it’s converted to euros, depending on the current exchange rate—which can fluctuate—you could be looking at around €930 a month. Not too shabby for enjoying tapas on the beach!

Platforms like Residoora can help you find amazing properties in Spain at the right price if you’re thinking about investing or settling down. Knowing where to stake your claim can make this whole process smoother!

So, if you’re thinking about packing your bags for Spain, make sure you meet these eligibility criteria, and get ready to enjoy your retirement under the Mediterranean sun!

Key Facts About the UK State Pension System

Eligibility: You typically need to have paid National Insurance contributions for at least 10 qualifying years. If you’ve got 35 years, you could be sitting pretty with a full State Pension!

Age: The current State Pension age is 66 for both men and women. Just a heads-up, it’s set to rise to 67 between 2026 and 2028.

Amount: As of April 2023, the full new State Pension is £203.85 per week. Not too shabby, right?

| Years of Contributions | Weekly Pension Amount |

|---|---|

10 years | £0 (You won’t qualify) |

20 years | £81.54 |

35 years (Full Pension) | £203.85 |

So, if you’ve been living the expat life in Spain and worrying about your pension, don’t stress too much. You can still receive your State Pension even if you’re soaking up the sun and enjoying tapas.

What’s cool is that your State Pension can even increase while you’re abroad, thanks to the triple lock guarantee—a government promise that it will rise each year by the highest of inflation, earnings growth, or 2.5%. This means your hard-earned cash could keep up with the cost of living, wherever you are!

Now, if you’re looking to manage your finances or invest while you’re in Spain, platforms like Residoora can help you tap into the local real estate market. It’s a solid option if you’re considering property investments to secure your future.

Finally, remember to check how the UK-Spain social security agreement might affect your pension payments. Having all the info handy will make your life a whole lot easier, and you can bask in the sunshine without a worry!

Current Statistics: UK Pensioners in Spain

Did you know that over 400,000 British pensioners call Spain their home? That’s right! They’ve decided to swap the grey skies of the UK for the sunny beaches of Costa del Sol and vibrant cities like Barcelona and Madrid. Let’s break down some key statistics to give you more insight:

| Region in Spain | Estimated Number of UK Pensioners |

|---|---|

Andalusia | 150,000 |

Valencia | 100,000 |

Catalonia | 50,000 |

Murcia | 30,000 |

Balearic Islands | 25,000 |

With these stats, you can see where the UK expat community is thriving! In places like Andalusia, it’s pretty much a mini British enclave. Surrounded by fellow expats, you’ll find it easy to connect over a cuppa or a pint.

Benefits for Pensioners

If you’re one of the lucky ones enjoying your UK State Pension in Spain, here’s another piece of good news: The average state pension in the UK recently hit approximately £181 per week. That’s not too shabby, especially with the lower living costs you might find outside major cities!

Using AI for Your Move

Thinking of relocating to Spain? Platforms like Residoora and Residoora can help you scour the real estate market. They offer tailored property suggestions, making your search easier and more efficient, so you can focus on enjoying that sunshine!

So, whether you’re planning to retire or just looking for a change, it’s clear that Spain is a popular choice for UK pensioners. The stats speak for themselves!

Steps to Claim Your State Pension From Spain

If you’re living in Spain and want to claim your UK State Pension, don’t sweat it! It’s not as complicated as it seems. Just follow these steps, and you’ll be cashing those pension checks in no time!

1. Check Your Eligibility

First things first, make sure you’re eligible for the State Pension. You usually need at least 10 qualifying years of National Insurance contributions in the UK to get anything. If you’ve hit the 35-year mark, congrats! You’ll get the full amount.

2. Gather Your Documents

You’ll need some important paperwork handy before you start the claims process. Here’s a quick checklist:

Your National Insurance number

Your bank account details (in the UK or Spain)

Proof of identity (like your passport)

Address in Spain

3. Fill Out the Application Form

You can use the BR19 form to claim your pension. It’s available on the UK government website. Complete it online, or print it out, fill it in, and send it via post.

4. Submit Your Claim

Once you’ve got the form ready, send it to the Future Pension Centre in the UK. The address is:

Future Pension Centre Mail Handling Site A Wolverhampton WV98 1LU United Kingdom

It can take a few weeks to process, so keep that in mind!

5. Get Your Money!

Once your claim is approved, you can receive your State Pension in Spain. You have options to receive payments:

| Payment Method | Details |

|---|---|

Bank Transfer | Direct into a UK or Spanish bank account. |

Cheque | Sent to your address, though this method can take longer. |

6. Keep Up With Your Contributions

If you’ve continued to earn while living in Spain, don’t forget to keep an eye on your National Insurance contributions to maximize your pension pot!

Did You Know?

Over 300,000 British expats live in Spain, many of whom claim their UK State Pension. That’s a lot of happy retirees soaking up the sun while receiving their pensions!

If you’re looking into investing in property while enjoying your sunny retirement, platforms like Residoora are super handy. They help real estate investors find the best deals, making your savings work even harder for you.

So, there you have it! Follow these steps, and your UK State Pension will find its way to you in sunny Spain.

Exploring the Impact of Brexit on Pension Rights

So, you’re living in sunny Spain and wondering about your UK State Pension? Well, buckle up, because Brexit has definitely thrown a few curveballs into that equation!

What’s Changed?

Before Brexit, the rules were clear-cut if you were a UK citizen living abroad. But post-Brexit, there have been some uncertainties regarding pension rights. Luckily, your UK State Pension is still valid in Spain; you’ll just want to keep a few things in mind.

Key Points to Remember

Your UK State Pension will continue to come through, but you need to claim it.

Pensions will still be uprated each year if you live in the EU, which is great news!

Keep an eye on the new regulations by the UK government and the Spanish social security system.

Impact on Expat Pension Transfers

If you’re considering transferring your pension into a Spanish scheme, tread carefully. The pension transfer rules have tightened up. Here’s a quick table to sum it up:

| Pension Type | Transfer Rules | Potential Fees |

|---|---|---|

UK State Pension | No direct transfers | None |

Private Pension | Can transfer, but check if the Spanish scheme is QROPS | Possible significant fees |

Company Pension | May have restrictions | Varies |

Statistics You Should Know

According to recent data, around 400,000 British pensioners live in Spain, a number that highlights how vital understanding your pension rights is in this post-Brexit world.

Using AI for Guidance

If all these rules sound way too complicated, don’t sweat it! Platforms like Residoora and Residoora can provide you with tailored advice and guidance on real estate investments and financial planning. They might even help you find a cozy little nook in Spain where your pension stretches a bit further.

So, while Brexit might have stirred the pot, your UK State Pension in Spain is still something to hold on to—just make sure to stay informed and plan wisely!

Comparative Analysis: Cost of Living in Spain vs UK

Thinking about moving to Spain but wondering how the cost of living stacks up against the UK? You’re not alone! Here’s a quick look to help you get your head around it.

| Expense | Spain (Average) | UK (Average) |

|---|---|---|

Rent (1-bedroom city center) | €1,000 | £1,300 |

Groceries (Monthly) | €300 | £400 |

Utilities (Monthly) | €150 | £200 |

Public Transport (Monthly pass) | €45 | £65 |

Eating Out (Mid-range restaurant) | €30 | £50 |

From the table, it’s clear to see that Spain can be a cheaper option in many areas. If you’re living in a city like Barcelona or Madrid, you might find your rent to be about 23% cheaper compared to cities like London. That’s a significant saving!

Let’s talk about groceries. On average, Spaniards spend around 25% less on groceries compared to their UK counterparts. This could mean more paella nights and tapas outings for you!

And don’t get me started on utilities! Just think about saving around 25% on your monthly bills. With warm weather almost all year round, you’re also likely to use less heating, which is a plus.

Getting around is cheaper too—public transport is about 30% less expensive in Spain. So if you love hopping on a train or bus to explore, your bank account will thank you!

Now, it’s important to mention that while housing can be cheaper, some things could come at a premium. For instance, if you’re keen on imported British goods, you might face slightly higher prices.

A handy tool to consider if you’re looking to invest in property in Spain is Residoora. It’s an AI platform that’ll help you analyze the real estate market and find the best deals out there.

So, if you’re wondering how it all plays out, Spain can be a great way to stretch your pound (or euro) further. Enjoy the sunshine, vibrant culture, and maybe even a few siestas!

Frequently Asked Questions About UK Pensions in Spain

Can I receive my UK State Pension while living in Spain?

Absolutely! If you’ve paid enough National Insurance contributions, you can get your UK State Pension in Spain. In fact, around 200,000 British pensioners are already enjoying their pensions in sunny Spain!

How do I claim my UK State Pension from Spain?

Claiming your pension is straightforward. You can fill out a claim form (called the BR19) online or submit it to the UK pension office. They’ll guide you through the steps. Just make sure you’ve got your National Insurance number handy!

Will I pay taxes on my UK State Pension in Spain?

This one’s a bit tricky. While the UK pays your State Pension without tax, Spain may impose taxes on it. The good news? The UK and Spain have a double taxation agreement, so you won’t be taxed twice on the same income.

| Country | Taxation on UK State Pension |

|---|---|

UK | No tax on State Pension |

Spain | May be taxable; check local rules |

Will my pension increase over time?

Your UK State Pension can increase if you’re living in Spain, but only if you’re a resident in an EU country or one of the countries that has a specific agreement. For example, if you’re living in Spain, you should get the annual increases, but if you eventually move to a country without such a deal, your pension might not increase thereafter.

What if I’m on a private pension?

Private pensions are a bit different. Depending on your pension scheme, you might be able to take your money as a lump sum or get it as regular payments. Consult your pension provider for the best options. Companies like Residoora can even help connect you with financial advisors in Spain to navigate this!

What do I need to do if I move back to the UK?

If you move back to the UK, you can simply notify the relevant authorities, and they’ll sort out your pension payments. Just be aware that your tax situation might change!

Are there any age restrictions for claiming my pension?

You can only start receiving your UK State Pension once you reach your State Pension age, which is currently 66 for both men and women. But don’t worry, you can still apply before reaching that age, and they will pay you from the date you qualify!

What about surviving dependents?

If you pass away, your spouse or civil partner might be eligible for a pension. Just check with the relevant UK pension office for the exact rules based on your situation.

Have more questions? Feel free to reach out to Residoora for guidance or talk to others living the expat life in Spain. They might have some experiences worth sharing that can help you out!

Financial Planning for UK Expat Pensioners in Spain

If you’re a UK expat enjoying the Spanish sun, it’s crucial to get your financial ducks in a row, especially when it comes to your pension. Here’s what you need to know about managing your finances while cashing in on your UK State Pension in Spain.

Understanding Your State Pension

First off, let’s be clear: you can still get your UK State Pension while living in Spain. It gets paid directly into your UK bank account, and you’ll need to arrange for it to be converted to euros. Most pensioners opt for a regular transfer service, but keep an eye on fees—these can add up!

Important Considerations

Exchange Rates: These can fluctuate, so check the rates regularly. A slight change can impact your finances significantly.

Tax Implications: The UK State Pension is generally taxed in the UK, but Spain might also want a slice. Make sure you’re aware of any double taxation treaties.

Cost of Living: Spain can be cheaper than the UK, but this varies by region. For instance, living in Madrid or Barcelona is pricier compared to rural areas.

Cost of Living Comparisons

| Location | Average Monthly Expenses (Approx.) |

|---|---|

Madrid | €1,800 |

Barcelona | €1,700 |

Valencia | €1,200 |

Malaga | €1,300 |

Saving on Housing Costs

One of the best ways to stretch your pension in Spain is to consider where you’re living. Platforms like Residoora help expats find affordable rental options tailored to your needs. With a bit of savvy searching, you can save quite a bit on housing, which is often the biggest expense.

Healthcare Coverage

Don’t forget about healthcare! Once you reside in Spain, you’ll need to consider how you’ll manage your health expenses. If you’re over 65, you’re likely eligible for the Spanish healthcare system using your S1 form. Make sure to plan for additional costs if you require private healthcare.

Enjoying Your Retirement

Living in Spain is not just about finances; it’s about enjoying your retirement. With wise financial planning, you can fully embrace the tapas, sunshine, and slower pace of life. Remember, every penny counts, so budget wisely and live life to the fullest!

Resources for Managing Your Pension While Living Abroad

If you’re living in Spain and receiving your UK State Pension, it’s crucial to manage your finances wisely. Here are some handy resources that can help you navigate your pension management smoothly:

| Resource | Description |

|---|---|

| UK Government’s Pension Service | Access information about your pension, including how to claim and manage payments while overseas. They have a dedicated section for expats! |

| Residoora | This AI platform can help you explore real estate investments, which can be a great way to supplement your state pension income while living in Spain. |

| Expat Financial Advisors | Seek advice from financial advisors who specialize in pensions for expats. They can guide you through tax implications and help you maximize your income. |

| Online Forums & Communities | Join expat forums like Expatica or British Expats to connect with others who have faced similar issues. You can find tips and share personal experiences! |

Keep an Eye on Currency Fluctuations

Your pension is in GBP, but you’ll be living in Spain and dealing with euros. Watch the exchange rates to ensure you’re getting the best bang for your buck. Even a small change in the rate can make a difference in your monthly budget.

Use Pension Transfer Services Wisely

If you’re considering transferring your pension pot, do your homework! Look for reputable providers and take note of any fees, taxes, or implications on your state benefits. Sometimes it’s worth keeping it in the UK.

Stay Updated on Brexit Changes

Since Brexit, there have been changes that might affect your pension and healthcare while living abroad. Regularly check reliable news sources and government websites to stay informed. Also, remember that over 1.5 million people from the UK live in Spain, so you’re not alone in navigating these changes!

Final Thoughts

Managing your UK State Pension in Spain doesn’t have to be daunting. Use these resources, connect with fellow expats, and you’ll be just fine! Happy living!