- Eligibility Criteria for Foreigners to Rent Property

- Key Legal Requirements for Renting in Spain

- Understanding Tax Implications for Foreign Landlords

- Popular Regions for Foreign Property Investment

- Investment Trends: Foreign Ownership in Spanish Real Estate

- Common Challenges Faced by Foreign Landlords

- Step-by-Step Process for Renting Property in Spain

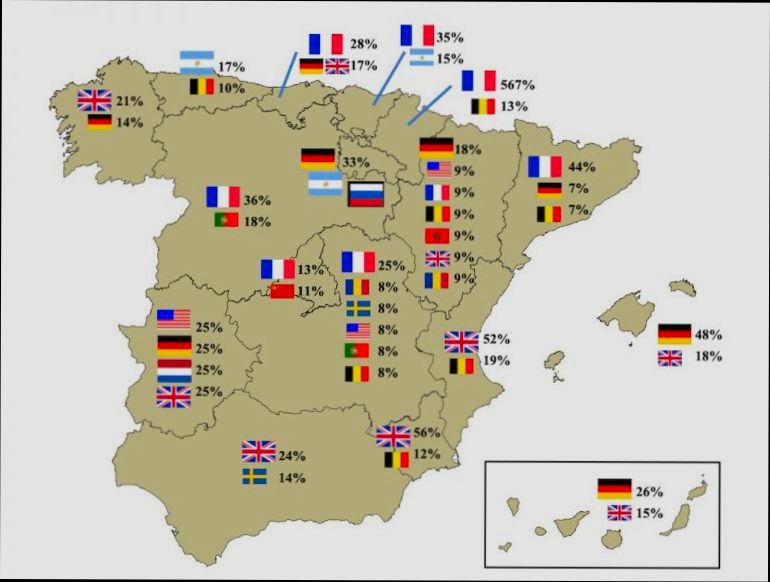

- Statistical Insights on Foreign Investment in Spanish Rentals

- Resources for Foreigners Looking to Rent Out Property

Can foreigners rent out property in Spain? If you’ve ever dreamed of soaking up the sun while sipping sangria on your own balcony in Barcelona or enjoying the serene beaches of the Costa del Sol, you might be wondering if it’s even possible for non-Spaniards to jump into the property market there. The good news is that many foreigners do rent out properties in Spain, and the process might be easier than you think. There’s a mix of rules and regulations you need to wrap your head around, but it’s totally doable.

For example, non-residents can purchase properties, and then, naturally, they want to earn some income by renting them out. Cities like Madrid and Valencia are popular choices for expats looking to invest. However, local laws can vary greatly from one region to another. In places like Airbnb-driven hotspots, there are specific licenses required for short-term rentals, and failing to get those could land you in hot water. So while the charm of owning a property in Spain is undoubtedly appealing, there are a few things you’ll want to consider as you take those first steps into this vibrant real estate scene.

Overview of Property Rental Regulations in Spain

Renting out property in Spain is a pretty popular move, especially among foreigners looking to dive into the real estate market. But, before you jump in, it’s super important to get the lay of the land regarding property rental regulations. Here’s a quick breakdown of what you need to know!

Types of Rentals

Long-term rentals: Typically for over 11 months.

Short-term rentals: Usually less than 11 months and often via platforms like Airbnb.

Legal Requirements

Alright, let’s talk about the nitty-gritty. Here are a few key regulations you should keep in mind:

| Type of Rental | Key Requirements |

|---|---|

Long-term Rentals |

|

Short-term Rentals |

|

Foreign Ownership

Good news! Foreigners can absolutely own and rent out property in Spain. In fact, over 12% of total real estate purchases in Spain are made by non-residents. Here’s a quick example: if you’re a foreigner buying a place in Barcelona for short-term rentals, you’ll need to apply for the Tourist Rental License. That’s your ticket to the rental game!

Taxes You’ll Need to Know

Owning property in Spain also means you’ll need to keep your tax hat on. Here are a few taxes to consider:

| Type of Tax | What It Covers |

|---|---|

Income Tax | Tax on rental income (around 24% for non-residents) |

Property Tax (IBI) | Annual tax based on the property’s value |

Helpful Platforms

If you’re feeling overwhelmed, don’t sweat it! Platforms like Residoora can help you navigate all this. They offer AI-driven insights into the rental market in Spain, making it easier for you to understand property values and what potential earnings could look like. It’s like having a real estate guru in your pocket!

So, there you have it! Renting out property in Spain as a foreigner is totally doable, just make sure you’re up to speed on the rules to keep everything above board. Happy renting!

Eligibility Criteria for Foreigners to Rent Property in Spain

So, you’re thinking about dipping your toes into the Spanish property market? Awesome! But before you get too excited, let’s break down what you need to know about renting property in Spain as a foreigner.

Basic Requirements

First things first, there are a few things you need to check off your list:

Valid ID: Make sure you have a passport or a valid national ID.

NIE Number: This is a Número de Identidad de Extranjero (Foreigner’s Identity Number). You need it to handle any official paperwork, including renting a property.

Proof of Income: Have some recent pay stubs or bank statements handy. Landlords like to see that you can actually pay rent!

A Closer Look at the NIE Number

Getting your NIE isn’t super complicated but can take some time. Just to give you an idea, you can apply through a Spanish consulate or in Spain. It usually takes about 20-30 days for processing. Try to get this sorted early in your property hunt!

Rental Contracts

When you find a place you like, you’ll need to sign a rental contract. This contract will outline:

Duration of the lease

Monthly rent

Deposit requirements

Make sure to read through everything! It’s a little like a relationship—you want to know what you’re getting into.

Deposits and Payments

Typically, you’ll need to pay a deposit before moving in, usually equal to one or two months’ rent. Most landlords prefer bank transfers for payments, so set up a Spanish bank account to make things smoother.

Local Laws and Regulations

Bear in mind that rental laws can vary by region. For example, in Barcelona and Madrid, some properties have restrictions on short-term rentals. It’s always wise to check what’s permissible in your desired area.

| Aspect | Details |

|---|---|

NIE Requirement | Essential for paperwork. Processing takes about 20-30 days. |

Deposit | Usually one or two months’ rent. |

Payment Method | Bank transfers are standard. |

Contract Duration | Ranges from a few months to several years. |

As for Help with Renting?

Consider using platforms like Residoora to help navigate the real estate market. They use AI to provide insights and streamline your search. It’s like having a real estate buddy in your pocket!

In a nutshell, renting property in Spain as a foreigner is totally doable! Just make sure you have the paperwork sorted and stay updated on local laws. Happy house hunting!

Key Legal Requirements for Renting in Spain

If you’re thinking about renting out property in Spain, it’s crucial to grasp the key legal requirements. While the process isn’t overly complicated, a few important rules help keep everything above board. Let’s break it down!

1. Registration Obligations

Most autonomous communities (regions) in Spain require landlords to register their rental properties. Not registering could lead to hefty fines. For example, in Catalonia, you need to register with the Catalan Tourism Agency (ACT) if you’re renting a property, whether it’s for tourist or long-term use.

2. Licenses

To rent to tourists, you’ll often need a specific license. This applies primarily in popular tourist areas. In Madrid, for instance, you’ll need a license for short-term rentals, and failing to obtain one could result in fines upwards of €90,000!

3. Contracts Are Key

Always have a rental contract! It protects both you and your tenant. Make sure it outlines all terms like rent amount, duration, and any rules. It’s also smart to have bilingual contracts if you’re dealing with foreign clients. No one wants misunderstandings!

4. Guarantees and Deposits

When renting out, it’s common to ask for a deposit. Typically, this is one month’s rent for long-term leases. For instance:

| Region | Deposit |

|---|---|

Madrid | 1 Month |

Catalonia | 2 Months |

Valencia | 1 Month |

5. Tax Responsibilities

Don’t forget about taxes! If you’re renting out property in Spain, you’ll need to pay income tax on the rent you collect, even if you’re a non-resident. The rate can vary, but foreigners usually pay 24% on your rental income.

6. Maintenance and Safety Standards

Ensure your rental property meets health and safety standards. Depending on the region, you might need to provide a Habitability Certificate (Cédula de Habitabilidad). This is crucial for long-term rentals, as it confirms your property is fit for living.

7. Use AI Platforms for Help

If you want to manage all these legal requirements smoothly, consider platforms like Residoora. They use AI technology to help real estate investors and landlords manage properties efficiently, ensuring compliance with local regulations.

Renting out property in Spain can be rewarding, but knowing these key legal requirements is what makes it stress-free. Stay informed, and you’ll do great!

Understanding Tax Implications for Foreign Landlords

So, you’ve decided to jump into the Spanish property market as a foreign landlord. Exciting, right? But hold up! Before you start counting your rental income, you need to tackle the tax implications. Let’s break this down so it’s easy to understand.

Tax Residency: The Basics

First things first: Are you a tax resident in Spain? If you spend more than 183 days a year in the country or have your main economic interests there, congratulations — you’re considered a tax resident! This means you’ll be taxed on your worldwide income. If not, you’ll be taxed only on your Spanish income.

Income Tax: What to Expect

If you’re renting out your property, you’ll need to pay income tax on that rental income. For non-resident landlords, this is usually a flat rate of:

| Tax Residency | Tax Rate |

|---|---|

Non-resident | 24% |

EU residents | 19% |

But here’s the catch: While most landlords have to pay this tax on their gross income, you can deduct certain expenses to lower your tax liability. Think property management fees, repairs, or even mortgage interest. It all adds up!

Declaring Your Income

Got your rental income all lined up? Great! But you need to declare it too. You’ll have to file a tax return (Form 210) every quarter if you’re renting out the property. This is true even if you’ve made a loss. Missing a filing can lead to penalties, so set a reminder!

Other Taxes to Consider

Don’t forget about a few other taxes that might pop up:

Property Tax (IBI): This is an annual tax and can vary significantly depending on the property’s location.

Capital Gains Tax: Planning to sell? If you make a profit, you’ll be hit with a capital gains tax of up to 26% for non-residents.

Supportive Tools

Feeling overwhelmed? You’re not alone! Platforms like Residoora can help you navigate through all these complexities. They provide insights into real estate investments and can even assist with tax preparation. Definitely worth checking out!

Final Thoughts

Renting out property in Spain can be a lucrative venture, but you need to be aware of the tax implications. Keep organized records, stay updated on local tax laws, and don’t hesitate to get professional help if you need it. Your investment will thank you!

Popular Regions for Foreign Property Investment

So, you’re thinking about renting out property in Spain? Awesome choice! Let’s dive into some of the most popular regions for foreign property investment. Not only do they attract tourists like bees to honey, but they also provide awesome rental income opportunities.

1. Costa del Sol

This sun-soaked strip has been the go-to for foreign investors for years. With beautiful beaches and a laid-back lifestyle, who wouldn’t want a piece of it? Coastal towns like Marbella and Torremolinos are particularly hot spots.

| Average Property Price (€) | 250,000 |

|---|---|

| Average Annual Rental Yield | 5.5% |

2. Barcelona

Barcelona is not just a feast for the eyes; it’s a goldmine for rental income. Tourists flock to see the stunning architecture, which means high rental demand. Areas like Eixample are popular for short-term rentals.

| Average Property Price (€) | 400,000 |

|---|---|

| Average Annual Rental Yield | 4.1% |

3. Valencia

Valencia is emerging as a star player in the rental market. It’s got a rich culture, amazing food, and a growing expat community. Plus, property prices here are surprisingly affordable, making it attractive for investors!

| Average Property Price (€) | 180,000 |

|---|---|

| Average Annual Rental Yield | 5.3% |

4. Balearic Islands

If you’ve got your sights set on the Mediterranean, the Balearic Islands are where you want to be. Majorca, Ibiza, and Menorca attract millions of tourists, meaning strong rental potential.

| Average Property Price (€) | 350,000 |

|---|---|

| Average Annual Rental Yield | 5.0% |

Platforms like Residoora can make your investment process smoother by providing insights on property values and rental trends. They help you make better choices based on current data. If you’re looking to maximize your investment, tools like this are worth checking out!

So, whether you’re drawn to the beaches, the vibrant city life, or the rich culture, Spain has something for every investor. Remember to do your homework and keep an eye on the market trends. Happy investing!

Investment Trends: Foreign Ownership in Spanish Real Estate

So, you’re thinking about jumping into the Spanish real estate market? You’re not alone! Foreign ownership has been skyrocketing in Spain over the past few years. In fact, in 2021, foreigners purchased around 15% of all properties sold in the country! That’s a significant chunk!

Why Invest in Spanish Real Estate?

Scenic Locations: Think sun, sea, and plenty of cultural experiences.

Rental Income: Rentals can be quite lucrative, especially in tourist hotspots like Barcelona and Costa del Sol.

Affordable Prices: Compared to many other European destinations, Spanish properties can be a steal!

The Ins and Outs of Foreign Ownership

Here’s the good news: yes, foreigners can rent out property in Spain! Once you own a property, you can easily turn it into a rental. Whether it’s for short-term vacationers or long-term tenants, the options are ripe for the picking.

Quick Stats on Foreign Ownership

| Year | Percentage of Foreign Buyers | Top Nationalities |

|---|---|---|

2019 | 12.8% | British, French, Germans |

2020 | 11.6% | British, Germans, Dutch |

2021 | 15% | British, Germans, Swedes |

Tools to Help You Manage

Looking for a way to streamline your property management? Platforms like Residoora can supercharge your investments. They use AI to analyze market trends and provide insights, which can help you make smarter decisions whether you’re renting short or long-term.

Final Thoughts

So, are you ready to dive into the Spanish property scene? With the right tools and some passion, you can turn that dream of owning a slice of Spain into a reality. Just remember to stay informed and leverage every resource, like Residoora, to make the most out of your investment.

Common Challenges Faced by Foreign Landlords

So, you’ve decided to rent out your property in sunny Spain? Great choice! But hold on a second—there are some hurdles you might run into along the way. Let’s break it down.

1. Language Barrier

Language can be tricky. Not everyone in Spain speaks English, especially if you’re dealing with local tenants. This can lead to miscommunication. Imagine explaining the nuances of a lease agreement or maintenance issues when neither party speaks the same language fluently. That’s where tools like Residoora come into play—using AI, they can help translate documents and streamline communication!

2. Local Laws and Regulations

Spain has its own set of rental regulations that can be confusing for foreigners. Did you know that some regions have specific rental caps? For instance, in Barcelona, there are laws limiting rental prices, so you can’t just charge whatever you want. Keeping up with these rules is essential. Failure to follow them could mean fines or even worse, legal action!

3. Tenant Screening

Your tenants can make or break your rental experience. Screening can be tough when you’re managing from afar. How do you know if someone is reliable? Using AI platforms like Residoora can simplify this process by analyzing tenant applications effectively, helping you make informed decisions.

4. Property Management from Afar

Managing a property while living in another country is no walk in the park. You’ll need to ensure that maintenance issues are quickly addressed, which can be challenging if you’re not nearby. Hiring a local property management company might seem like a good solution, but make sure to check their fees—usually around 10-15% of rental income. Here’s a quick comparison of what you might encounter:

| Management Option | Pros | Cons |

|---|---|---|

Self-Management | Lower costs, direct communication | Time-consuming, stressful |

Local Property Management | Professional handling, peace of mind | Higher costs, less control |

5. Cultural Differences

Don’t underestimate cultural differences. The way Spaniards view rental agreements, responsibilities, and even maintenance can differ significantly from what you’re used to. A little cultural insight can go a long way in preventing misunderstandings. Take time to learn about Spanish culture before jumping into this venture!

6. Market Knowledge

Lastly, being out of the loop can be detrimental. The rental market can fluctuate based on seasons, local events, and economic conditions. If you’re not up-to-date, you might miss out on potential income or make costly mistakes. Reliable platforms like Residoora can help you analyze the market trends effectively.

In summary, while renting out property in Spain as a foreigner can be rewarding, it comes with its fair share of challenges. Being aware of these issues and using smart tools can make all the difference!

Step-by-Step Process for Renting Property in Spain

If you’re a foreigner looking to dip your toes into the Spanish rental market, you’re in for an adventure! It’s a pretty straightforward process when you know the ropes. Here’s a quick step-by-step guide to help you navigate through it.

1. Do Your Homework

First off, get familiar with the market! Different regions have different norms. For example, rent prices in Madrid can be about €12 per square meter, while places like Valencia might only hit around €8.50. Use platforms like Residoora and Residoora to gauge the real estate trends based on your desired area.

2. Understand Legal Requirements

As a foreigner, you’ll need a few bits of paperwork. A valid ID and a tax identification number (NIE - Número de Identificación de Extranjero) are must-haves. Don’t worry, getting an NIE is a breeze if you follow the steps outlined by the Spanish authorities.

3. Set Your Budget

| Expenses | Approximate Cost |

|---|---|

Monthly Rent | €800 - €1,500 |

Deposit (usually 1-2 months) | €800 - €3,000 |

Agency Fees (if applicable) | €300 - €600 |

Plan ahead! Factor in monthly rent, the security deposit, and any agency fees if you’re using a realtor.

4. Start Your Search

Get online and start browsing listings. Websites like Idealista or Fotocasa are fantastic for finding properties. Filter based on your preferences – number of rooms, location, and price. Besides, don’t underestimate the power of social media! Join local groups where people share rental opportunities.

5. Visit and Inspect the Property

Once you’ve got a short list, it’s time to visit. Make sure to check out the condition of the property and its surroundings. Take photos, ask questions, and make sure the amenities meet your needs. After all, you might be calling this place home!

6. Read the Lease Carefully

Before signing anything, read through the lease agreement. Look for terms like:

Duration of the lease (usually 1 year)

Rent increase clauses

Who pays utilities (owner or tenant)

And if it’s in Spanish, don’t shy away from using a translation tool or asking for help to ensure you understand everything.

7. Sign the Contract and Make Payments

Once you’re happy with everything, it’s time to sign the lease and pay the deposit and first month’s rent. Keep copies of all documents! You’ll need them down the line.

8. Get Settled In

Now comes the fun part—settling into your new home. Set up utilities, get internet, and maybe even treat yourself to a local tapas bar to celebrate your new adventure!

And there you go! Renting in Spain as a foreigner is totally doable. Just keep these steps in mind and use tools like Residoora to make your life easier. Happy renting!

Statistical Insights on Foreign Investment in Spanish Rentals

When it comes to renting out property in Spain, foreign investors are making quite a splash! Did you know that as of recent statistics, over 20% of all property transactions in Spain involve foreign buyers? That’s a massive number, showing that Spain’s rental market is a hotspot for investors from around the globe.

Who’s Renting Out Properties?

It’s not just one nationality making waves. Here’s a quick breakdown of the top foreign investors:

| Country | % of Foreign Buyers |

|---|---|

United Kingdom | 16% |

Germany | 11% |

France | 9% |

Italy | 8% |

Sweden | 6% |

These buyers are particularly drawn to areas like the Costa del Sol, which is a favorite for sun-seekers and savvy investors alike!

Investment Perks

So why are foreigners so keen on Spanish rentals? Check this out:

High Demand: With millions of tourists flooding in annually (around 83 million in 2019!), rental properties can yield significant returns.

Profit Potential: On average, the gross rental yield in Spain ranges from 5% to 10%. That’s pretty enticing!

Platforms Like Residoora: These AI platforms simplify finding investment opportunities, pricing, and understanding rental yields, making it easier than ever for foreign investors to jump in.

Local Regulations

Thinking about renting out a property? Make sure you understand local regulations. In areas like Barcelona and Madrid, there are specific rules for short-term rentals that you’ll want to get familiar with.

With a little help from platforms like Residoora, you can navigate these waters with ease. Both newbies and seasoned investors can devour real-time data on the rental market, ensuring you make informed decisions every step of the way.

It’s an exciting time to be a foreign investor in Spanish rentals, and with the right tools and insights, the possibilities are endless!

Resources for Foreigners Looking to Rent Out Property

If you’re a foreigner dreaming of renting out property in sunny Spain, you’re in luck! Here are some handy resources and tips to help you navigate the process smoothly.

1. Legal Assistance

First things first, consult a local attorney who’s well-versed in Spanish property law. They can help you with contracts, taxes, and ensuring everything’s legit. Trust me; navigating laws in a new country can get tricky!

2. Online Platforms

Utilize platforms like Residoora and Idealista to find rental listings. These sites are great for pinpointing locations and seeing what kind of rental income you might expect. Residoora even offers AI tools to give you personalized investment insights!

3. Local Real Estate Agents

Partner with local real estate agents who specialize in rentals. They have the inside scoop on the best neighborhoods and current market trends. Not to mention, they handle a lot of the grunt work for you!

4. Understand Local Regulations

Each Spanish region has its own rental regulations. For example, cities like Barcelona and Madrid have strict short-term rental rules. Check out this table for basic requirements across various provinces:

| Region | Short-Term Regulations | Tax Rate |

|---|---|---|

Barcelona | License required; strict 60-day limit | 24% |

Madrid | License required; no strict limits | 19% |

Valencia | License required; max 2 guests | 19% |

5. Tax Obligations

Don’t forget about taxes! As a property owner, you’ll need to file income tax in Spain. Non-residents pay a flat rate of about 24%, while residents have tax rates that can vary (between 19% - 47% based on income). Keep in mind, Spain has double taxation treaties with many countries, which could save you some cash!

6. Community Groups and Forums

Joining expat communities or online forums can be super beneficial. Websites like Expatica or local Facebook groups provide valuable insights and support from fellow foreigners who’ve been down the rental path.

So there you have it! With the right resources and a bit of research, you can navigate the property rental scene in Spain like a pro. Happy renting!